Weak Eurozone Demand Could Drag the Euro Down

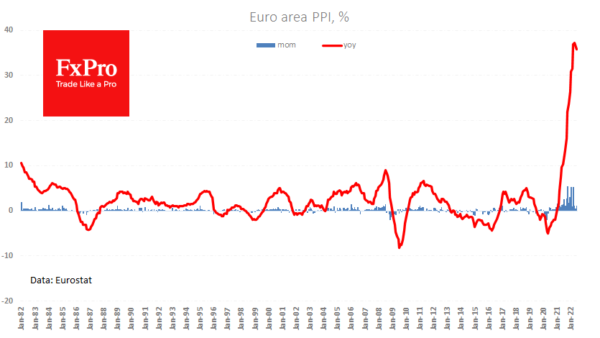

In contrast to many other countries and regions, the Eurozone recorded a slowdown in output inflation. The year-over-year PPI growth rate declined for the second month, showing a fall in June to 35.8% from 36.2% and 37.3% in the previous...

Both Dollar and Euro Performed Mixed Against G10 Peers

Markets FOMC member Bullard join the hawkish parade kickstarted by Daly, Mester and Evans yesterday. This morning he reiterated his views of a policy rate at 3.75-4% by the end of the year and said there’s a need to get...

Swiss Franc Rebound Continues

USD/CHF dips below 0.9500 The Swiss franc is showing little movement today, but USD/CHF has fallen below the 0.9500 line for the first time since May. The US dollar pushed the Swiss franc above the parity line in June, but...

Week Ahead: RBA, BOE, OPEC, and NFP to Rock Markets this Week

Central bank mania continues this week, with both the RBA and the BOE expected to hike rates by 50bps. Watch for wording in the statements for hints of further rate hikes (or pauses). The FOMC continued to make things a...

Weekly Economic & Financial Commentary: Not Yet a Recession Way Down Inside

Summary United States: Busy Data Week Shows Wobbling U.S. Economy Data released this week showed that U.S. economic growth modestly contracted in Q2. New home sales were yet another data release that pointed toward a cooling housing market. The FOMC...

Euro Gets Crushed ahead of Inflation and GDP Numbers

It has been a brutal month for the euro. Business surveys already point to a recession and traders are worried Russia might cut off the gas and paralyze the economy completely. The upcoming batch of inflation and GDP data on...

Euro Stabilizes after Sharp Slide

The euro has edged higher on Wednesday, after sliding over 1% yesterday. In the North American session, EUR/USD is trading at 1.0147, up 0.29% on the day. All eyes on Federal Reserve The markets are eagerly awaiting the FOMC decision...

Australian Inflation Lifts as Broadly Expected

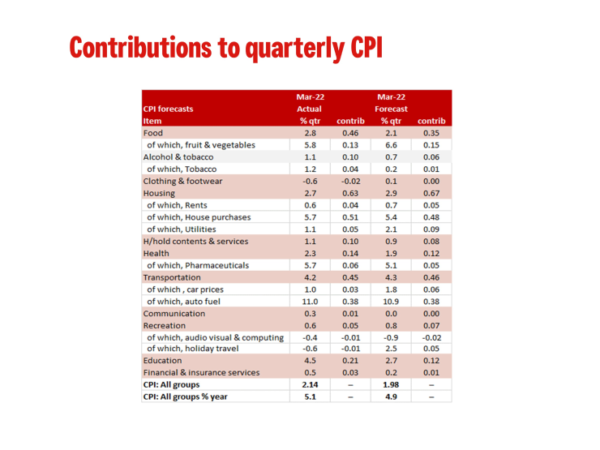

June 2022 CPI 1.8%qtr vs 1.7% forecast; Trimmed Mean 1.5% vs 1.4% forecast. The CPI came in broadly as expected even with food, clothing & footwear, household furniture, equipment & services surprising to the high side. The CPI gained 1.8%...

Cliff Notes: Inflation Still of Paramount Concern as Risks to Activity Build

Key insights from the week that was. In Australia and abroad, it was a quiet week for data, keeping the focus on monetary policy. At home, the July RBA minutes and speeches by RBA Governor Lowe and Deputy Governor Bullock...

Euro Jumps as ECB Delivers 50bps

As mentioned earlier, there was a great deal of uncertainty over whether the European Central Bank would opt for a 25- or 50-basis point rate hike today, which meant that the euro would move sharply based on the decision as the market...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals