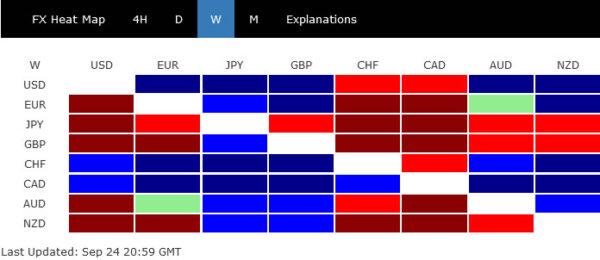

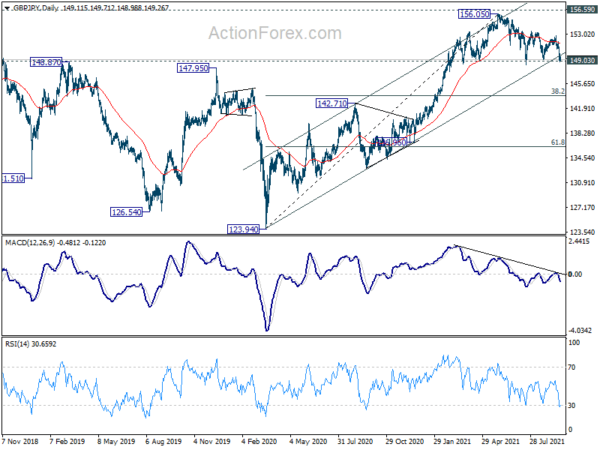

Yen Crosses Accelerating Upward on Persistent Rally in Treasury Yields

Strong rally in treasury yields is currently the main theme driving the markets. On the back on hawkish Fed rhetorics, 2-year yield rose to 18-month high, above 0.3%. Benchmark 10-year yield also breaks above 1.5% handle. Yen is currently the...

Dollar Mildly Higher after Durable Goods Orders, Sterling Advancing in Crosses

Dollar trades mildly higher in early US session, lifted by stronger than expected durable goods orders data. But it’s being overwhelmed by both Sterling and Aussie. Commodity currencies are firmer on “stable” market sentiment, but there is no follow through...

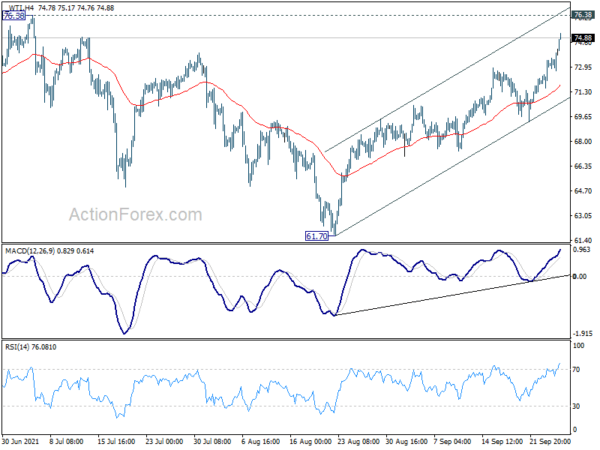

Canadian Dollar Rises Together With Oil, Euro Shrugs German Election

Canadian Dollar leads commodity currencies higher in Asian session, with help from extended rally in oil price. Overall sentiment is mixed though and Yen is trying to pare back some of last week’s losses. Some weakness in seen in both...

Yen Dropped Broadly as Treasury Yields Jumped on Hawkish Fed

Yen’s fortune reversed last week as US treasury yields accelerate up after hawkish FOMC meeting and projections. US stocks also display strong resilience and closed generally higher, reversing prior losses. Sterling, on the other hand, shrugged off hawkish BoE voting...

Yen Dives as Market Sentiment Turned Bullish, USD/JPY Pressing 110.44 Resistance

Market sentiment took a big turn overnight with strong rally in US indexes. Nikkei follows in Asia and reclaimed 30k handle, but other Asian markets are soft. Yen dropped notably following return of risk appetite while Dollar also weakened. On...

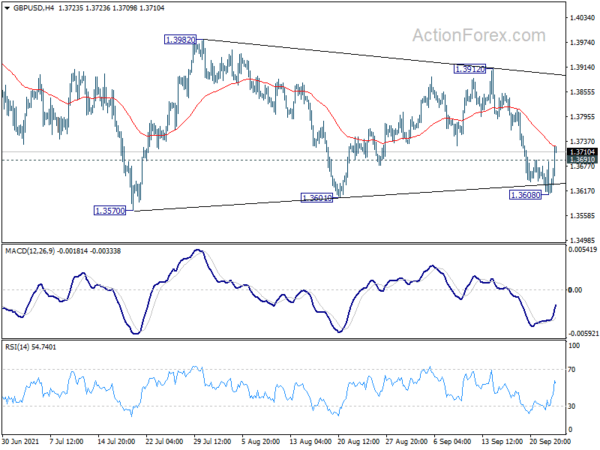

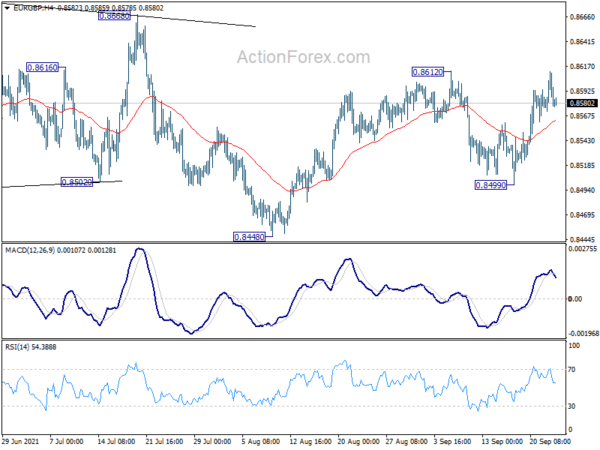

Sterling Rebounds on Hawkish BoE Surprise, Risk Sentiments Improved

Sterling rebounds strongly after two BoE MPC member voted for tapering. Also, recent developments strengthened the case of modest tightening. Commodity currencies are also firmer following mild rebound in the stock markets. On the other hand, Yen, Swiss Franc and...

Markets Responded Positively to FOMC, Sterling Stays Soft ahead of BoE

Dollar initially dipped after FOMC overnight, but quickly found its footing. Overall market reaction was positive, but insufficient to alter the near term outlook. Sterling remains the worst performing one for the week while Swiss Franc is the strongest. Both...

Sterling Staying in Selloff Mode, Quiet Markets Await Fed

Trading in the forex markets is rather subdued today, as FOMC policy decision, dot plot and economic projections are awaited. The markets could come back to live if there are some hawkish twists in Fed’s projections. For now, Sterling is...

Markets Turned Cautious ahead of FOMC, Hawkish Surprise Possible

Markets have turned quiet today as focus is shifted to FOMC policy decisions. While a tapering announcement is highly unlikely, there are still prospects of hawkish surprises in the dot plot and the economic projections. In the currency markets, Sterling...

Swiss Franc Jumps While Risk Aversion Eased

Risk aversion seems to have eased a bit today, with recoveries seen in European markets and US futures. Yen and Dollar have both turned into sideway consolidations. But no clear support is seen in Aussie and New Zealand, as both...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals