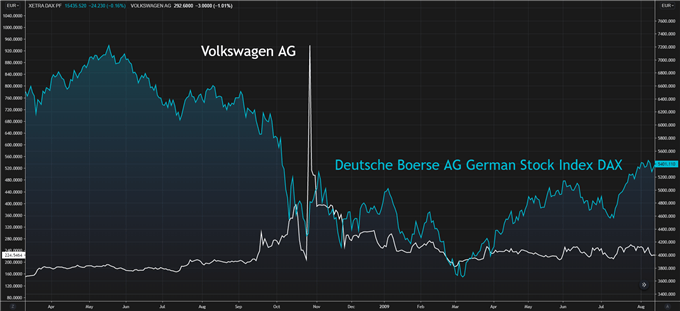

What is a Short Squeeze and How to Trade It?

The short squeeze has demanded the audience from many of the best investors and traders the world over, with some boastful about correct market predictions while others are humbled by the swift yet destructive nature that is the short squeeze....

Contractionary Monetary Policy: What is it and How Does it Work?

Contractionary monetary policy is utilized by central banks to reign in an overheating economy and surging inflation. Find out what tools are used and how they work Signal2frex feedback

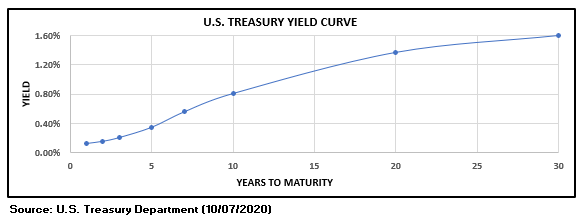

The Bond Market as a Forecasting Tool for Stocks: Four Key Yield Curve Regimes

YIELD CURVE AND STOCKS: Wall Street refers to the bond market as smart money because of its track record of predicting future economic outcomes When analyzing the interplay between bonds and stocks, traders often look at shape of the yield...

How to Determine a Bull or Bear Market

Bull and bear markets are two very different animals – in more than one way. The ability to discern whether you are in a Bull market (going up) or a Bear market (going down) is fundamental for traders and investors...

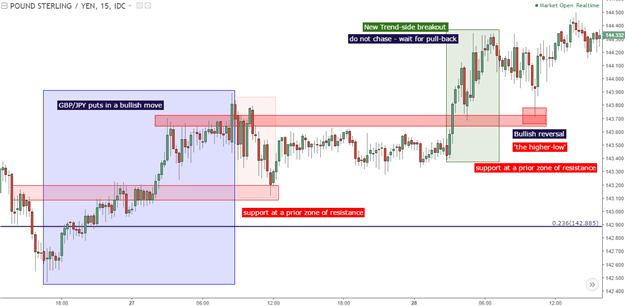

How to Use Price Action to Trade New Trends

‘The trend is your friend’. We’ve all heard it, and it makes perfectly logical sense; but in practice, this advice is so opaque that it’s practically worthless. Because even if you’re on the ‘right’ side of whatever trend is showing...

Commodities vs Stocks: Top 5 Differences & Trading Tips

Stocks and commodities are two of the most widely-traded financial products today. These asset classes can serve as a powerful influence on the economy, business infrastructure and the trading behaviors of millions around the world. Read on to discover the...

What are Safe-Haven Assets & How to Trade Them

Safe-haven assets are an essential antidote to economic downturns. They represent the markets that can protect traders and investors from losses when equities fall. Continue reading for our guide on the best safe-haven assets to choose, how they can safeguard...

The Four-Hour Trader, A Full Trading Plan

A complete trading plan that will take less than four hours of a traders time each week. And further, this is an approach that can be focused on longer term moves, and swings. Signal2frex feedback

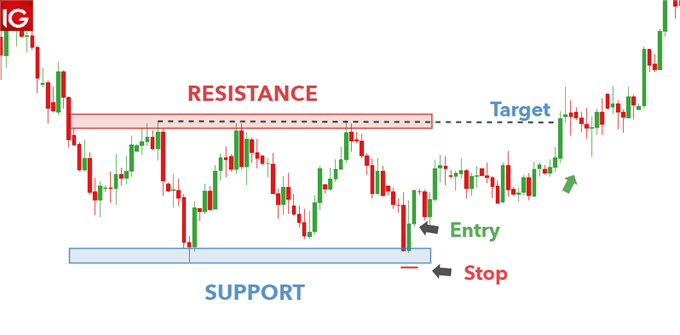

Risk Management Techniques for Trading

Risk management is a key component for a successful trading strategy which is often overlooked. By applying risk management techniques, traders can effectively reduce the detrimental effect losing positions have on the value of a portfolio. Keep reading to learn...

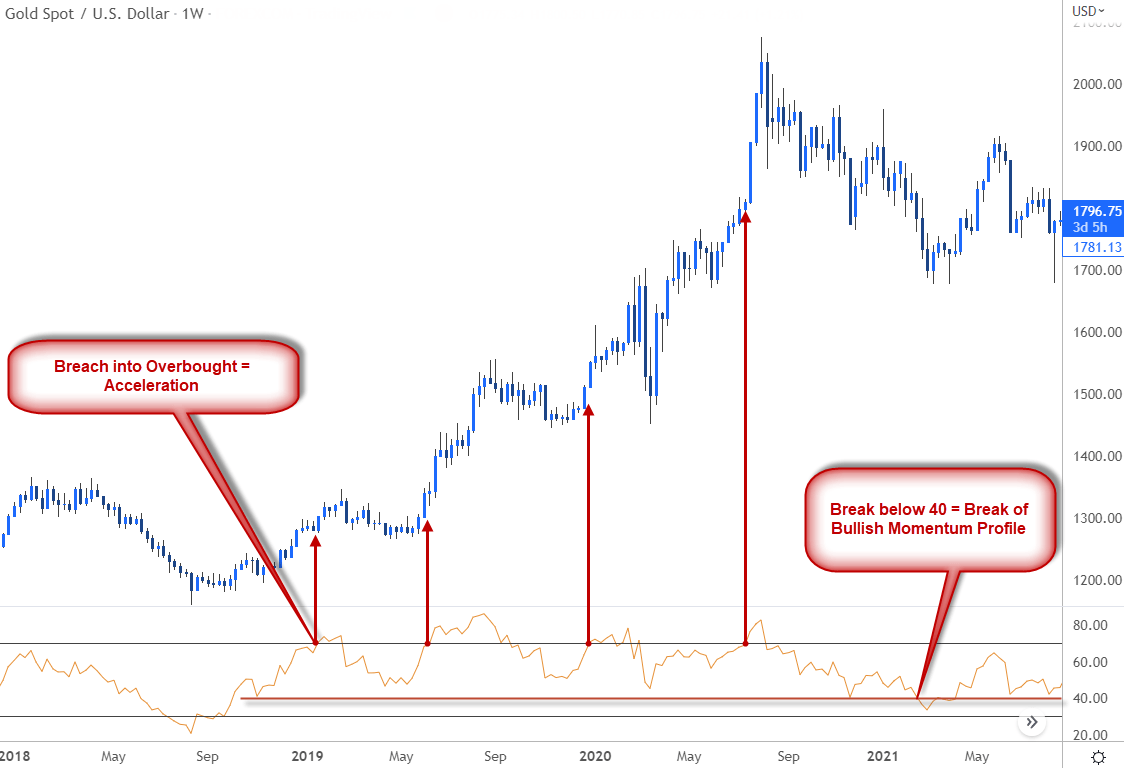

How I Use RSI

The Relative Strength Index (RSI) is a simple oscillator that is used to measure speed or inertia of a given price move. The objective is to identify times when market may be in an overbought / oversold condition. While the...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals