Geopolitical risk has been a dominant theme of 2018, with escalating trade tensions, Australia’s Prime Minister getting ousted, traders questioning the independence of Turkey’s institutions, and high-stakes negotiations around NAFTA and Brexit all grabbing headlines at various points this year. With traders focused on these day-to-day developments, arguably the most impactful political development of the year has snuck up on us; the US mid-term elections are now less than 50 days away!

Overview

For the uninitiated, mid-term elections take place, not surprisingly, in the middle of a President’s 4-year term. US Senators are elected to six-year terms, with roughly 33 Senators up for re-election every two years (35 this year), while US Representatives are elected to two-year terms, and as a result, every seat in the House of Representatives will be up for grabs come November 6.

As it currently stands, Republicans currently control both houses of Congress, with 51 Republicans, 47 Democrats, and 2 Independents, who both caucus with the Democrats, in the Senate. Meanwhile, there are 238 Republicans (including 1 Delegate and the Resident Commissioner of Puerto Rico), 197 Democrats (including 4 Delegates), and 6 vacant seats in the House of Representatives.

What’s at Stake?

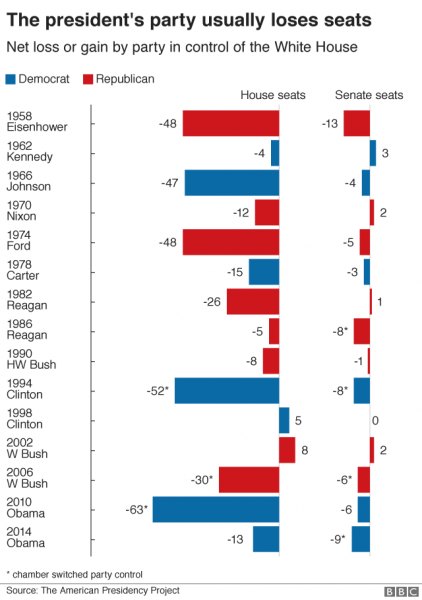

A near-ironclad rule of US politics is that the President’s party tends to lose Congressional seats in mid-term elections, and with President Trump’s approval rating hovering around 40% as of writing, that tendency is likely to play out again this year.

According to the polling mavens at FiveThirtyEight.com, the Democrats currently have a 75-80% of gaining a majority in the House of Representatives, depending on which model you use, though obviously this probability will continue to fluctuate as the elections approach.

Interestingly, even though Republicans have a razor-thin 51-49 advantage in the Senate (note that the Vice President, Republican Mike Pence, casts the deciding vote in the event of a tie), the electoral map is more favorable there, and as a result, FiveThirtyEight gives Democrats only about a 30% chance of taking control of the upper house of Congress. Come November 7th, we’ll know whether Democrats have managed to take control of either the House or Senate, or whether Republicans will control all three bodies of government for another two years.

Potential Market Impacts

Contentious issues like immigration, a desire for checks on one party’s control of the country’s entire lawmaking apparatus, foreign policy, the ongoing investigation by Special Counsel Mueller, and race relations will dominate much of the debate, but economic considerations are the primary consideration for traders. Before reading on, we wanted to emphasize that the relationship between political and economic developments is generally exaggerated, so readers should draw any conclusions with a whole bucketful of salt, rather than treating them as gospel.

In an effort to stay apolitical, we’ll focus on just the facts: the economy has undoubtedly performed well over the last two years. Both the unemployment rate and initial jobless claims are near half-century lows, the Fed has been able to raise interest rates consistently (if not particularly rapidly), inflation remains relatively subdued, and business confidence is through the roof. The S&P 500 rallied by nearly 22% in 2017 and is up solidly so far in 2018, largely on the back of the big tax cut package passed last December.

As a general rule of thumb, when one party controls the House, Senate, and Presidency, it will be more likely to enact its agenda. For Republicans, this means a continuation of the pro-business policies (primarily deregulation and tax cuts) that have characterized the last two years. Therefore, while the rally in US stocks is growing a bit “long in the tooth,” another round of tax cuts and/or continued deregulation could be enough to keep the stock market’s bullish party running for at least another year or two.

That said, Republican victories could come at the expense of US bonds, especially if we see a continued expansion in the government deficit, which could also push the Federal Reserve to raise interest rates slightly more aggressively at the margin. We expect US dollar traders will be less focused on domestic policy and more concerned with developments abroad over the next two years, with the Fed potentially slowing down its interest rate increases as rivals such as the European Central Bank embark on new tightening cycles.

On the other hand, if the Democrats retake control of at least one House of Congress, they could stymie the Republican agenda and return US politics to the gridlock that characterized most of President Obama’s second term. While a do-nothing Congress is hardly ideal, it could benefit Treasury bonds, as it may keep the deficit more limited than the alternative, potentially at the expense of US stocks, which would be less likely to see stimulus from additional tax cuts.

Trade policy is the biggest wildcard for traders. While Republicans have thus far supported President Trump’s aggressive attempts to renegotiate trade agreements with Canada, the European Union, China and others, a setback in the mid-term elections could see party support for all of Trump’s policies fade. In that case, we may see GOP lawmakers revert to a more “free trade” stance, as the party has historically supported.

EUR/USD: Will the “mid-term cycle” return?

One last historical pattern to be aware of is the so-called “mid-term” cycle in Euro/U.S. dollar (EUR/USD) currency pair. As the chart below shows, EUR/USD has shown a tendency to rise in the first half of the 2-year mid-term elections (November of even-numbered years to November of odd-numbered years) and fall in the second half:

Source: TradingView, FOREX.com

After the cycle failed to emerge for the 114th Congress over the 2014-2016 period, it resumed over the last two years. If this cycle plays out in the same fashion again, we could expect about a year of EUR/USD strength (US dollar weakness) regardless of the outcome on election day, followed by a peak for the world’s most widely-traded currency pair sometime late in 2019.

As this report shows, the 2018 mid-term elections may have big implications across the stock, bond, and FX markets. No matter what the U.S. election brings, our global team of expert analysts will continue to provide market analysis and identify real-time trade opportunities on a daily basis.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals