Jamie Dimon doesn’t expect permanent China-US trade deal in just 90 days

J.P. Morgan Chase CEO Jamie Dimon said a permanent trade agreement between the U.S. and China will be tough to reach in just 90 days. “There’s no way you can see the complexity of these trade negotiations in 90 days,”...

London to lose $900 billion to Frankfurt due to Brexit, German finance group claims

London is predicted to lose up to 800 billion euros ($909 billion) of assets by March next year, as banks move their business operations to other hubs before Brexit takes place. Lobby group Frankfurt Main Finance (FMF) released the figure...

What to Expect From Central Bankers in 2019

Highlights 2019 is likely to represent the peak level of interest rates for the U.S. and Canada. The debate among market participants will continue to heat up on whether central banks will succeed in finding the sweet spot in the...

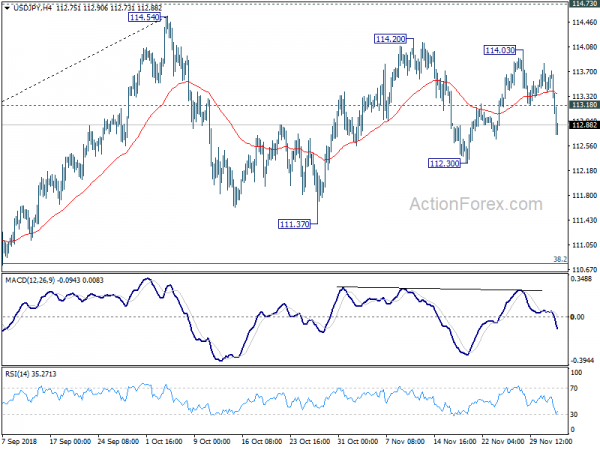

Japanese Yen Rallies as Risk Appetite Wanes

The Japanese yen has ticked higher in the Tuesday session. In North American trade, USD/JPY is trading at 112.92, down 0.64% on the day. It’s a quiet day on the release front, with no major indicators in Japan or the...

USDTRY Unlocks 2-Week High, Creating Significant Gains

USDTRY strengthened sharply today, climbing to a new two-week high, around 5.3653, extending its run from the pullback on 5.1330. The bullish picture in the very short-term is further supported by the RSI, which is rising above the 50 level...

Dollar Broadly Lower as 10 Year Yield Breaks Below 3%

Dollar is under broad based selling pressure on falling treasury yields, globally. In particular, 10 year yield drops below 3% level for the first time since September. Canadian Dollar and Swiss Franc are following as the next weakest. On the...

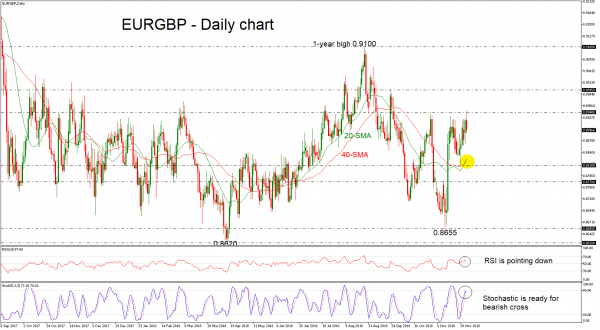

EURGBP Remains Neutral in Short and Long Term

EURGBP has had a strong bearish rally this morning after the bounce off the 0.8940 resistance level. Neutral to negative risks remain in the background as the RSI decreases momentum to the downside in the positive region, while the %K...

BOC Preview: Will Poloz Maintain Hawkish Stance?

Bank of Canada is expected to keep its policy rate unchanged at 1.75%, after a rate hike of +25 bps in October. Despite bets of another move this month, we believe policymakers would take a wait- and- see mode to...

WTI OIL Outlook: Recovery Extension Hits Two-Week High On Improved Sentiment, OPEC Meeting In Focus

WTI oil rose further on Tuesday and hit new high of nearly two weeks, in extension of recovery which started from Monday’s gap-higher weekly opening. The oil was up 2.5% for the day so far and fresh bullish acceleration pressures...

Inverted Yield Curve Curbing Risk Appetite?

Markets back in the red Well that didn’t last long. Day two of the post US/China truce and markets are back in the red and the US yield curve has inverted slightly, potentially taking some of the shine off the...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals