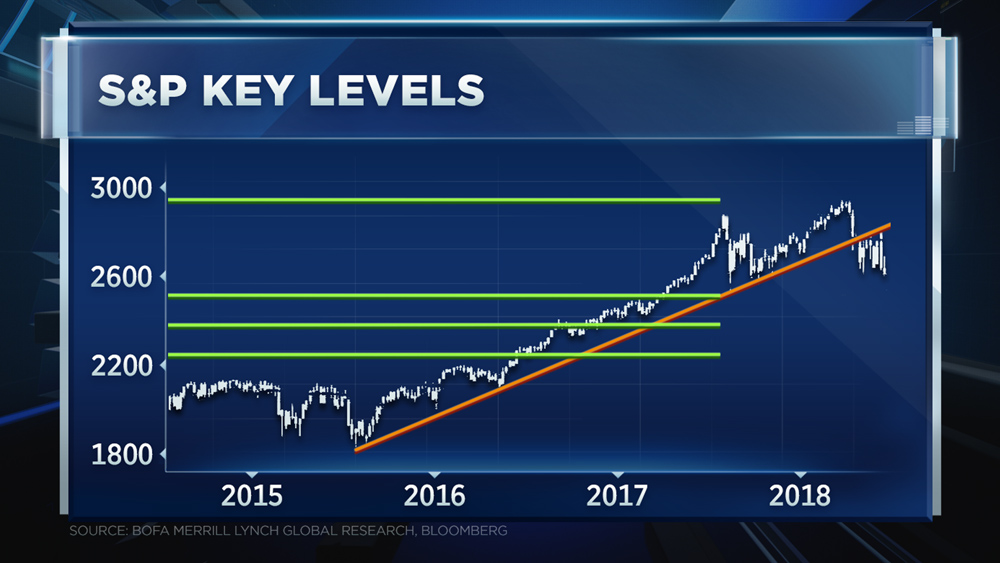

‘Just call it what it is’: BofA’s Stephen Suttmeier declares a bear market

Bank of America-Merrill Lynch sees stocks struggling through the first half of 2019. Stephen Suttmeier, the firm’s chief equity technical strategist, is building his case with two S&P 500 charts. They suggest stocks are in the throes of a bear...

Forex Forecast and Cryptocurrencies

First, a review of last week’s events: EUR/USD. Despite the fact that, on the eve of the US Federal Reserve interest rate increase, 70% of experts, supported by 100% indicators, expected the dollar to strengthen, nothing of the kind happened....

Stock Markets Correcting 10-Year Up Trend But Fed’s Not to Blame

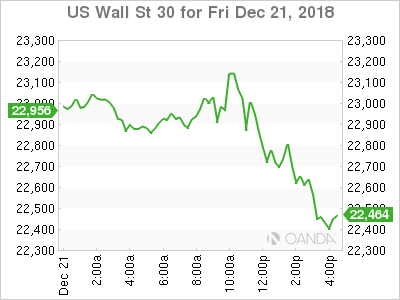

The global stock markets just turned from bad to worse last week. DOW suffered its worst week since the global financial crisis back in 2008, down the week by nearly -7%. S&P 500, down the month by -11.4%, is also...

Treasury Secretary Mnuchin moves to quell firestorm, says Trump never suggested firing Fed Chairman

President Donald Trump is adamantly opposed to the Federal Reserve’s rate hike campaign, but has never suggested firing Fed Chairman Jerome Powell, Treasury Secretary Steven Mnuchin said on Saturday, moving to defuse a controversy that could roil global markets even...

Wall Street’s view on Trump’s talk of firing Fed Chair Jerome Powell: ‘Utter madness’

President Donald Trump’s growing dissatisfaction with Federal Reserve Chairman Jerome Powell could be veering into dangerous territory: Late Friday, Bloomberg News, citing four unnamed sources, reported that Trump has discussed firing the central bank head. With the Fed embarked on...

Psychology and Trading | Podcast

Key points covered in this podcast Emotional control is an important characteristic of a good trader Poker and trading are similar in psychology The movie Rounders identifies key personality types to be aware of You should hone your skills on...

Trump reportedly wants to fire the Fed chair, a move that could wreak havoc on the financial markets

President Donald Trump wants to fire Federal Reserve Chairman Jerome Powell for raising interest rates, according to a report, an unprecedented action by a president against the independent body, that could undermine confidence in the U.S. financial system already under...

Weekly Economic and Financial Commentary: Data Show Still Solid, but Moderating Momentum in Q4

U.S. Review Data Show Still Solid, but Moderating, Momentum in Q4 Despite some softer-than-expected data in recent weeks and continued volatility in the financial markets, the FOMC raised the fed funds rate 25 bps at its policy meeting on Wednesday....

The Weekly Bottom Line: A Solid Year In Spite Of Headwinds

U.S. Highlights As widely expected, the Fed hiked rates once more this year. At the same time, the Fed’s dot plot moved lower over the forecast horizon. These changes are consistent with a softer inflation and economic outlook. Data came...

Volatility and Risk Aversion Continue to Dominate December

What a week for bears and volatility! The highly anticipated Fed event delivered volatility that brought down all the major indexes to their knees. The Fed raised rates, reduced their dot plot forecasts, but they signaled that quantitative tightening is...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals