The market could be setting itself up for a letdown from Wednesday’s Fed decision

With investors over the past several months aggressively pricing in a friendly Federal Reserve, it seems the only thing the central bank could do at its meeting that wraps up Wednesday is disappoint. After all, the market is anticipating that...

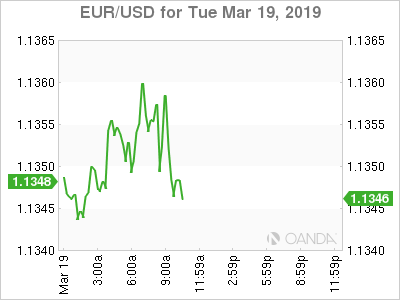

Dollar Steady Ahead Of FOMC Meeting Today

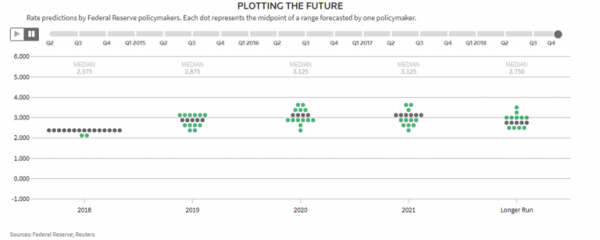

The US dollar, which was trading subdued the past few days held steady ahead of the FOMC meeting today. The Fed will be releasing its economic projections and dot plot summary alongside the press conference. The US factory orders report...

USD/JPY Target 111.90

Pivot (invalidation): 111.45 Our preference Long positions above 111.45 with targets at 111.75 & 111.90 in extension. Alternative scenario Below 111.45 look for further downside with 111.30 & 111.15 as targets. – advertisement –

Comment The RSI is bullish...

Attention Shifts To The Fed As Brexit Strolls Into Final Week

UK casually strolling into final days without a deal There’s less than 10 days to go until the UK is meant to leave the European Union and despite the growing worry around Westminster, within there seems to be a severe...

China’s tech-savvy millennials are fueling interest in US stocks

As China’s technology companies have become some of the largest in the world, they’re influencing the investing habits of their employees and customers, and spurring a new business of online stock trading. Real estate remains by far the hottest investment...

Dollar Higher But Gain Limited by Risks of FOMC Dovishness

Dollar trade generally higher today as markets await FOMC rate decision. But gain is very limited as traders are guarding against unexpected dovishness in Fed. In particular, such dovishness could be embedded in the new economic projections. Meanwhile, Swiss Franc...

Gold Price Could Continue To Rise Near Term

Key Highlights Gold price found support near $1,292 recently and climbed above $1,300 against the US Dollar. There was a break above a key bearish trend line with resistance at $1,305 on the 4-hours chart of XAU/USD. The US Factory...

Stocks making the biggest moves after hours: FedEx, Tencent Music and more

Check out the companies making headlines after the bell: Shares of FedEx fell more than 5 percent in extended trading Tuesday following the release of the logistic company’s disappointing third-quarter earnings and weak full year outlook. FedEx posted earnings per...

Fed to Clarify How Patient it Could Get With Rate Hikes

The Federal Open Market Committee (FOMC) has two main things to clarify at the end of its two-day policy meeting on Wednesday at 1800 GMT. First is the course of rate hikes that the central bank hinted it will pause until later this year....

Markets Remain Choppy ahead of Fed

USD – Dollar maintains soft tone as dovish Fed firmly priced in Brexit – EU to offer conditional extension Stocks – Risks are growing Oil – Delaying the April OPEC meeting should be bearish Gold – Higher as dovish Fed...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals