Canadian Firm Sentiment Falls Back to Earth

Canadian businesses reported a more somber mood in early 2019, as reported by the Bank of Canada’s Business Outlook Survey (BOS). The summary measure (‘BOS Indicator’) fell to -0.6 (from 2.2 previously), returning to negative territory for the first time...

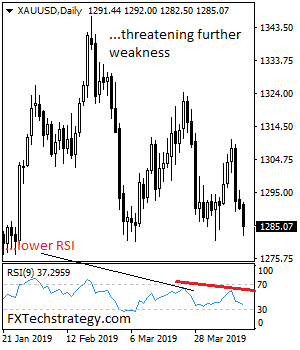

GOLD Looks To Extend Its Bear Pressure

GOLD looks to extend its bear pressure as it following through lower on the back of its past week losses during Monday trading session. On the downside, support comes in at the 1,280.00 level where a break will turn attention...

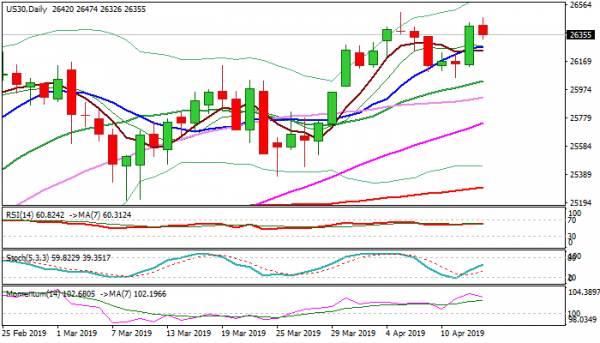

DOW: Sentiment Sours on Weak Bank Earnings

The Dow Jones eases from marginally higher one-week high at 26474 on Monday, as mixed bank earnings soured the sentiment. Signals that earnings season will disappoint came from weaker than expected earnings results for Goldman Sachs, Citi and Bank of...

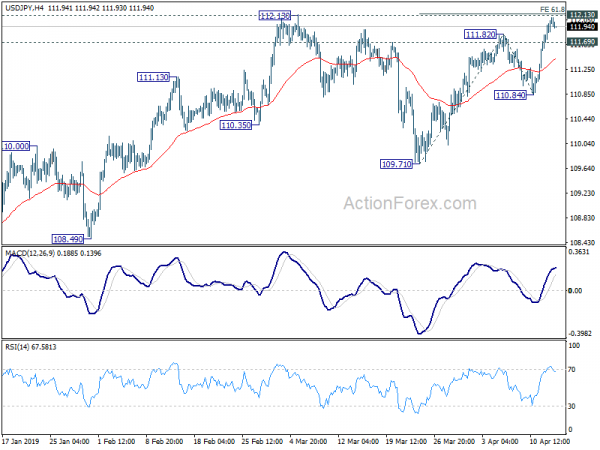

Forex Markets Turn Mixed as Risk Appetite Cools, More Inspirations Needed

The forex markets turn relatively mixed today and markets lack a general direction. Risk appetite appeared to be firm earlier in Asian session but quickly faded. Major US indices open the day mildly lower. While German 10-year yield is trading...

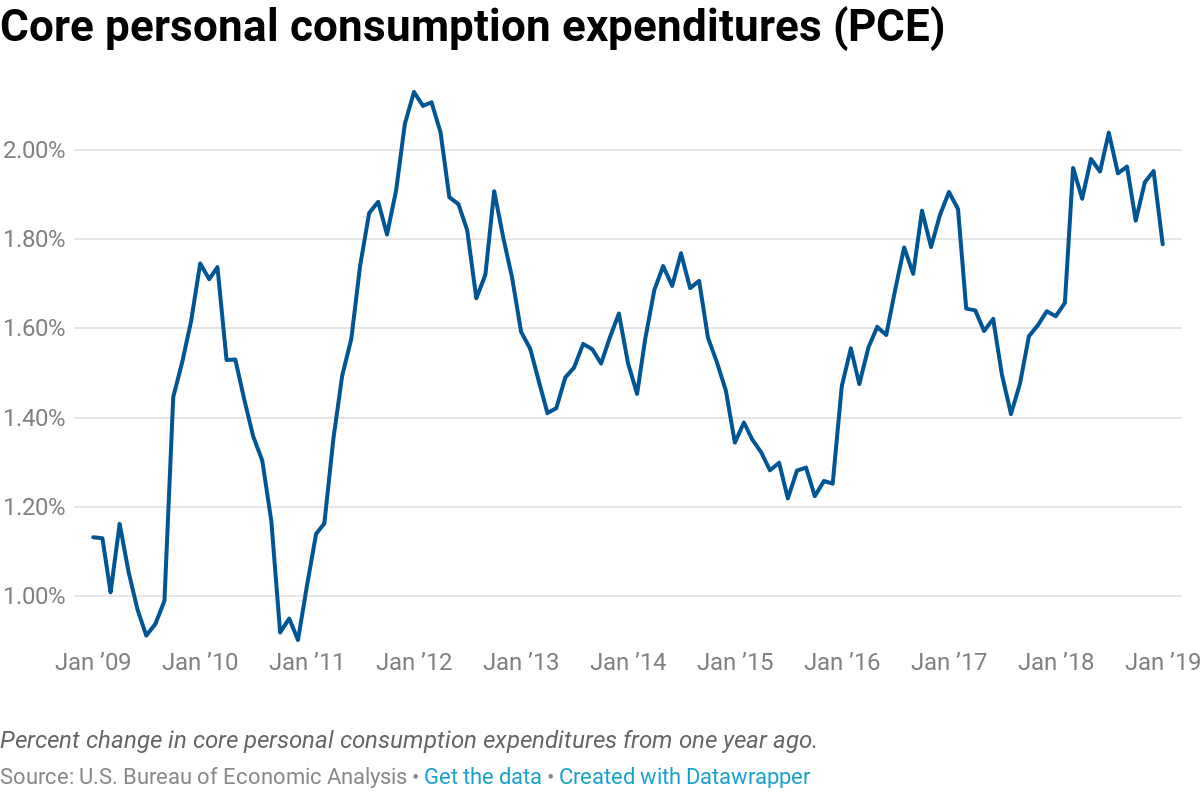

Fed’s Charles Evans tells CNBC rates can stay unchanged into fall of 2020

Chicago Federal Reserve President Charles Evans said on Monday that he’d be comfortable leaving interest rates alone until autumn 2020 to help ensure sustained inflation in the U.S. “I can see the funds rate being flat and unchanged into the...

Netflix Stock Eases Below SMAs In Neutral Bias

Netflix stock price posted a significant red day on Friday, heading below the short-term moving averages in the daily timeframe, creating a neutral bias. The RSI indicator dropped beneath the 50 level with strong momentum, while the MACD oscillator is...

EUR/USD – Euro Steady After Positive Week

EUR/USD has started the week with small gains. Currently, the pair is trading at 1.1310, up 0.10% on the day. Last week, the pair climbed 0.7%, its best week since mid-March. It’s quiet on the fundamentals front, with no major...

Quiet Start To Busy, Shortened Trading Week

Notes/Observations Shortened trading week due to Easter holiday but plethora of key data before then (Tues: German ZEW Survey, China Q1 GDP; Thurs: Major European PMI data, US retail sales data) US corporate earnings season picking up through the week...

Crude Oil Consolidation

Pivot (invalidation): 64.05 Our preference Short positions below 64.05 with targets at 63.30 & 62.95 in extension. Alternative scenario Above 64.05 look for further upside with 64.30 & 64.65 as targets. – advertisement –

Comment As Long as 64.05...

Risk Appetite Lifted by More US-China Trade Optimism, Eurozone and China Data Watched This Week

Dollar trade mildly lower in Asian session after more verbal attack on Fed by Trump. Australian Dollar follows as second weakest, paring some of last week’s gains. On the other hand, New Zealand Dollar is the second strongest one, followed...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals