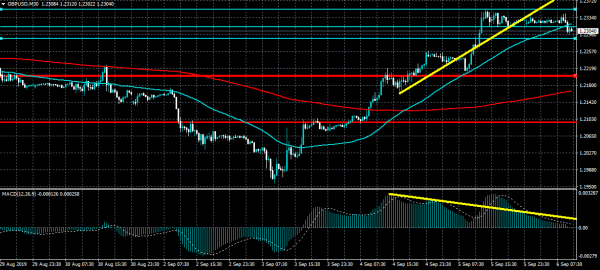

GBPUSD Bearish MACD Divergence

The British pound has moved back towards the 1.2300 support level against the US dollar after the pair found strong technical resistance from the 1.2350 level. The 30-minute time frame is showing that the recent rally has created bearish MACD...

Buying Elliott Wave Dips In 10 Year T-Note Futures

In this technical blog, we are going to take a look at the past performance of 10 Year T-Note Futures ticker symbol: $ZN_F 1-Hour Elliott wave Charts that we presented to our members. In which, the rally from October 2018 low showed...

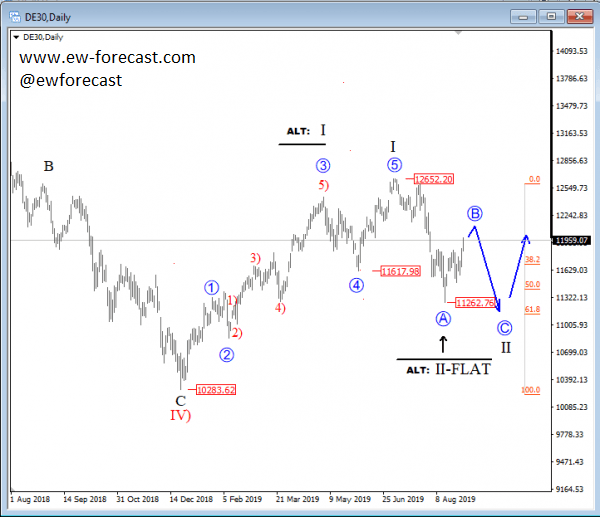

German DAX Looking Higher After A Pullback

German DAX made a five-wave recovery from the 10283 region, which we labelled it as a wave I, first leg of a bigger, bullish cycle. That said, latest bearish reaction from the 12652 area can now be sub-wave A of...

Markets Remains Risk On as Focus Turns to Non-Farm Payrolls

The financial markets remain in risk on mode today. Yen, Swiss Franc and Dollar continue to feel tremendous selling pressure. Meanwhile, commodity currencies are generally the strongest. Euro and Sterling are mixed for now as it’s still unsure where Brexit...

Everybody Loves A Trade Show

The buzz from the apparent de-escalation of trade tensions between the U.S. and China continues to be the only show in town, with Wall Street posting healthy gains again overnight. The U.S. ISM Non-Manufacturing PMI drew sighs of relief as...

Growing backlash in China against A.I. and facial recognition

A display for facial recognition and artificial intelligence is seen on monitors at Huawei’s Bantian campus on April 26, 2019 in Shenzhen, China. Kevin Frayer | Getty Images China’s seemingly unfettered push into facial recognition is getting some high-level pushback....

Stripe, the world’s most valuable private fintech company, is getting into lending

Stripe co-founders Patrick and John Collison Source: Stripe The world’s most valuable private fintech company is moving into a new area of banking: loans. Stripe, valued at $22.5 billion after its last funding round, announced the launch of a lending...

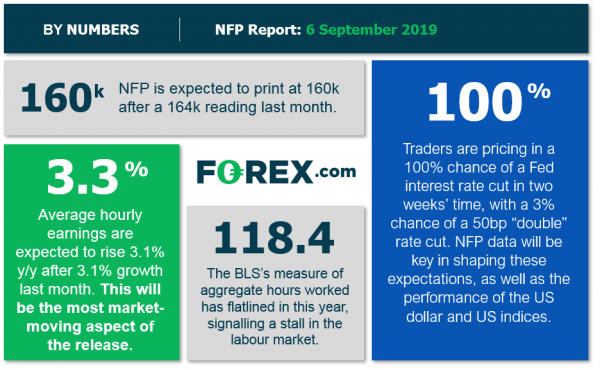

NFP Preview: Another Solid Report on Tap?

Seemingly every month, we remind traders that the Non-Farm Payrolls report is significant because of how it impacts monetary policy. In other words, the Fed is the “transmission mechanism” between US economic reports and market prices, so any discussion about...

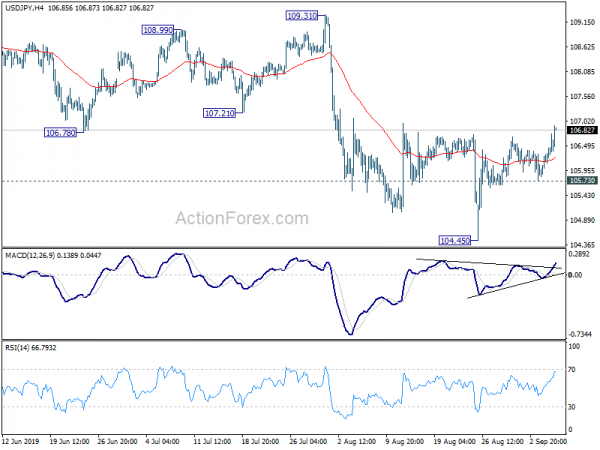

USD/JPY Technical Outlook Appears Bullish

The USD/JPY has broken above last week’s high today, thanks to positive sentiment towards risk assets in general. Sentiment has been boosted in part because of US-China trade optimism and receding no-deal Brexit risks. The UJ has been boosted further...

Risk Appetite Strong on Trade, Brexit and Italy

Risk appetite is general strong today on rather positive news. Firstly, US and China both confirmed that trade negotiations are continuing and both teams are in preparing for a high-level face to face meeting in October. There is no specific...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals