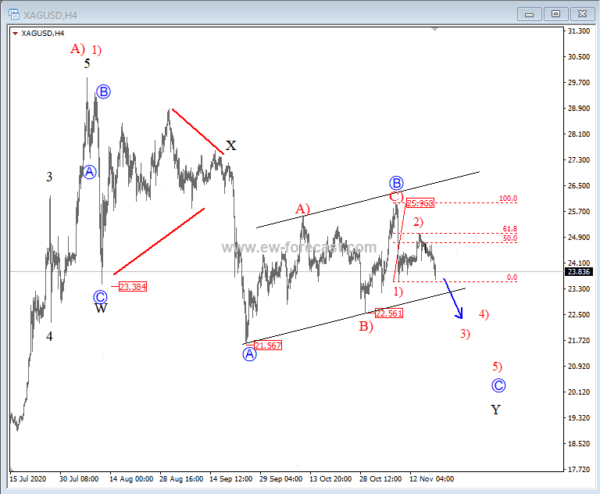

Silver in a Big Correction

Silver is trading in a bigger, complex W-X-Y correction, down from August highs. At the moment we are tracking a sub-wave C of Y, down from 25.97 level, where sub-wave B correction fully unfolded its three-wave move. Wave C is...

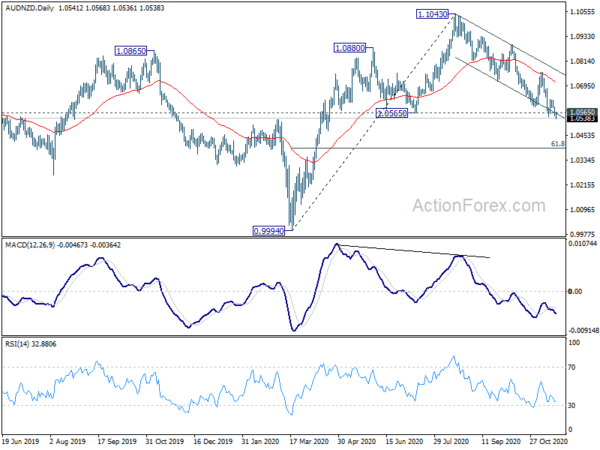

Dollar Still in Recovery Despite Rise in Initial Jobless Claims

Dollar rises mildly today despite the first rise in initial jobless claims in five weeks. Euro and Swiss Fran are following closely. Global markets are still engaging in consolidative trading, with mild weakness in European equities and US futures. Australian...

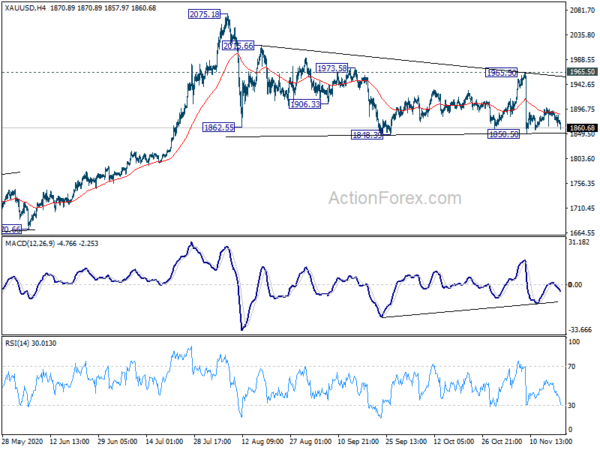

Oil Edges Higher, Gold Range Trading

Crude inventories saves oil’s blushes Oil would probably have finished the overnight session lower as well but can thank a lower than expected rise in official US Crude Inventories. The 768,000-barrel print was well below market expectations of a 1.65-million-barrel...

Dollar Recovers in Consolidative Markets, Coronavirus Cases and Restrictions Weigh on Sentiments

Consolidative trading continue as Dollar rises in general in Asian session together, followed by Swiss Franc. On the the other hand, Sterling is reversing some of this week’s gains together with Aussie and Kiwi. News on coronavirus vaccines are unable...

Elliott Wave View: GDX Correction Remains In Progress

Elliott Wave view in Gold Miners (GDX) suggests the Index is correcting the cycle from March 16, 2020 low. The correction is unfolding as a double three Elliott Wave Structure. In the 60 minutes chart below, we can see wave...

Market ‘tug-of-war’ with Covid-19 may limit downside, $7.2B money manager says

Money manager Kevin Nicholson believes downside is limited for the S&P 500 through next month. Nicholson, who’s co-chief investment officer of global fixed income at RiverFront Investment Group, blames the market’s “tug-of-war” with Covid-19 news. “When we announce new vaccines,...

Pound Climbs as Inflation Beats Estimate

GBP/USD is in positive territory for a fourth straight day, as the pair continues to make inroads against the greenback. Currently, the pair is trading at 1.3305, up 0.47% on the day. British inflation beats forecast Inflation levels are an...

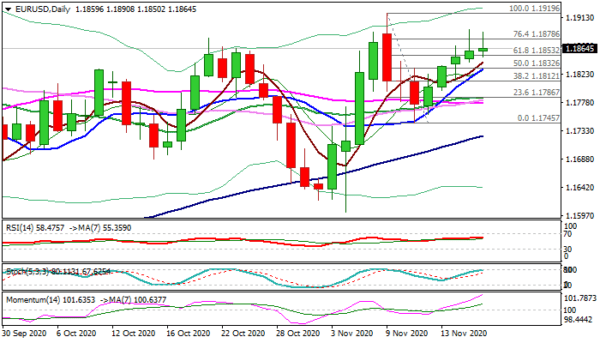

EUR/USD Outlook: Bulls Lose Traction at Pivotal Fibo Barrier and Generate Initial Signs of Stall

Bulls started to lose steam on approach to 1.1900 barrier as the uptrend from 1.1745 struggles at 1.1878 Fibo level (76.4% of 1.1919/1.1745) for the second day. Tuesday’s inverted hammer candle gives initial warning of stall, as candles of last...

US: Housing Starts Continue to Defy Expectations in October

The information contained in this report has been prepared for the information of our customers by TD Bank Financial Group. The information has been drawn from sources believed to be reliable, but the accuracy or completeness of the information is...

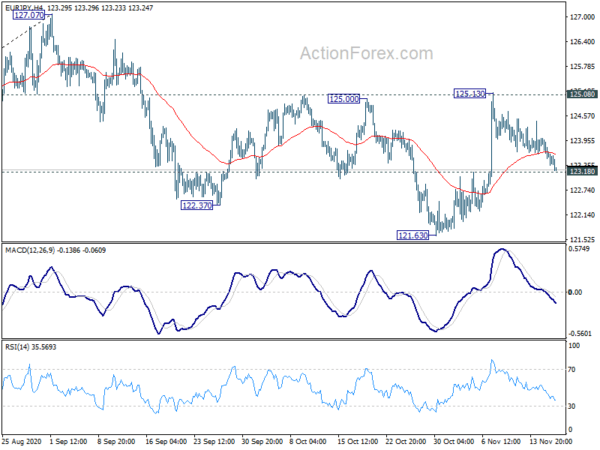

Yen Mildly Higher in Subdued Markets, Dollar and Euro Soft

Dollar and Euro are both trading mildly lower in a relatively subdued, consolidative markets today. Yen and Kiwi are, on the other the stronger ones. There is no clear sing of range breakout yet. Pfizer provided another piece of upbeat...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals