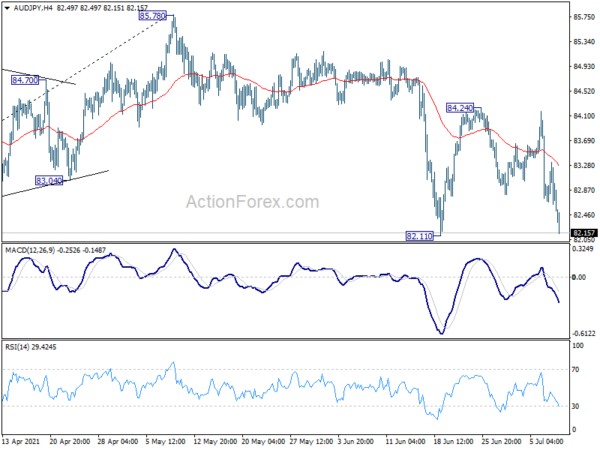

The One Variable that Explains this Week’s Big Market Moves…and What It Means for CAD/JPY

Over the last several months, many markets have become one-way trades, attracting trend-following speculators and leading to excessive positioning in several of the planet’s most-traded assets. For a generally quiet post-holiday, pre-earnings week, we’ve certainly seen some big market moves...

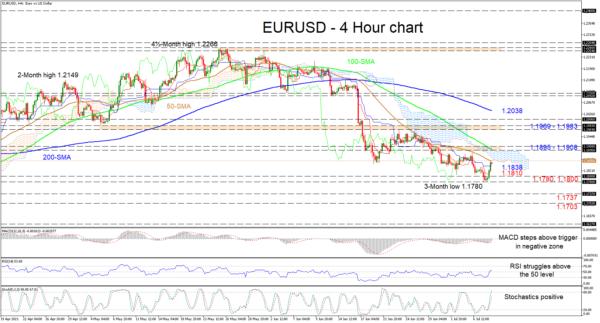

EURUSD Remains Heavy as Rebound Curbed by 50-MA

EURUSD has been logging green candles after finding its footing around a three-month low of 1.1780 and is pushing up against the 50-period simple moving average (SMA) at 1.1856, which has dismissed previous bounces ever since it adopted a downwards...

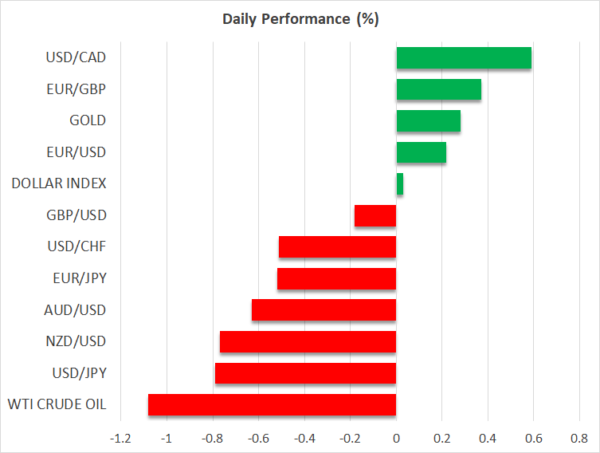

Swiss Franc and Yen Soar on Deep Risk Averse Sentiment

Risk aversion generally dominates the global markets today. Following selloff in Asia, major European indexes open lower and are trading down around -2%. DOW future is also losing around -500pts. Swiss Franc and Yen are overwhelmingly the strongest ones for...

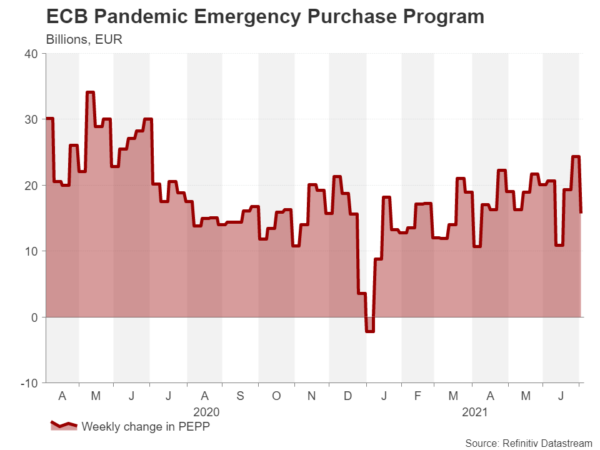

Special ECB Announcement Could Rock The Euro Today

ECB set to announce higher inflation target, Lagarde presser to follow Dollar little changed after Fed minutes, yen shines as yields crumble Stocks retreat amid Chinese regulatory crackdown, oil tanks Euro braces for special ECB announcement The European Central Bank...

USOil Sinks Towards Daily Support

Oil plunges as the OPEC+ deadlock over supply, fuels concerns for a price war. The RSI divergence already indicated a loss in the upward momentum. Price’s successive drop below 75.00, then 73.60, is the confirmation of a correction. Strong momentum...

Yen Rises Broadly as Hong Kong Free Fall Triggers Risk Aversion in Asia

US stocks surged to new record overnight, shrugging off FOMC minutes. But Asian markets are walking another path, as led by the free fall in Hong Kong stocks. Yen surges broadly on risk aversion, followed by Swiss Franc. Commodity currencies...

FOMC Minutes Reveals that QE Tapering to Begin Later this Year

The FOMC minutes for the June meeting confirmed more optimism over the economic outlook. Unwinding of stimulative monetary policy would likely begin earlier than previously anticipated. As the members would begin tapering discussions in coming months, we expect an announcement...

Don’t give up on value trades because ‘the economy is on fire,’ Credit Suisse’s Jonathan Golub says

One of Wall Street’s biggest bulls isn’t jumping on the growth stock bandwagon. Despite the tech-heavy Nasdaq’s run to record highs, Credit Suisse’s Jonathan Golub prefers value trades right now. “The second quarter of this year will be the fastest...

EUR/USD Outlook: Bears Crack 1.1800 Support and May Accelerate on Hawkish Tone from Fed Minutes

The Euro cracked 1.1800 support as bears attempt to resume downtrend after Tuesday’s upside rejection and close below 1.1836 Fibo support (76.4% of 1.1704/1.2266 ascend) generated bearish signal. The single currency maintains negative tone on the fact that Fed is...

ECB Minutes to be Overshadowed by Looming Strategy Review Outcome

The European Central Bank will publish the minutes of its June 9-10 policy meeting on Thursday (11:30 GMT) as the Eurozone recovery gets into full swing. Policymakers struck a markedly dovish tone at their last gathering and although not all...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals