Currency Pair of the Week: DXY

Big earnings, an FOMC meeting, important economic data, the track of the coronavirus, and the infrastructure bill could provide movements of the US Dollar index Although the US Dollar Index is (DXY) not a currency pair, the index has the...

FOMC Preview – Policy Stance to Stay Intact Despite Surging Inflation

With no updates on median dot plots and economic projections, the focus of this week’s FOMC meeting would be the policy statement and the press conference. Since the June meeting, inflation has continued to accelerate. Market optimism was, however, overshadowed...

Sterling Rises on Falling Delta Infections, Dollar Softens

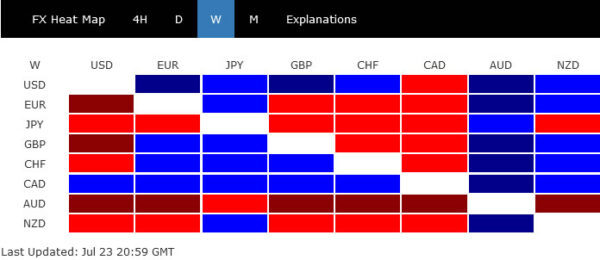

Sterling rises broadly today despite dovish comments from a BoE policymaker. Sentiment towards the Pound is likely support by declining trend in delta variant infections. Other European majors are also firm together with Yen. On the other hand. Dollar is...

The US Dollar Remains Firm

Investors flock to safety of US dollar The US dollar remains near 5-month highs versus the majors, with the dollar index closing 92.90 on Friday, not far from its 93.20 high last Monday on the “delta-dip.” The persistent strength of...

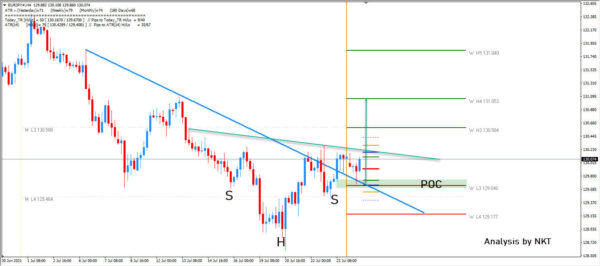

EUR/JPY Surges As Yen Weakens

EUR/JPY is trying to breakout above the W L3 which became a support. We could see further strength if the neckline breaks. The POC is a bouncing zone. 129.65-75 where buyers are. Look for a trend line break and continuation...

Dow futures fall more than 200 points ahead of a huge week of Big Tech earnings

Traders working at the New York Stock Exchange (NYSE), today, Wednesday, April 21, 2021. Source: NYSE Stock futures slipped after the major averages finished the previous session at record closing highs and ahead of a busy week of earnings reports...

Swiss Franc and Yen Higher on Selloff in Hong Kong and China

Yen and Swiss Franc are trading mildly higher as the week starts. Heavy selling is seen in stock markets in Hong Kong and China. Yet, Japan came back from holiday with mild gains. Commodity currencies are generally soft, with Aussie...

EUR/USD Could Decline Further Below 1.1750

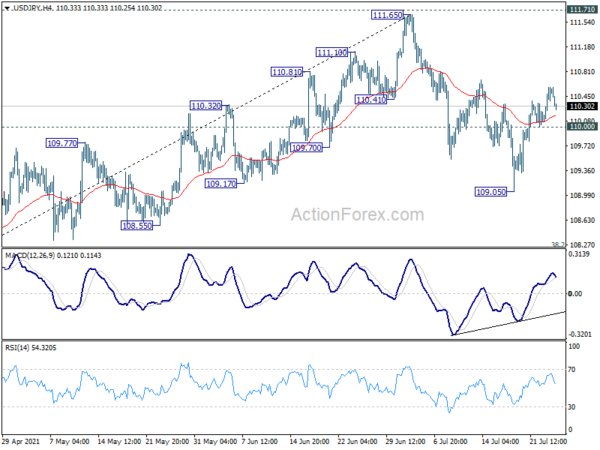

Key Highlights EUR/USD is trading in a bearish zone below the 1.1850 pivot level. A crucial bearish trend line is forming with resistance near 1.1800 on the 4-hours chart. GBP/USD recovered nicely after it tested the 1.3600 support zone. USD/JPY...

Stocks Closed at Records as Delta Worries Receded, Dollar Index Holding On to Weak Rally

It has been a very volatile week as risk markets were initial knocked down by fear of the infectious delta variant. But sentiment made an about-turn then, even with US indexes closing at record highs. Still, despite late recovery, Australian...

Week Ahead: FOMC, Earnings, and Q2 GDP to move markets

The European Central Bank meeting on Thursday was basically a rehash of the Strategic Review: No change in monetary policy, no change in PEPP, and a statement wording change to reflect a “symmetrical 2%” rather than “Close to, but below...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals