Euro On Hold Ahead Of Nonfarm Payrolls

The euro is flat in Friday trade. Currently, EUR/USD is trading at 1.1873, up 0.01% on the day. Eurozone data a mixed bag Eurozone numbers were a mix on Friday. Services PMIs for August in Germany and the eurozone continue...

Euro On Hold Ahead Of Nonfarm Payrolls

The euro is flat in Friday trade. Currently, EUR/USD is trading at 1.1873, up 0.01% on the day. Eurozone data a mixed bag Eurozone numbers were a mix on Friday. Services PMIs for August in Germany and the eurozone continue...

GBPJPY Improves After Bounce Around Familiar Floor

GBPJPY, although having nudged over the 50-day simple moving average (SMA) at 151.85, has yet to overstep the Ichimoku cloud’s upper surface, residing between the 50-and 100-day SMAs. The 100- and 200-day SMAs are backing a positive picture, while the...

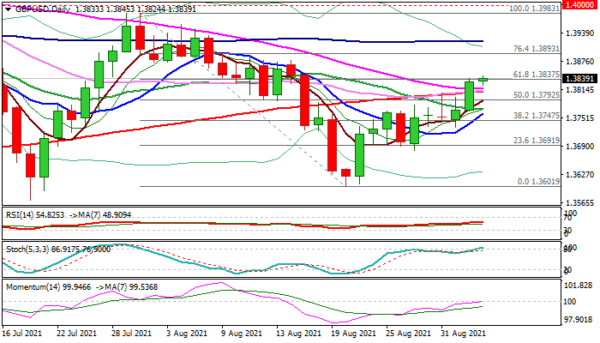

GBP/USD Outlook: Bulls Hold Grip Ahead Of US Jobs Data

Cable is consolidating round pivotal Fibo barrier at 1.3837 in European trading on Friday, following Thursday’s 0.46% advance and awaiting US labor data for fresh signal. Near-term structure firmed after Thursday’s lift above three-day congestion and close above converged 30/55/200DMA’s,...

Gold Analysis: Reveals Triangle Pattern

The previously assumed-to-be sideways trading of the yellow metal has been slowly decreasing volatility. Moreover, by inspecting the hourly candle chart, a triangle pattern has been spotted. In theory, all trading in a triangle pattern eventually ends with a break out...

USD/JPY Analysis: Trades Around 110.00

Since the middle of Wednesday’s trading, the USD/JPY has continued to trade sideways around the 110.00 level. However, up to the start of Friday’s trading, the rate was finding support in the 200-hour simple moving average. On Friday, the rate...

GBP/USD Analysis: Breaks 1.3800 Level

The GBP/USD currency exchange rate managed to pass the resistance of the 1.3800 level. It resulted in a sharp surge, which stopped, as it approached the 1.3850 mark. Afterwards, the GBP consolidated its gains against the US Dollar by retracing...

USDCAD At Risk Of More Declines, Uptrend Still Valid

USDCAD bears snapped the ascending trendline after a three-day battle on Thursday, forcefully pushing the price towards the 50- and 200-day simple moving averages (SMAs) and to a two-week low of 1.2539 ahead of the all-important US nonfarm payrolls . With the...

Dollar, Yen and Swiss Franc Continue to Decline as Focus Turns to NFP

Overall developments in the markets are unchanged for the week. US stocks continued with recent up trend overnight. Dollar, Yen and Swiss Franc extended near term decline. New Zealand and Australian Dollars are the strongest one, followed by Euro and...

Chinese stocks are too risky right now – buy its bonds instead, J.P. Morgan’s Joyce Chang suggests

A major investment bank is avoiding Chinese stocks, but buying its bonds. J.P. Morgan’s Joyce Chang believes the country’s regulation crackdown is heating up and will create downward pressure on major market groups and industries. “We really recommended [investors] to...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals