Bond Rates Moving Towards Realistic Levels

Prospects for the unwinding of QE in the US and Australia in 2022 are finally lifting bond rates. The FOMC looks likely to have unwound its current QE program by mid 2022 along with the RBA. These forces along with...

Elliott Wave View: DAX Rally Should Fail

Short-term Elliott wave view in DAX suggests the decline from August 13, 2021 high is unfolding as a double three Elliott Wave structure. Down rom August 13 high, wave W ended at 15453.96 and rally in wave X ended at...

Stock futures muted after a tech-driven sell-off on Wall Street

Stock futures were muted in overnight trading on Monday following a tech-led sell-off as investors continued to dump high-flying shares in the face of rising rates. Futures on the Dow Jones Industrial Average slipped 30 points. S&P 500 futures were...

Stocks making the biggest moves midday: Facebook, Ford, General Motors and more

Facebook’s logo displayed on a phone screen. Jakub Porzycki | NurPhoto via Getty Images Check out the companies making headlines in midday trading. Facebook — Facebook shares fell 5.5% after a company whistleblower unveiled her identify and accused the social...

US Open Note – Stocks Static and Yields Fail to Aid Dollar

OPEC and global energy risks; Central Banks and NFP report are drivers of the week Market uncertainty lingers but the greenback’s haven appeal remains muted, as a global energy crisis threatens recoveries across the globe. Stocks are slightly on the...

Swiss Franc Rises Broadly as Dollar and Yen Pare Gains

Swiss Franc is the winner so far today, as Dollar and Yen pare back some of last week’s gains. Meanwhile, Euro is also soft after poor investor confidence data. On the other hand, New Zealand Dollar is following closely as...

Crude Oil In Wait For OPEC+ Decisions

Early in the first full week of October, the oil market has decent expectations while waiting for the next OPEC+ meeting. Brent is trading at $79.00 and will surely very actively respond to all comments, both from the cartel itself...

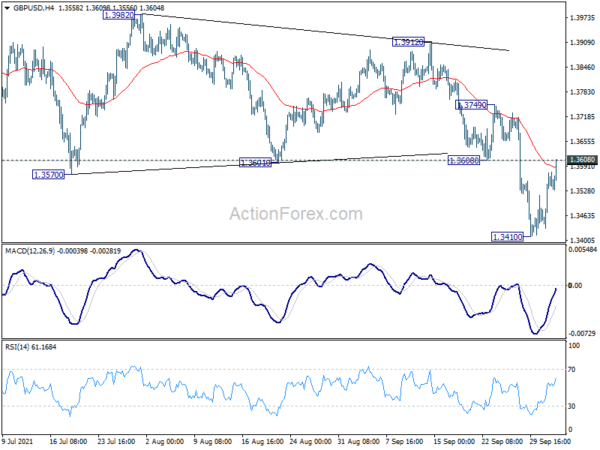

GBP/USD Outlook: Recovery Extends Into Third Straight Day And Pressures Pivotal Barriers At 1.36 Zone

Fresh bulls from new nearly ten-month low (1.3411) hold grip for the third straight day and crack pivotal 1.1.3570/1.3600 resistance zone (former lows of July/Aug / daily Tenkan-sen/Fibo 38.2% of 1.3912/1.3411). Renewed risk appetite keeps pound afloat in the neat...

USD Seems To Recover After Friday’s Drop

The USD seemed to recover somewhat against some of its counterparts during todays’ Asian session, after Friday’s wide retreat as uncertainty seems to be on the rise once again. It should be noted that shares in China’s giant developer Evergrande...

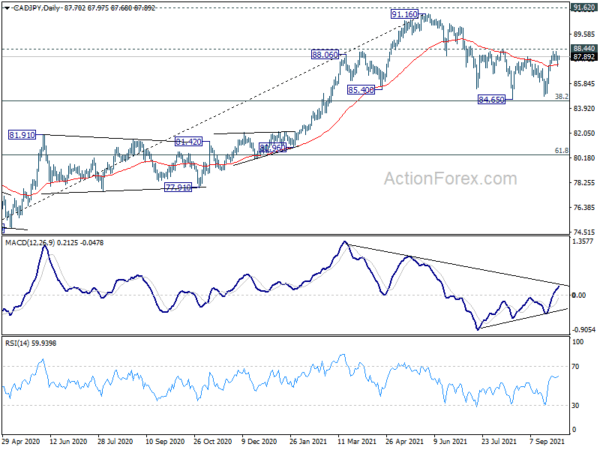

Yen to Follow Risk Sentiment, RBA and RBNZ Featured Early in the Week

While some selling pressure is seen in Asian stocks, the forex markets are relatively steady. Canadian Dollar is currently the stronger one, followed by Yen. Sterling is the softer one, followed by Swiss France, Euro and Dollar. Overall risk sentiment...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals