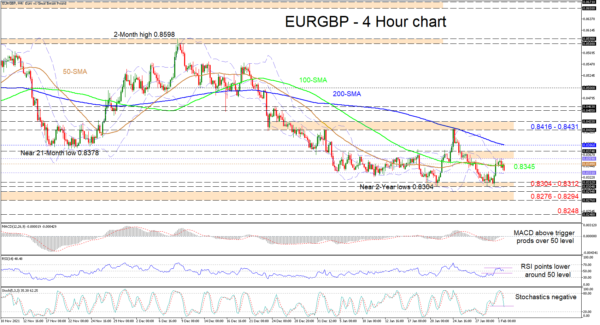

EURGBP Consolidates But Reserves Bearish Tilt

EURGBP has returned below its horizontally entwined 50- and 100-period simple moving averages (SMAs) following its fresh bounce at two-year low levels, which was curbed by the upper Bollinger band around 0.8359. The descending 200-period SMA is defending the bearish...

ISM Manufacturing Index Registers 20th Consecutive Month of Expansion in Spite of Omicron

January ISM manufacturing index fell to 57.6, just beating market expectations for 57.5. This marked a 1.2 percentage point decrease from the December reading of 58.8. New orders decreased by 3.1 percentage points to 57.9, while new export orders increased...

What Will Happen to Bitcoin in February?

Bitcoin rose 2.1% on the last day of January, ending the day at around $38,500. Ethereum added 4.3%, while other leading altcoins in the top 10 strengthened between 0.5% (XRP) and 9.2% (Terra). The total capitalisation of the crypto market,...

Gold Price Moved into a Short-Term Negative Zone Below $1,825

Gold price failed to clear the $1,850 resistance and corrected lower against the US Dollar. The price broke the $1,825 support level to move into a short-term negative zone. Besides, there was a break below the $1,800 level and the...

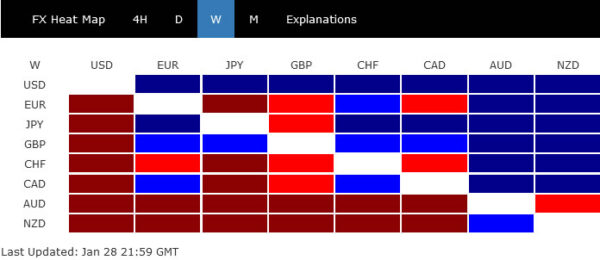

Dollar Skyrockets on Hawkish Fed, Sterling Trailing Behind

The FOMC meeting turned out to me more hawkish than expected and markets are now pricing in four to five hikes this year, instead of three. Dollar was given a strong boost and surged broadly to end as the strongest...

Weekly Economic & Financial Commentary: The Hawks in Full Control at the Fed

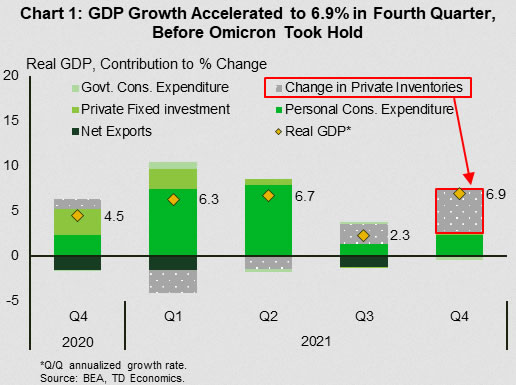

Summary United States: Moderating Growth and a More Aggressive Fed The economy had the wind at its back in 2021 with generous fiscal policy and an accommodative Fed. Inflation and supply chains were the key obstacles. In light of a...

The Weekly Bottom Line: Fed Sets the Stage for Rates to Liftoff Soon

U.S. Highlights The Fed left the policy rate unchanged at this week’s FOMC meeting but signaled that a rate hike was imminent come March. Uncertainty on the pace of hikes post March remains elevated, contributing to stock market volatility this...

Week Ahead: Central Banks, Geopolitics, Earnings and NFP

Last week, the FOMC met and Powell delivered a hawkish press conference which turned up the fire under already volatile markets. Not to be overlooked, the Bank of Canada set the table for a rate hike in March as well. ...

Week Ahead: 31 January 2022

Central Banks: RBA, BoE and ECB Earnings: GOOGL, AMZN and FB Data: Eurozone GDP and CPI, and US NFP Following the previous week’s big drop in US stock markets, we saw some very volatile price action as dip buyers initially...

Key Fed inflation gauge rises 4.9% from a year ago, fastest gain since 1983

A gauge the Federal Reserve prefers to measure inflation rose 4.9% from a year ago, the biggest gain going back to September 1983, the Commerce Department reported Friday. The core personal consumption expenditures price index excluding food and energy was...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals