GameStop shares surge as much as 20% after news it plans to launch an NFT marketplace

A person wearing a protective mask exits from a GameStop Corp. store at a mall in San Diego, California, on Thursday, April 22, 2021. Bing Guan | Bloomberg | Getty Images GameStop shares jumped on Friday after news that the video...

Citigroup will terminate unvaccinated workers by Jan. 31, a first among Wall Street banks

Pedestrians cross a road in front of a Citigroup Citibank branch in Sydney, Australia, on June 1, 2018. Brendon Thorne | Bloomberg | Getty Images Citigroup will be the first major Wall Street institution to enforce a vaccine mandate by...

Here’s where the jobs landed — in one chart

The leisure and hospitality sector led hiring in December as restaurants added wait staff, cooks and bartenders ahead of the holidays.

Week Ahead – US Inflation Report to Decide Dollar’s Fate

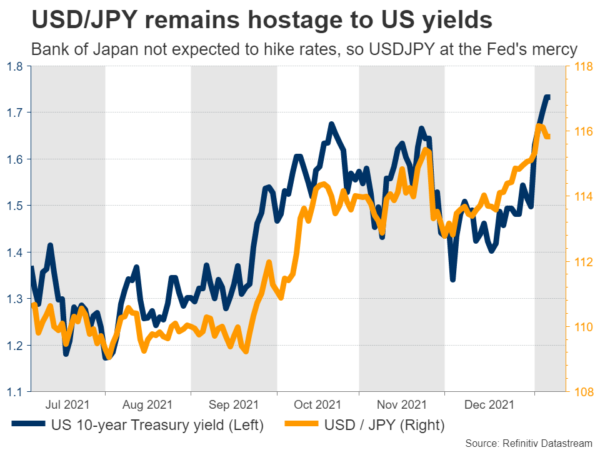

The new year has kicked off with a sharp spike in yields, which has turbocharged the US dollar but demolished the Japanese yen. Whether this trend persists will depend on next week’s US inflation report, as that could decide whether...

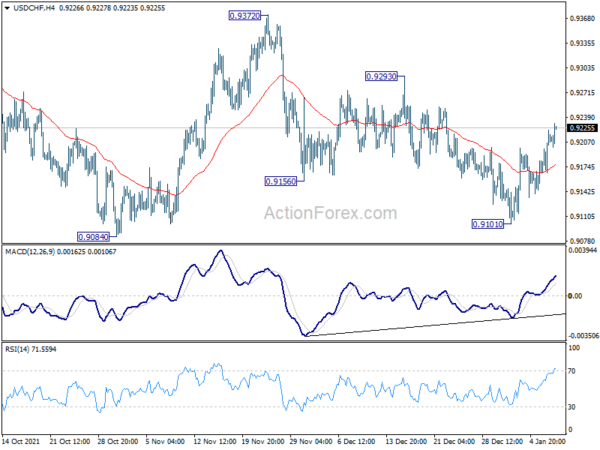

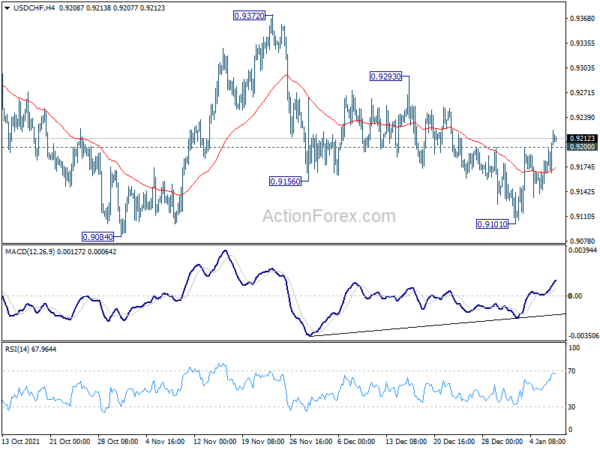

No Decisive Reaction to Mixed NFP, Dollar Staying Firm

At the time of writing, markets are still figuring out how to react to the mixed US non-farm payroll data. While the headline job grow was very disappointing, unemployment rate improved. More importantly, wages reported another month of strong growth....

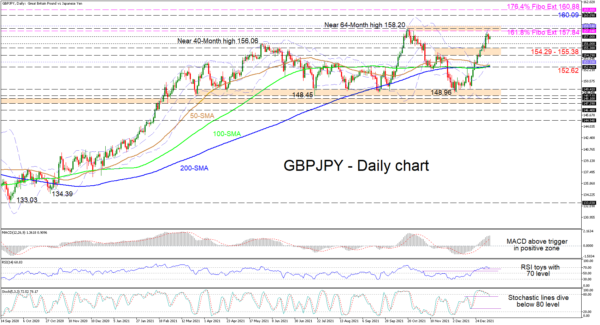

GBPJPY Bulls Hang in there Despite Minor Pullback to 157

GBPJPY’s strong two-week rally, which began from 149.50 has lost steam just shy of the 157.84 level and the more than 5-year high of 158.20, the former being the 161.8% Fibonacci extension of the down leg from 144.94 until 124.00....

US 30 Retreats from All-Time High as Bearish Forces Reign

The US 30 stock index (cash) has been experiencing a minor pullback in the last few four-hour sessions since its long-term rally peaked at the all-time high of 36,950. Moreover, the price crossed below its 50-period simple moving average (SMA), reinforcing...

Markets Steady as NFP Awaited, EUR/USD Still in Range

Markets are generally steady as focus turns to non-farm payroll from US today. For the week so far, Sterling and Dollar are still the strongest ones, as supported by strong rally in benchmark yields and expectation of hawkish central bank...

Stock futures inch higher ahead of key jobs report

U.S. stock index futures were little changed during overnight trading on Thursday, ahead of Friday’s key jobs report. Futures contracts tied to the Dow Jones Industrial Average gained 65 points. S&P 500 futures advanced 0.2%, while Nasdaq 100 futures added...

EUR/USD and GBP/USD Look Lower: Elliott Wave Analysis

Hawkish FED is causing a sharp reversal in the markets, with stocks coming down as US yields rise which makes USD very strong across the board. So we think that volatility is likely going to stay here because of Central...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals