Week Ahead – Markets Wind Down, Mind the Liquidity Gap

As the year draws to a close, liquidity could be in short supply next week. This means that sharp market moves are possible without any news behind them. The economic calendar is pretty light, so the spotlight will remain on...

Nikola shares surge 18% after company delivers its first EV truck, says more to come

Nikola shares jumped 18% on Thursday after the electric truck maker completed delivery of its first vehicle. Loading chart… The surge in the stock came a day after the company announced on Twitter that its first customer delivery is done, signaling...

What the top crypto execs predict for the industry in 2022: Regulation and a Big Tech ‘brain drain’

Sam Bankman-Fried, CEO of cryptocurrency exchange FTX, at the Bitcoin 2021 conference in Miami, Florida, on June 5, 2021. Eva Marie Uzcategui | Bloomberg | Getty Images Cryptocurrencies have had yet another wild year. Bitcoin, the world’s largest digital asset,...

Stocks making the biggest moves midday: Nikola, Las Vegas Sands, Stitch Fix, Crocs and more

Nikola Motor Company Two truck Source: Nikola Motor Company Check out the companies making headlines in midday trading. Nikola — The electric truck maker saw its stock surging more than 16% a day after the company announced on Twitter that its first customer...

WTI Oil Futures Meet December’s Bar; Bullish Bias Still in Play

WTI oil futures (February delivery) paused their two-day advance near December’s resistance zone of 73.10. Although some consolidation is likely around that ceiling, the bulls could soon recharge their batteries according to the momentum indicators. The RSI has breached its previous...

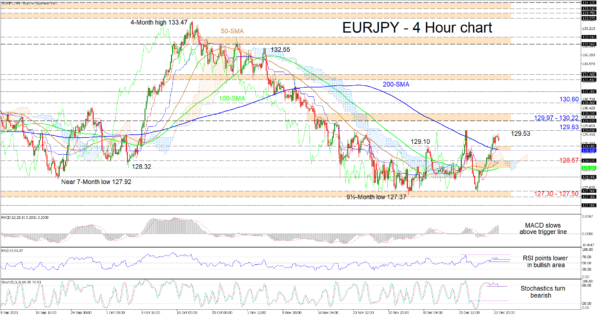

EURJPY’s Ascent Slows, and Neutral Tone Strengthens

EURJPY is struggling to extend its latest rally, which began around 127.50, beyond the December 16 high of 129.63. The converging simple moving averages (SMAs) are hinting that a more neutral price development may evolve confined now between a lower...

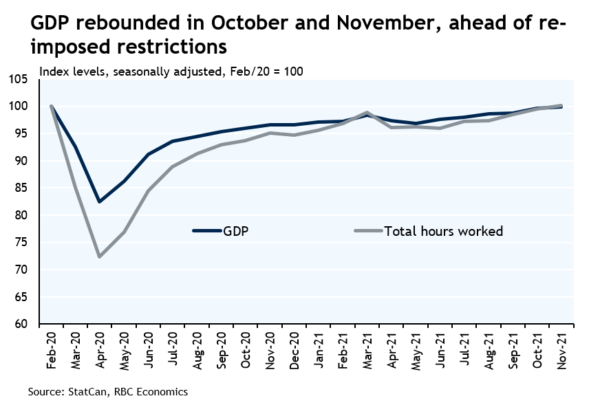

Canadian GDP Rebounded in October and November ahead of Omicron

GDP grew 0.8% in October, backed by a bounce-back in goods-producing industries. Preliminary estimate that output grew another 0.3% in November, despite significant disruptions from flooding in BC. Omicron threat and re-imposed containment measures adding downside risk near-term, but impact...

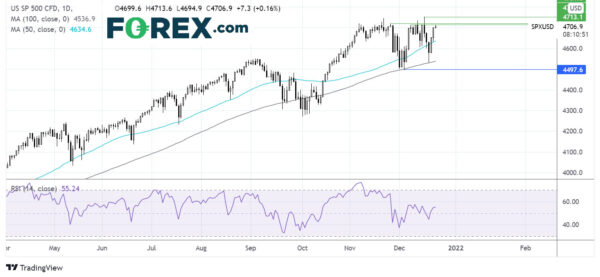

Stocks Point Higher as Omicron Fears Ease, Inflation Rises

Stocks head higher on upbeat Omicron news. US PCE Index rises to 5.7%. US futures Dow futures +0.34% at 35870 S&P futures +0.35% at 4710 Nasdaq futures +0.25% at 16291 In Europe FTSE +0.45% at 7352 Dax +0.8% at 15692...

Stocks March Higher as Omicron Jitters Subside

Dollar gains traction after PCE release; Safe havens plummet Despite its weakness early in the session, the stronger-than-expected PCE inflation print enabled the greenback to pare a significant part of its losses. Specifically, the US annual Core PCE inflation rose...

Sterling Skyrockets, Dollar Shrugs PCE Inflation

Sterling’s rally picks up some strong momentum in pre-holiday trading. Meanwhile, overall steady to risk-on sentiment is also lifting Aussie and other commodity currencies. On the other hand, Euro is under tremendous pressure, thanks to selloff against the Pound. Dollar,...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals