British Pound Yawns as CPI Matches Estimate

UK inflation nudged higher in May, as was expected. The headline release rose to 9.1% YoY, up slightly from the 9.0% gain in April. On a monthly basis, CPI nudged higher to 0.7%, up from 0.6% in April. UK inflation...

USD/JPY: Bulls Pausing Under New Multi-Year High Before Fresh Push Higher

The USDJPY is taking a breather under new 24-year high on Wednesday, as overbought conditions prompt some profit-taking after the pair advanced 3.3% in past three days and traded at levels last seen in 1998. Overall picture shows bulls fully...

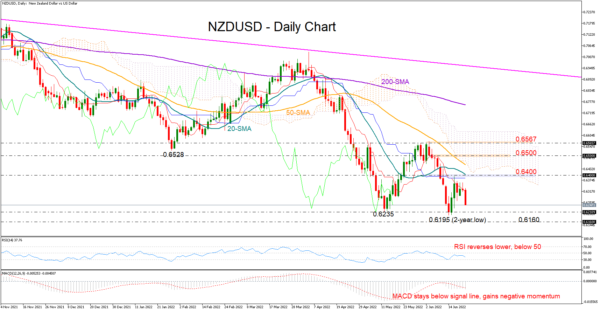

NZDUSD Eyes June’s Lows as Bears Regain Control

NZDUSD resumed its slide on Wednesday, bringing the key 0.6335 – 0.6195 bottom area back under the spotlight after a four-day-long unsuccessful battle with the red Tenkan-sen line. The RSI and the MACD remain negatively charged within the bearish zone,...

Eurozone PMIs: Slowing Down But No Recession Yet

The flash PMI releases by S&P Global are one of the monthly highlights of the Eurozone calendar as the forward-looking indices tend to track GDP growth in the euro area quite closely. The first look at the June readings is...

Yen Selloff is Back as USD/JPY Resumes Up Trend

Yen’s selloff accelerates today as US stocks are set to stage a rebound after the long weekend. For now, Euro is the strongest one with help from rebound against Sterling and Swiss Franc. It’s followed by Canadian Dollar, which is...

GBPUSD Rebounds Off 27-Month Low But SMAs Act as Strong Resistance

GBPUSD has reversed back up again after finding support at the 27-month low of 1.2070, achieved last week, but the current momentum is still weak. The technical indicators are pointing to a neutral to negative bias in the short term...

Key Takeaways from Today’s RBA Communique and What it Means for AUDUSD

Following last week’s mega moves by central banks, the calendar this week allows central bankers to finetune some of those shifts, starting with a plethora of communique from the RBA this morning. The calendar this week allows central bankers to...

US Dollar Index Outlook: Dollar is Set for Further Advance

Bulls are consolidating under new two-decade high but remain in play and position for further advance. The dollar is supported by strong Fed rate hikes and hawkish stance that signals further action, as well as safe-haven demand on economic and...

Markets Tread Water With US on Holiday, Dollar and Yen Soft

Markets are generally quiet today, with a near empty European calendar and US holiday. Major European indexes are recovering slightly but lack follow through buying. Gold and oil are staying in tight range. In the currency markets, Aussie and Kiwi...

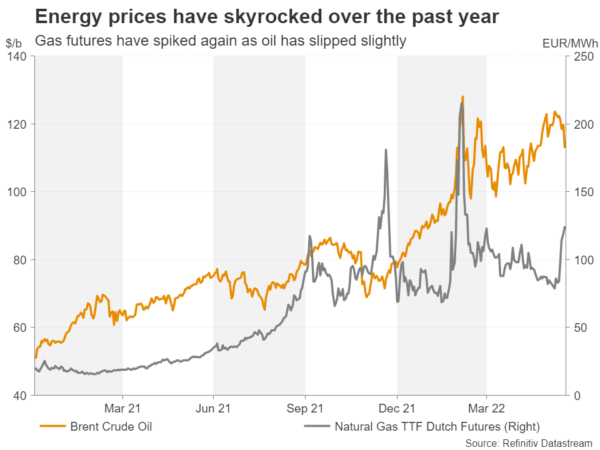

U.S. recession isn’t ‘inevitable,’ but inflation is ‘unacceptably high,’ Treasury Secretary Yellen says

Talk of a recession has accelerated this year as inflation remains high and the Federal Reserve takes aggressive steps to counter.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals