Here’s what the Federal Reserve’s 0.75 percentage point rate hike — the highest in 28 years — means for you

What the federal funds rate means to you The federal funds rate, which is set by the central bank, is the interest rate at which banks borrow and lend to one another overnight. Although that’s not the rate consumers pay,...

The Federal Reserve just hiked interest rates by 0.75 percentage point. How raising rates may help slow inflation

Federal Reserve Chairman Jerome Powell speaks at a news conference following a Federal Open Market Committee meeting on May 4, 2022 in Washington, DC. Win McNamee | Getty Images The Fed’s main tool to battle inflation is interest rates The...

Here’s everything the Fed is expected to announce, including the biggest rate hike in 28 years

The Federal Reserve on Wednesday is expected to do something it hasn’t done in 28 years — increase interest rates by three-quarters of a percentage point. In response to soaring inflation and volatile financial markets, the central bank will hike...

Fed Policy Meeting: Switching to Sharper Rate Hikes?

The Federal Reserve is undoubtedly expected to approve another jumbo-sized rate hike at the conclusion of its policy meeting on Wednesday at 18:00 GMT. Following the latest surprise pickup in inflation, investors have immediately become certain that the central bank...

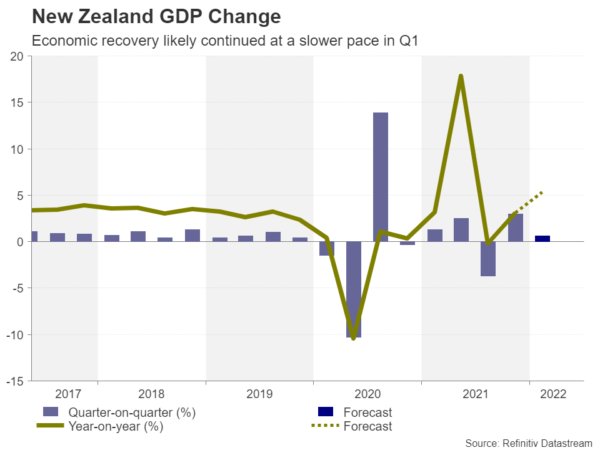

Kiwi Caught in Fed and Inflation Crossfire, New Zealand GDP Might Not Help

New Zealand’s economy has had a bumpy but strong recovery from the pandemic lockdowns and data due on Thursday (Wednesday, 22:45 GMT) is expected to show GDP kept expanding in the first quarter. The healthy economic backdrop has allowed the...

AUDJPY Wave Analysis

AUDJPY reversed from resistance level 95.66 Likely to fall to support level 92.00 AUDJPY currency pair recently reversed down from the strong resistance level 95.66 (which stopped the multi-month uptrend in April), coinciding with the upper daily Bollinger Band. The...

Gold Price Technical Analysis 13th June 2022

Gold price started a fresh increase from the $1,825 support zone against the US Dollar. The price broke the $1,840 resistance to move into a positive zone. Besides, there was a clear move above a major bearish trend line with...

Stagflation Worries Pushed Dollar and Yield Higher, Stocks Lower

Worries of stagflation intensified a whole lot last week. In particular, even the habitually cautious ECB pre-committed to rate hikes in July and September, while delivering new economic forecasts with sharply higher inflation and lower growth projections. Selloff in risk...

Weekly Economic & Financial Commentary: SNB and BoE Hold Policy Meetings Next Week

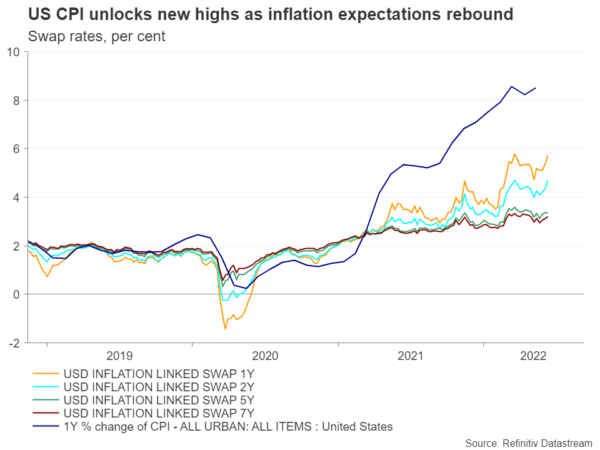

Summary United States: Prices Push Higher in May, Signaling Little Immediate Relief for Consumers Consumer price inflation continued to push higher in May, with the consumer price index rising more than expected and lifting the annual rate of inflation to...

The Weekly Bottom Line: The Good, the Bad and the Ugly

U.S. Highlights U.S. CPI came in above expectations, with the headline reading reaching a new 40-year high. Core inflation also surprised with a broad-based acceleration. The U.S. trade deficit narrowed in April with both lower U.S. imports and rising exports...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals