Carlyle’s Rubenstein says biggest economic risk is high unemployment, not stock market speculation

David M. Rubenstein, Co-Founder & Co-Executive Chairman, The Carlyle Group. David A. Grogan | CNBC Carlyle Group co-founder David Rubenstein told CNBC on Thursday he believes the largest economic risk is high unemployment, not some areas of the stock market where valuations...

Weekly jobless claims drop sharply but labor market remains challenged

Jobless claims fell sharply last week despite severe winter storms that swept across Texas and other parts of the South, the Labor Department reported Thursday. First-time filings for unemployment insurance totaled 730,000 for the week ended Feb. 20, well below...

Euro Attempts a Come Back, Global Yields Surge Continues

Surging global yields remain the major focus today, with Germany 10-year bund yield hitting as high as -0.234, while UK 10-year gilt yield reaching as high as 0.818. Earlier in Asia, Japan 10-year JGB yield closed strongly at 0.152. US...

USD/NOK 4H Chart: Falling Wedge Pattern In Sight

Since the end of December, the USD/NOK exchange rate has been trading within a falling wedge pattern. From a theoretical perspective, it is likely that the currency pair could continue to follow the predetermined pattern in the medium term. In...

Team Risk-On Extends Leads as DOW Hits New Records

As DOW hit another record with strong rise overnight, team risk-on is extending the lead over team risk-off in the currency markets. New Zealand Dollar is having a mild upper hand over Australian, Canadian and Sterling for now. But the...

Market Morning Briefing: Aussie Has Been Rising Boosted By A Strong Copper

STOCKS Dow has surged to test 32000 as expected. 32000-32200 will be an important resistance zone to watch now to see if a reversal is happening or not. A break above 32200 will negate our view of seeing a reversal....

Just Like The Good Old Days: Yields, Stocks, Commodities, And USD/JPY All Higher!

Things seem like they are back to normal, regardless of Jay Powell says: Higher stocks, higher yields, higher USD/JPY higher, higher Crude. They all seem to be acting in harmony with one another, just like the old days! With a...

Double down on epicenter stocks and avoid Big Tech, market bull Tom Lee suggests

The Nasdaq’s slump may be just starting. Fundstrat Global Advisors’ Tom Lee sees a major market shift underway in which Big Tech starts to greatly underperform economically sensitive stocks. So, he’s telling investors to double down on epicenter trades, which...

The Anatomy of a Stop Run: EUR/GBP

Yesterday, we discussed where GBP could be headed next, given the unveil of the reopening plan for the UK economy. We also discussed how the BOE has become “less dovish” than other central banks. And we looked at how the...

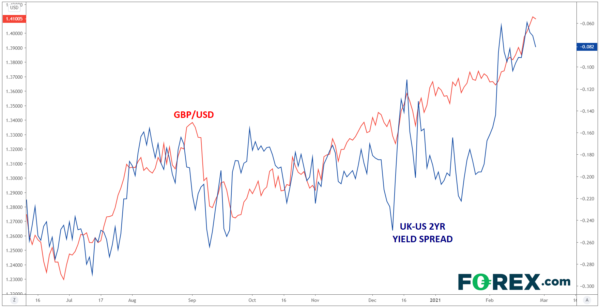

GBP/USD: The #1 Most Important Factor Powering Cable’s Relentless Rally

Through a global pandemic, Brexit, US political upheaval, and countless other storylines, there has been one constant in the FX market over the past 6-12 months: A relentless bid for GBP/USD. After bottoming near 1.1500 as COVID fears peaked last...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals