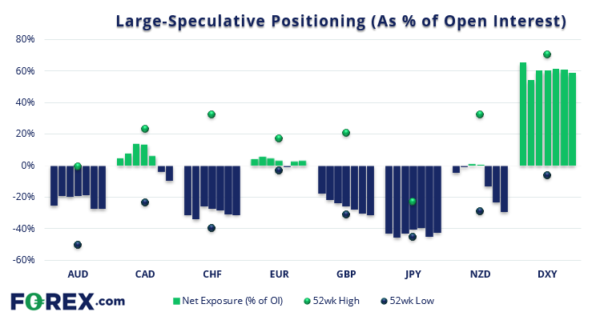

Commitment of Traders Report (COT): CHF Bears Begin to Capitulate

Whilst the COT report shows us traders were their most bearish on CHF futures in 6-months, recent events and price action suggest some of those bears have closed out. Commitment of traders (as of Tuesday 17th May 2022): The weekly...

Swiss Franc Won the Week, But Aussie Could Jump on Turnaround Sentiment

It was another roller-coaster week. Swiss Franc ended as the strongest one after SNB Chairman Thomas Jordan surprisingly said it’s ready to act if inflation solidified. But it should reminded that he reiterated the readiness on intervention too. Euro was...

Weekly Economic & Financial Commentary: April Economic Data Show Resilient U.S. Economy

Summary United States: April Economic Data Show Resilient U.S. Economy U.S. retail sales topped expectations in April, while industrial production also grew more rapidly than economists expected. Data on housing starts, home sales and homebuilder sentiment, however, showed tentative signs...

EUR/USD: Improving Techs Point to Further Short-Squeeze, But Fundamentals Still Rule

The Euro is standing at the back foot on Friday, following 1.2% advance on Thursday, but dips were so far limited, adding to positive signal from Thursday’s bullish engulfing pattern. Fresh bullish momentum on daily chart and formation of 5/10DMA...

EUR/USD Pair Moved into a Positive Zone from $1.0420

The Euro started a fresh increase from the 1.0420 support zone against the US Dollar. The EUR/USD pair surpassed the 1.0500 level to move into a positive zone. The price even traded above the 1.0550 level and the 50 hourly...

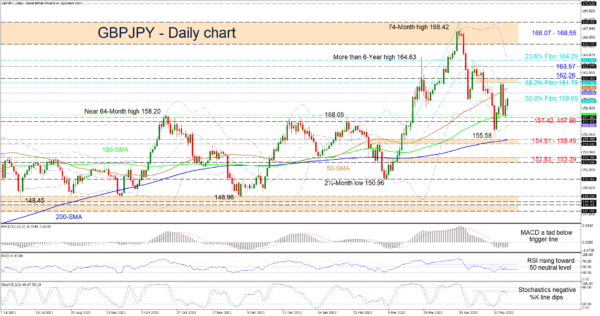

GBPJPY Tackles 50.0% Fibonacci after Bouncing Off 100-MA

GBPJPY is confronting the 159.69 barrier, which is the 50.0% Fibonacci retracement level of the uptrend from 150.96 until the multi-year high of 168.42, which failed to close north of the 166.07-168.55 resistance zone that extends back to February 2016....

GBP/USD: Don’t Get too Comfy with Recent Gains

GBP/USD look headed for its first weekly gain in four weeks moving into late Thursday trading. At the time of writing, the pair was trading up by 2.03% at 1.25089, supported by a broadly weaker US dollar. But a stronger...

Swiss Franc Staying as Winner, Yen Catching Up

Risk aversion is once again a clear main theme of the day, with European indexes in deep red while US futures point to extended selloff. Safe-haven flows are also pushing benchmark global yields lower, with Germany 10-year yield back at...

AUDUSD Bears Take a Breather after Almost 2-Year Low

AUDUSD could not find enough buyers to overcome the 0.7050 resistance level, with the spotlight remaining to the downside as the steep negative bias is still holding. Encouragingly, however, the RSI and the MACD continue to hold above their recent...

Swiss Franc Jumps on Risk Aversion, Dollar and Yen Lag Behind

Markets are back in risk-off mode as down dropped more than -1100 pts overnight. Dollar and Yen tried to rebound but there was no follow through buying. Indeed, both remain the worst performing ones for the week. Instead, safe-haven flow...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals