Stocks making the biggest moves midday: General Electric, Warner Bros. Discovery, UPS, 3M and more

A General Electric (GE) sign is seen at the second China International Import Expo (CIIE) in Shanghai, China November 6, 2019. Aly Song | Reuters Check out the companies making headlines in midday trading. General Electric — Shares slid more...

DXY Continues to Surge; EUR/USD Lower

The US Dollar Index has broken above the top trendline of the upward sloping channel and is gunning for the March 2020 highs DXY began moving higher in May 2021 as the Fed hinted that it may be ready to...

GBPUSD: Cable Extends Steep Fall as Exodus into Safety Accelerates

Cable falls further in early Monday, hitting the lowest since Sep 2020, extending Friday’s 1.5% drop (the biggest daily fall since 18 Mar 2020) and last week’s 1.64% loss (the biggest weekly fall since mid-Aug 2021). Bears gained pace after...

Dollar Powered Up, Fed to Hike 50bps in May and 75bps in Jun?

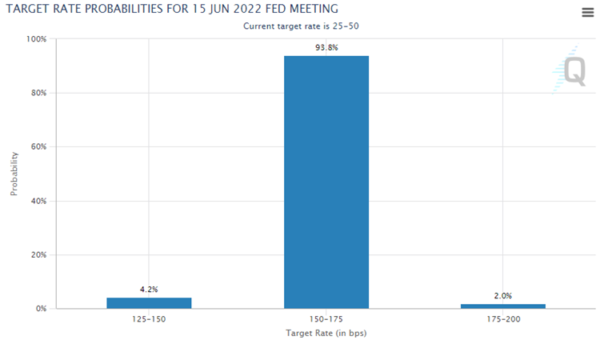

Speculations on aggressive Fed tightening intensified sharply last week after a chorus of hawkish comments from policy markets. Markets are indeed pricing in near 70% chance of federal funds rate at 1.50-1.75% by the end of first half, i.e., 125bps...

The Week Ahead: Vive la France!

Traders are convinced that the Fed is going to raise interest rates aggressively “until something breaks.” The Week Ahead: Vive la France! For most traders, the focus last week was on the ramp up into peak Q1 earnings season. We...

The Weekly Bottom Line: Economic Outlook Dims

U.S. Highlights US yields continued to move higher this week, as Fed Chair Jerome Powell solidified the case for a 50-basis point rate hike at the Fed’s next meeting on May 4th. He also left the door open to additional...

Fed’s Mester casts doubt on the need for ‘shock’ interest rate hikes ahead

Cleveland Federal Reserve President Loretta Mester said Friday she’s in favor of raising interest rates quickly to bring down inflation, but not so quickly as to disrupt the economic recovery. That means a strong likelihood of backing a 50 basis...

Powell says taming inflation ‘absolutely essential,’ and a 50 basis point hike possible for May

Federal Reserve Chairman Jerome Powell affirmed the central bank’s determination to bring down inflation and said Thursday that aggressive rate hikes are possible as soon as next month. “It is appropriate in my view to be moving a little more...

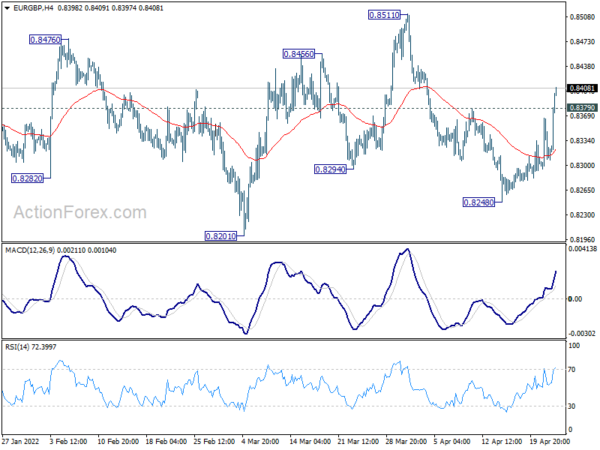

Sterling Falls Broadly after Weak Retail sales, Dollar Up

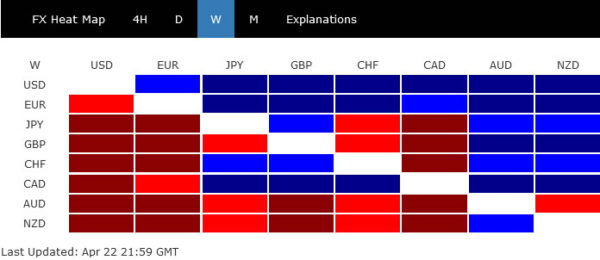

Sterling drops broadly today as weak UK retail sales data argues that the expected consumption drag from high inflation might have arrived already. Aussie is currently the second worse for the day, then Kiwi. On the other hand, Dollar is...

WTI Oil: Oil price eases on growth concerns and China lockdowns but still lacking clear direction

WTI oil edges lower on Friday, pressured by prospects of weaker global growth and higher interest rates, as the International Monetary Fund cut its global economic growth forecast and Fed Chair Powell signaled that half percentage point rate increase will...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals