Crude Oil Price Start Fresh Increase, Gold Consolidates

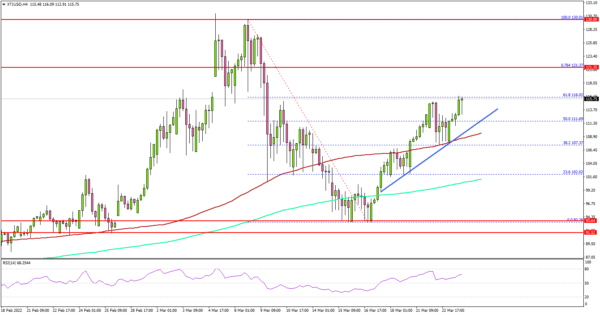

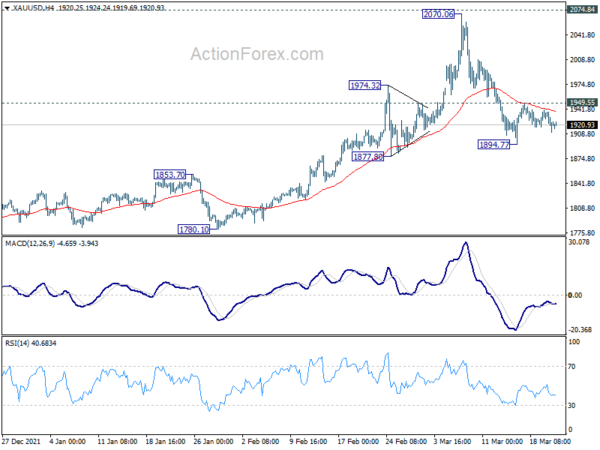

Key Highlights Crude oil price started a steady increase above the $105.00 resistance. A key bullish trend line is forming with support near $113.70 on the 4-hours chart. Gold price is consolidating above the $1,900 support zone. The US Manufacturing...

Russia to Demand Rubles for Their Oil, Gold Set to Breakout?

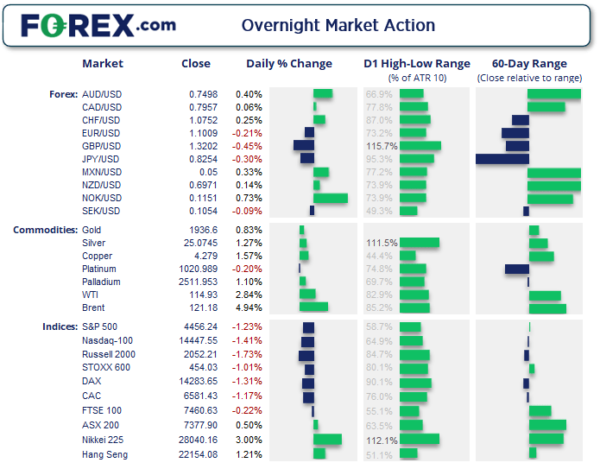

US indices pulled back from their highs overnight as bond yields continued to scream higher as Fed officials maintained their hawkish rhetoric. Wednesday US cash market close: The Dow Jones Industrial fell -448.96 points (-1.29%) to close at 34,358.50 The...

Mortgage refinance demand plunges 14%, as interest rates spike higher

Fast-rising mortgage rates are causing a drop in mortgage demand, especially refinances.

Bitcoin Rises on Capital Flight from Bonds

BTC rose 3.5% on Tuesday. At the peak of the day, the rate exceeded $43.2K, but by Wednesday morning it rolled back to $42K, demonstrating a 0.7% correction. Ethereum is losing 1% over 24 hours, while other leading altcoins from...

Fed Hawks Send Yield Higher, Yen Lower

There is no change in the overall theme in the forex markets. Yen’s decline continues and there is no sign of slowing yet. Hawkish comments from Fed officials pushed treasury yields further up. Fed Chair Jerome Powell will speak again...

AUD/USD Gains Pace, Why It Could Continue Higher

Key Highlights AUD/USD started a fresh increase above the 0.7320 resistance. It broke a key bearish trend line with resistance near 0.7300 on the 4-hours chart. EUR/USD is still struggling below 1.1120 while GBP/USD surpassed 1.3200. Oil price is rising...

Mortgage rates are surging faster than expected, prompting economists to lower their home sales forecasts

A home is offered for sale on January 20, 2022 in Chicago, Illinois. Scott Olson | Getty Images The average rate on the popular 30-year fixed mortgage hit 4.72% on Tuesday, moving 26 basis points higher since just Friday, according...

Stock futures are steady as investors juggle Fed comments and policy

Traders on the floor of the NYSE, March 17, 2022. Brendan McDermid | Reuters U.S. stock futures were little changed in overnight trading on Tuesday as investors continue to digest revelations from the Federal Reserve on inflation and interest rates....

Yen Free Fall Continues, Sterling Jumps

The selloff in Yen remains the major theme in the market today, but both Dollar and Euro are also now under some pressure. For now, New Zealand Dollar is winning the race, followed by Aussie and Sterling. Swiss Franc and...

AUD/USD Outlook: Aussie Breaks Key Fibo Barrier, Lifted by Rise in Asian Stocks

The Australian dollar resumes higher on Tuesday after bulls paused on Monday, on headwinds from pivotal Fibo barrier at 0.7416 (76.4% retracement of 0.7555/0.6967). Today’s break through this barrier, generated fresh signal of continuation of recovery leg from 0.70 zone,...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals