The Weekly Bottom Line: Looking Back, Looking Forward

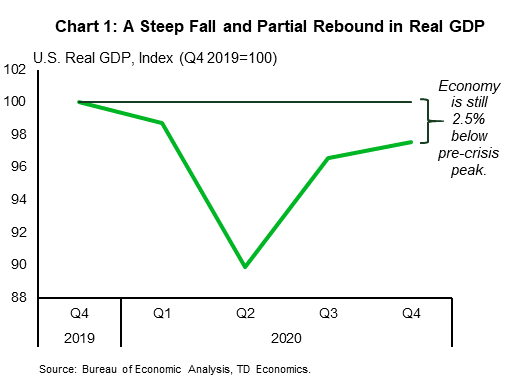

U.S. Highlights Data on U.S. fourth quarter GDP showed the economic recovery continuing, but at much slower pace (4% annualized) than the previous quarter (33.4%). The Federal Reserve held its policy rate unchanged, and committed to doing all it can...

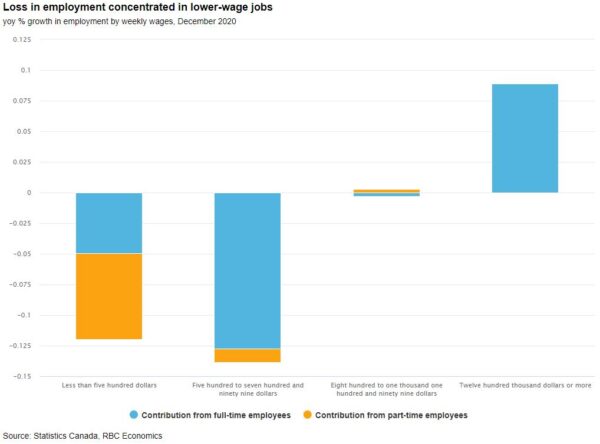

Forward Guidance: January’s Employment Report to Show a Double-Dip from Added Restrictions

Escalating virus spread and containment measures likely caused labour markets to shed jobs for a second straight month in January. We expect Canadian headline employment to have fallen 40k. This would build on December’s 53k drop which was the first...

Week Ahead: BOE, RBA, Coronavirus and More “Short Squeezes”?

What a week! It’s hard to look ahead when most are still trying to understand what happened to GME and other high-flying individual stock names last week. Can it continue? Although everyone was caught up in the “Robinhood” and “short-squeeze”...

Week Ahead – NFP Bounce, Stimulus Progress Might Calm Markets; BoE and RBA Eyed

It’s going to be a relatively busy start to February as investors will be hoping the latest US jobs report will confirm that December’s rough patch was short lived. However, that won’t be the only data to test the market...

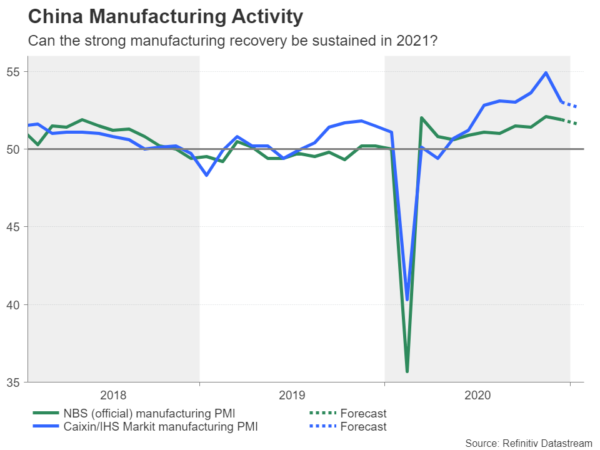

Weekly Focus – Is the Manufacturing Cycle Peaking?

The COVID-19 development continues to be challenging with improvements in most European countries and the US but also signs that countries that ease restrictions see a flare-up again. France for example has experienced a new increase in cases raising concerns...

Delay In Vaccine Roll – Out Can Turn Into Political Risk For The EU

Market movers today Today’s focus is the EMA meeting which is set to discuss (and approve) the AstraZeneca vaccine. This got another layer of interest as Germany has said that they will not use it for the 65y+ age group,...

The Economic Outlook: What Could Possibly Go Wrong? Part III

Part III: Supply Constraints Drive Inflation Higher Summary In the second report of our series on economic risks in the foreseeable future, we looked at how demand-side factors could potentially lead to significantly higher inflation in the United States in...

The Fed Left Rates Unchanged And Noted A Slowdown In Te Recovery

Members of the Federal Reserve System left the base interest rate unchanged at the level of 0.00 – 0.25%, noting a moderate recovery of the US economy. In terms of using all available tools to support the economy during the...

US: Headline Miss in Otherwise Solid Durable Goods Report

Summary The durable goods report signals that while the post-shutdown surge has faded, underlying strength continues to propel orders and shipment to record levels. The headline miss is mostly attributable to a drop in aircraft orders. Headline Fade Influenced by...

Aussie Dips As Business Confidence Slides

The Australian dollar has reversed directions on Wednesday and is trading in red territory. Currently, AUD/USD is trading at 0.7724, down 0.24% on the day. Business Confidence plunges In Australia, business sentiment sank in December, according to the National Australia...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals