Crude Oil Price Maintains Bullish Momentum

US equities turned positive on Wednesday after strong quarterly earnings by Morgan Stanley, Bank of America, and Procter & Gamble. The two banks published better-than-expected results, which were helped by the rising loan growth and investment banking revenues. P&G, on...

Equities Under Fire, Dollar Shines as Yields Soar

Stocks remain under pressure as traders position for Fed hikes Dollar outperforms, yen benefits from risk aversion, euro hammered Oil prices keep going, Canadian inflation stats in the spotlight All about the Fed Bets that the Fed will take a...

US Bond Yields Had a Roaring Start

Markets US bond yields had a roaring start coming out of a long weekend during early morning trading hours. We’ve distinguished some general drivers for the aggressive bond selloff. First, there was already some general yield momentum lingering as suggested...

Could Canadian Inflation Power Loonie’s Rally?

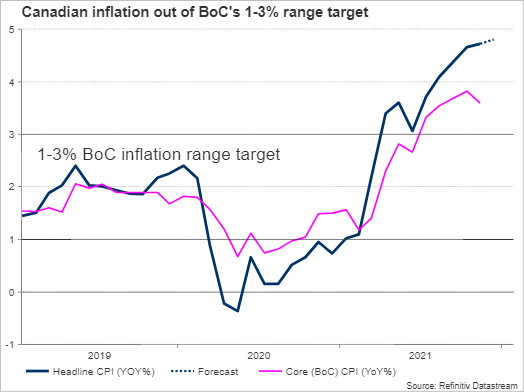

The Canadian dollar could face fresh volatility when December’s CPI inflation data come out on Tuesday at 12:30 GMT. Forecasts point to another pickup and investors are highly confident that the central bank could raise interest rates as soon as...

Canada’s Manufacturing Sector Recovery Continued in November

Canada’s manufacturing sales increased 2.6% (month/month) in November, following a 4.6% increase in October. The outturn was still solid after accounting for price effects, with manufacturing shipment volumes up 1.9% on the month. The increase in nominal sales spanned 18...

Chinese GDP Growth Continued to Lose Steam

Markets US retail data on Friday printed softer than expected. Headline sales declined 1.9% M/M and control group sales (-3.1% M/M), a proxy for consumption in GDP, missed the consensus by quite a big margin. Omicron is affecting sales, at...

Weekly Economic & Financial Commentary: U.S. Dollar Stumbles to Start the Year

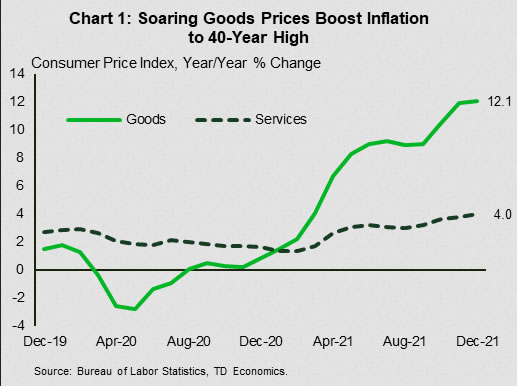

Summary United States: Not Through with 2021 Just Yet Inflation is intensifying and consumer activity is cooling, data covering the month of December reveal. The Consumer Price Index (CPI) rose 7.0% year-over-year, the fastest increase in nearly 40 years. Similarly,...

The Weekly Bottom Line: Eyeing Inflation Like a Hawk

U.S. Highlights Equity markets saw further losses this week, following more hawkish messaging from the Fed. Between Powell and Brainard’s confirmation hearings and other Fed speakers, the signals for a March rate hike are flashing loud and clear. December’s inflation...

Week Ahead: Russia, BoJo, and Earnings Season Ahead

After three meetings with NATO and its allies over Ukraine left both sides at an impasse, signals are beginning to emerge that Russia may be ready to invade Ukraine. Will it happen this week? Last week, it was brought to...

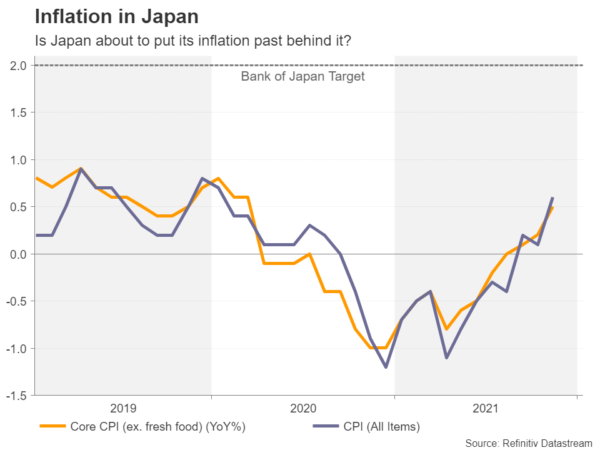

BoJ to Defy Peers, Stay on Dovish Course, But for How Long?

The Bank of Japan will conclude its first monetary policy meeting of 2022 on Tuesday and publish an updated set of economic forecasts. So far, the BoJ has been excluded from the global central bank race to normalize policy amid...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals