White House Wrangling Dominates Holdiay Season Markets

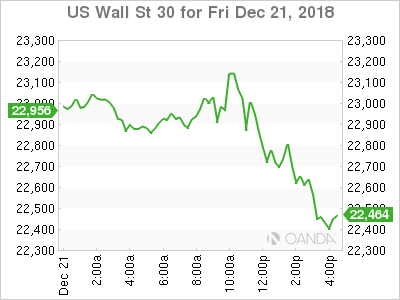

With the government in partial shutdown already, fuel has been added to the fire by the Treasury Secretary’s ring round of the banks, an unexpected move that could add to volatility later in the week. US futures point to a...

EURUSD Is Ready For Christmas

At the beginning of another December week, EURUSD is slowly rising and trading close to 1.1395. investors’ response to the US Federal Reserve decisions helped the instrument to reach 1.1485, the highest level over the previous trading week. In general....

FX Year Ahead 2019: End of Dollar Dominance?

As 2018 draws to a close, the heavily sold currencies are set to end the year off their lows, while the US dollar – one of the biggest winners of 2018 – appears on track to start 2019 on a...

DAX – Another Brutal Week as Global Equity Markets Plunge

It was a dismal week for global equity markets, and the DAX index fell 2.2 percent. The Frankfurt index is closed on Monday as we head into the Christmas holiday. It’s been a grim December for stock markets, and the...

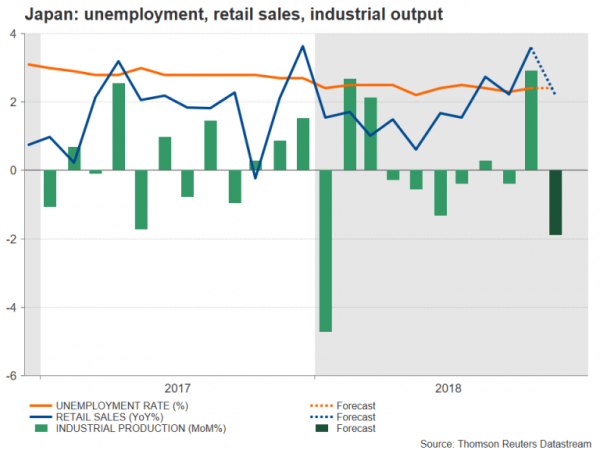

Japanese Industrial Output and Retail Sales to Weaken in November as Yen Enjoys Revived Safe-Haven Status

Economic data out of Japan – the only major releases of the week – are anticipated to point to further trouble for the Japanese economy on Friday (local time). Like much of the rest of the world, growth in Japan...

Weekly Economic and Financial Commentary: Data Show Still Solid, but Moderating Momentum in Q4

U.S. Review Data Show Still Solid, but Moderating, Momentum in Q4 Despite some softer-than-expected data in recent weeks and continued volatility in the financial markets, the FOMC raised the fed funds rate 25 bps at its policy meeting on Wednesday....

The Weekly Bottom Line: A Solid Year In Spite Of Headwinds

U.S. Highlights As widely expected, the Fed hiked rates once more this year. At the same time, the Fed’s dot plot moved lower over the forecast horizon. These changes are consistent with a softer inflation and economic outlook. Data came...

Volatility and Risk Aversion Continue to Dominate December

What a week for bears and volatility! The highly anticipated Fed event delivered volatility that brought down all the major indexes to their knees. The Fed raised rates, reduced their dot plot forecasts, but they signaled that quantitative tightening is...

Businesses Still Relatively Upbeat in Canada’s Q4 Business Outlook Survey

Highlights: The survey was relatively upbeat with business investment intentions holding up well despite lower oil prices. There was little change in measures of capacity pressures — which remained elevated — although there was some easing in concerns about those...

US: Good Times for Consumers, Spending Solid and Inflation Contained

Personal income rose 0.2% in November (month-on-month), slightly below expectations for 0.3%. But, personal spending more than made up for the disappointment, rising 0.4% on top of an upward revision to October (+0.8%, prev. 0.6%). Inflation readings were soft. Overall...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals