Week Ahead – With the Central Bank Mayhem Out of the Day, the Festive Wind Down Begins

After a super exciting week, things will wind down significantly in the run up to the Christmas weekend, with the biggest risk for traders likely being suffering from post-central bank blues. Out of all the meetings, the Fed’s announcement undoubtedly...

Japanese Yen Calm after BoJ Meeting

The Japanese yen is showing little movement on Friday. In the European session, USD/JPY is trading at 113.44, down 0.13% on the day. It was a dramatic week, with central banks in the spotlight. There were significant announcements on both...

Euro Gains Ground after ECB

ECB to wind up PEPP, increase APP The euro has extended its gains and touched 1.1360 earlier, its highest level in December. This follows the ECB policy meeting earlier today. In the North American session, EUR/USD is trading at 1.1332,...

Fed Struck a More Hawkish Tone; BoE Raises Interest Rates

Fed catches up with inflation; BoE raises interest rates On Wednesday, the Fed struck a more hawkish tone, doubling its tapering pace and signaling three rate hikes for 2022. However, the US dollar quickly erased early gains closing the day...

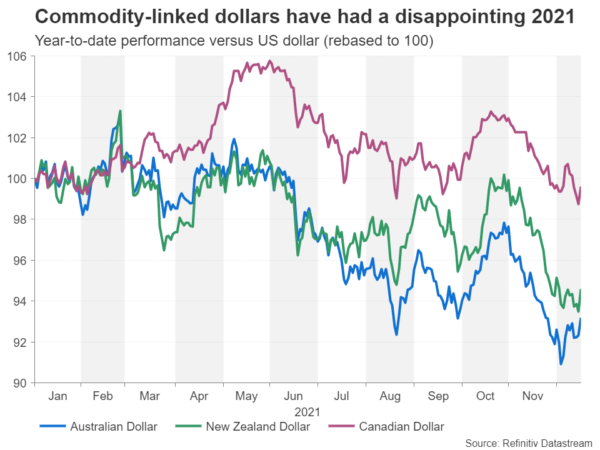

Antipodean Data Crushes Expectations: What Next For AUDUSD And NZDUSD?

Kiwi GDP contracted by 3.7% over the September quarter (due to lockdown), less than the -4.5% expected, despite Auckland spending the entire month of October in lockdown. The smaller contraction shows that businesses and households have learned to adapt to...

US Retail Sales Weak and UK CPI Stronger, But the Focus is on FOMC

November Retail Sales were 0.3% MoM for November vs an expectation of 0.9% MoM, much lower than October’s 1.8% MoM print. Retail Sales ex-autos were also 0.3% MoM vs an expectation of 0.7% MoM and a 1.8% MoM reading in...

The Fed Taking A More Decisive Approach On Inflation

Markets An unexpected acceleration in US PPI inflation (0.8% M/M and 9.6% Y/Y) yesterday triggered a temporary rise in US bond yields, reinforcing the case for decisive Fed action at today’s policy decision. Part of the move was reversed (in...

ECB Meeting: Shadow Tapering

The European Central Bank (ECB) will have to decide by how much to slash its asset purchases when it concludes its meeting at 12:45 GMT Thursday. It will probably be another battle between hawks and doves, with the most likely...

Virus Concerns And Upcoming Central Bank Meetings In Focus

ActionForex.com was set up back in 2004 with the aim to provide insightful analysis to forex traders, serving the trading community for over a decade. Empowering the individual traders was, is, and will always be our motto going forward. Contact...

EUR/USD – Consolidation ahead of Fed and ECB

Which will break first? It would seem EURUSD is in consolidation ahead of the Fed and ECB events this week. It appeared to be flirting with a breakout higher but it wasn’t long until bulls abandoned ship, ahead of the...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals