The Weekly Bottom Line: Holding the Helm in Stormy Waters

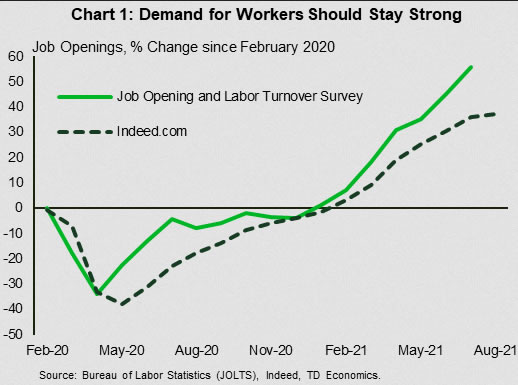

U.S. Highlights The economy is fighting stormy undercurrents caused by the Delta variant, but we are confident that it will stay the course. The job market will take longer to recover, but demand for workers should remain strong. Businesses remain...

Forward Guidance: Inflation Data to Take Centre Stage

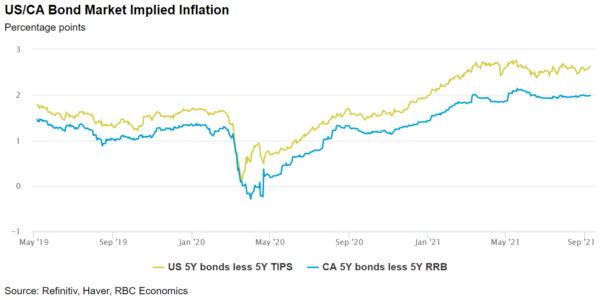

Inflation reports will steal the spotlight next week, with annual Canadian price growth expected to climb to 4% in August compared to a year ago—the fastest pace since 2003. But much of that rise is from very low levels last...

Week Ahead: Focus Shifts to Pricing Pressures

Country US The focus in the US shifts from the labor market to pricing pressures. Tuesday’s release of the August inflation report could move some Fed members into joining the ‘inflation is persistent’ camp. Prices that Americans pay for everyday...

Canadian Employment Change in Line as Data Continues to Show Improvement

Canada’s employment change for the month of August came in roughly as expected: +90,200 vs +100,000 expected. The breakdown between full-time jobs and part-time jobs had a nice distribution, with three-fourths of the jobs going to full-time positions and one-fourth...

Euro Strengthens As Market Digests Recent ECB Action

ActionForex.com was set up back in 2004 with the aim to provide insightful analysis to forex traders, serving the trading community for over a decade. Empowering the individual traders was, is, and will always be our motto going forward. Contact...

ECB Research – Saving the Battle for December

At today’s meeting, ECB decided to slow its PEPP bond purchases to a ‘moderately lower pace of net asset purchases under the pandemic emergency purchase programme (PEPP) than in the previous two quarters.’ This slowdown was widely expected and probably...

Stocks Little Changed, ECB Moderates Purchases, Another Pandemic Low for Jobless Claims

US stocks pared losses after weekly jobless claims hit a fresh pandemic low and as the ECB turns optimistic enough to moderate their PEPP buying. The S&P 500 index won’t make a major move unless inflation heats up or if...

USD/CAD: Loonie a loser as Bank of Canada cites supply chain risks

The BOC’s monetary policy statement confirmed the risks to the global economy, especially for export-dependent, growth-sensitive currencies like the Canadian dollar… Back in July, the Bank of Canada (BOC) tapered its weekly asset purchases from CAD $2B to $3B in...

BoC Doesn’t Overreact to Soft GDP Data

Policy rate, QE pace, forward guidance all unchanged Statement discounts last week’s disappointing GDP data Recovery still expected to strengthen but risks remain The Bank of Canada left its key policies unchanged today and didn’t sound as dovish as it...

US Dollar Index Soars As Signs Of Global Slowdown Emerge

Bitcoin and other cryptocurrency prices tumbled in the overnight session, ending a remarkable bull run that pushed BTC above $52,000. The decline happened after El Salvador bought Bitcoin worth more than $20 million making it the first country to do...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals