Forex Cryptocurrencies Forecast

EUR/USD: it’s All About the Labor Market The EUR/USD pair drew another wave of sine waves on the chart: it fell by the same amount in the first week of August as it rose in the last week of July....

Weekly Economic & Financial Commentary: Summer Hiring Heats Up

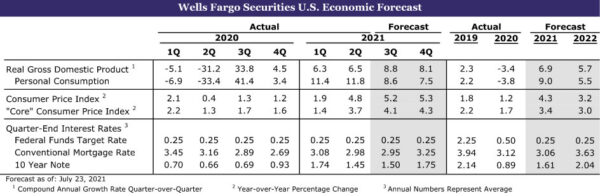

Summary United States: Summer Hiring Heats Up Data this week highlighted the economy’s resilience in the face of ongoing supply constraints, while financial markets weighed the impact of the Delta variant wave on the outlook for the economy and Fed...

The Weekly Bottom Line: Now and Then

U.S. Highlights The U.S. economy added 943k jobs in July, slightly better than an upwardly revised 938k in the month prior. The unemployment rate fell to 5.4% from 5.9% in the month prior, while wage growth accelerated to 3.9% in...

Week Ahead: NFP Over-analysis, US CPI, and Emerging Market Central Banks

US Non-Farm Payrolls culminated last week with a whopping +935,000 jobs for July. In addition, the unemployment rate fell from 5.9% in June to 5.4%! This week will be filled with speculation as to whether this is enough substantial further...

Week Ahead – Taper Debate in Focus

Country US A blockbuster nonfarm payroll report has moved forward taper expectations and allowed the yield curve to steepen. The labor market recovery is accelerating as temporary layoffs and permanent job losses dramatically improve. Wall Street will pay close attention...

Non-Farm Payrolls Shine, Markets to Prepare for a September Taper Announcement

US Non-farm Payrolls for July were +943,000 vs +870,000 expected and a higher revised +938,000 in June! In addition, the Unemployment Rate fell from 5.9% to 5.4%, and 5.7% expected. This was a massive beat compared to expectations. Also, Average...

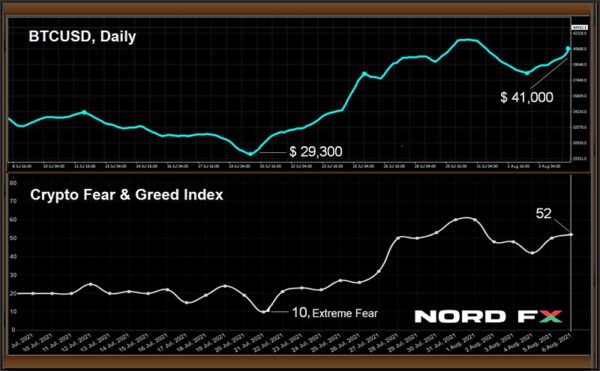

US Job Growth Will Give The Dollar A New Flourishing

For markets, today is employment day. The US publishes its monthly jobs growth estimate. This indicator could regain its lost glory this month as the economic indicator that provokes the most volatility in the markets. Strong data this time will...

Bank of England’s Subdued Signal of Future Tightening

Summary The Bank of England (BoE) held monetary policy steady at today’s announcement, but sent a subdued signal of future policy tightening in its accompanying statement. Specifically, the BoE said some modest tightening of monetary policy over the forecast period...

Steady ahead of Jobs Report

We appear to have entered into a holding pattern following a whirlwind session on Wednesday, as conflicting data and hawkish Fed commentary created some choppy conditions. You can sense the nervousness in the markets this week. Every data release feels...

Aussie Shrugs Off Soft Retail Sales

Australian dollar extends rally The Australian dollar continues to impress and is in positive territory for a third successive day. AUD/USD punched into 74-territory earlier in the day before retreating slightly. Australian dollar shrugs off retail sales decline The news...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals