Forex and Cryptocurrencies Forecast

First, a review of last week’s events: EUR/USD. Recall that the head of the Fed Jerome Powell literally brought down the American stock markets with his speech on February 4. Powell stayed indifferent to the surge in US Treasury yields,...

The Weekly Bottom Line: Economic Resiliency On Display Again

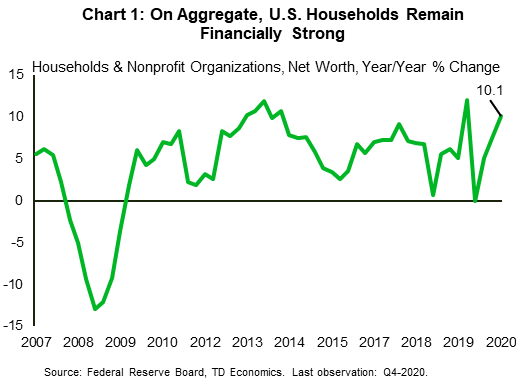

U.S. Highlights One year after the start of global lockdowns, it is starting to feel like the end is finally approaching. The new fiscal package signed into the law will continue to support a stronger economic recovery and the financial...

Weekly Economic & Financial Commentary: European Economic Trends Remain Unsettled For Now

U.S. Review Inflation Begins Spring Bloom Inflation appears to be heating up. During February, the Consumer Price Index (CPI) rose 0.4% and the Producer Price Index (PPI) advanced 0.5%. The NFIB Small Business Optimism Index edged up to 95.8 in...

Week Ahead: Rising Treasury Yields Will Make this an Interesting FOMC Decision

The bond market seems determined to make this an interesting FOMC policy decision. Treasury yields have been surging after the Biden administration passed the $1.9 trillion COVID relief bill and set a May 1st goal of getting vaccines to all...

Week Ahead: Packed Week with Fed, BOE, BOJ and Australian Jobs

With the central bank meetings this week, traders need to be on the lookout for hints as to when a change in monetary policy may be coming. After the BOC and the ECB meetings last week, this week brings a...

Forward Guidance: Vaccine Developments Bring Forward Recovery Hopes and Inflation Fears

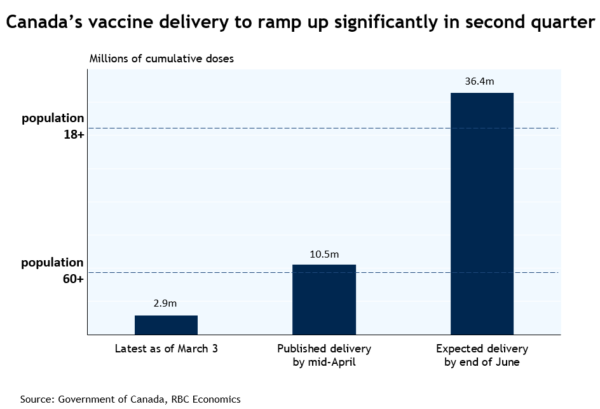

After falling behind peers, vaccine delivery in Canada is anticipated to ramp up significantly over the coming months. Canada is now expecting around 8 million doses by the end of March, and as many as 36.4 million doses by the...

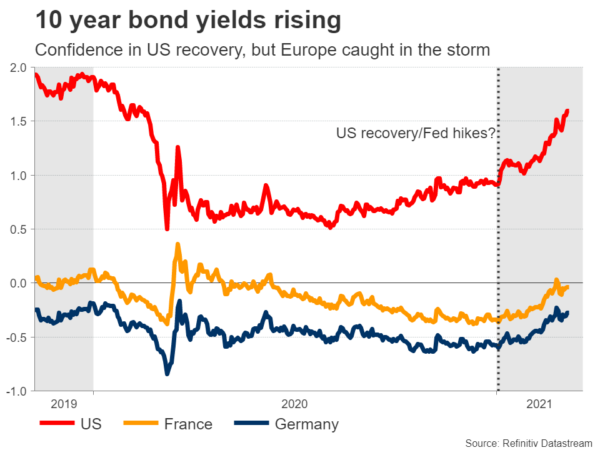

Would ECB Bond-Buying Might Slow The Uptrend Of EMU Bond Yields?

Markets European and US bonds parted ways yesterday, driven by a different ‘domestic’ narrative. After cautious positioning ahead of the ECB decision, European bonds outperformed as the ECB put money on the table to reinforce its commitment to prevent an...

European Central Bank Leans Against Rising Yields

Summary The European Central Bank (ECB) announced its latest monetary policy decision today. While policy interest rates and the total size of its Pandemic Emergency Purchase Program (PEPP) were left unchanged, the ECB did make one notable policy tweak. In...

Oil Consolidates, Gold Rebounds

Oil markets continue to consolidate Having retraced nearly 50% of last week’s rally, oil markets rose modestly overnight, as both Brent and WTI consolidate recent gains. The official US crude inventory data show massive swings in inventories, gasoline and distillate...

Will the ECB Fight Rising Yields?

The European Central Bank (ECB) will wrap up its policy meeting at 12:45 GMT Thursday. Some senior policymakers have been vocal about fighting the rise in bond yields, but it is probably too early for that. If the ECB takes...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals