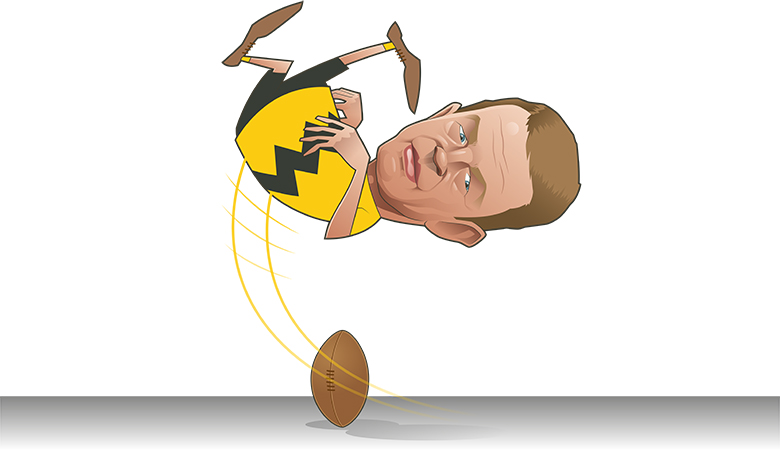

Macaskill on markets: Bank shares and the Charlie Brown trap

Bank shares have bounced back from recent lows in early 2019, but investors tempted to bet on a sustained rally risk yet another year of disappointment. The Peanuts comic strip features a recurring gag where Charlie Brown is convinced to...

Sideways: Trump makes banks look good – for now

The 35-day partial shutdown of the US government over Trump’s call for funding of a border wall gave the country’s banks an opportunity to position themselves as responsible corporate citizens, with the interests of their customers at heart. Large banks...

Royal Commission is uncomfortable reading for Australia’s big banks

Justice KennethHayne From the big banks’ point of view, the final report from the Australian Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry is embarrassing and humbling but changes little. Justice Kenneth Hayne handed over the...

Impact investing: The mindless mantra – ‘doing well by doing good’

On the recommendation of a few people in the impact investment community I am reading ‘Winners take all: The elite charade of changing the world’, and although I’m only a third of the way through, I’m already reeling. By next...

Macaskill on markets: After the Draghi put, a Coeuré call?

Draghi ended his last full year as ECB president with a performance that deployed his trademark adroit management of market expectations with choreographed policy changes. He confirmed in a December press conference that expansion of the ECB’s quantitative easing (QE)...

Sideways: The Fed – I’m a central banker… get me out of here!

Federal Reserve chairman Jay Powell President Trump appointed Powell to run the Federal Reserve, so the central banker cannot complain that he didn’t know what he was getting into when he took the job. It is nevertheless unlikely that Powell...

How European banks can consolidate without merging

If they stand any chance of making money from serving the small and medium-sized clients that American investment banks will never touch, European firms must gain scale by bringing together the continent’s disparate financial markets. That sounds like wishful thinking....

Down but not out, Romania is just a riskier bet

The cards have been stacked against Romania in a turbulent year Analysts have downgraded Romania in Euromoney’s country risk survey according to preliminary results for Q1 2019 to be officially released next week. The country has come through a turbulent...

Africa: Safaricom’s new overdraft facility ‘will boost revenues’ for M-Pesa

Safaricom has signed up more than four million customers to its new overdraft facility Fuliza, extending $170 million in credit since its launch in January. The new overdraft facility was born out of necessity, explains Bob Collymore, CEO of Safaricom, during an...

US banking inches closer to ESG alignment

Aspiration’s chief executive and co-founder Andrei Cherny In March, JPMorgan Chase announced it would stop financing GEO Group and CoreCivic – the largest operators of private prisons and immigration detention centres in the US. The decision follows months of protests from...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals