WTI Futures Extend Advance as Positive Momentum Strengthens

WTI oil futures (July delivery) have been in a sustained uptrend since the 92.60 region rejected any further dip, generating a profound structure of higher highs and higher lows. Moreover, the ascending 50- and 200-day simple moving averages (SMAs) endorse...

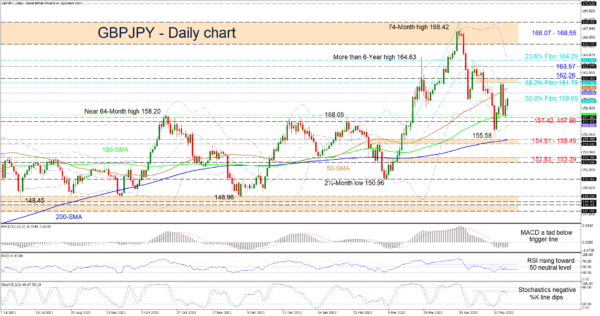

GBPJPY Rangebound after Decline Halts

GBPJPY has experienced a sharp decline after peaking at the six-year high of 168.41 in early April. However, the pair has managed to find its feet and is currently trading sideways, while near-term risks seem to be tilted to the...

USDJPY’s Retracement Opposed by Soaring 50-day SMA

USDJPY is trading around the lower Bollinger band residing within a support zone which is linking the 127.34 barrier with the rising 50-day simple moving average (SMA) at 126.25, the former being the 23.6% Fibonacci retracement of the uptrend from...

Elliott Wave Analysis: EUR/USD Has Room for Higher Prices

The USD is moving lower across the board as gap between FED and other CB is narrowing. We see more and more ECB members and speculation for a potential 50bp hike which is the main reason for stronger euro these...

NZDUSD Increases above 0.6500 in Short-term Bounce

NZDUSD is ticking higher above 0.6500 again after the bounce off the two-year low of 0.6214. The technical indicators are showing more positive signs, as the MACD is advancing above its trigger line in the negative region, while the RSI is...

US 500 Index’s Downside Bearing Curbed as Buyers Step In

The US 500 stock index (Cash) is trading near the red Tenkan-sen line at 3,952 following an increase in risk appetite around a recorded 14½-month low of 3,809. The rolling over of the 200-day simple moving average (SMA) is feeding...

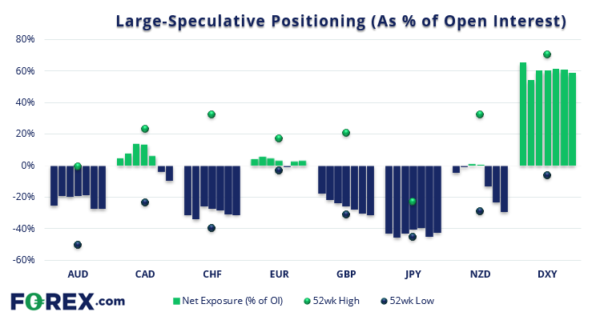

Commitment of Traders Report (COT): CHF Bears Begin to Capitulate

Whilst the COT report shows us traders were their most bearish on CHF futures in 6-months, recent events and price action suggest some of those bears have closed out. Commitment of traders (as of Tuesday 17th May 2022): The weekly...

EUR/USD: Improving Techs Point to Further Short-Squeeze, But Fundamentals Still Rule

The Euro is standing at the back foot on Friday, following 1.2% advance on Thursday, but dips were so far limited, adding to positive signal from Thursday’s bullish engulfing pattern. Fresh bullish momentum on daily chart and formation of 5/10DMA...

EUR/USD Pair Moved into a Positive Zone from $1.0420

The Euro started a fresh increase from the 1.0420 support zone against the US Dollar. The EUR/USD pair surpassed the 1.0500 level to move into a positive zone. The price even traded above the 1.0550 level and the 50 hourly...

GBPJPY Tackles 50.0% Fibonacci after Bouncing Off 100-MA

GBPJPY is confronting the 159.69 barrier, which is the 50.0% Fibonacci retracement level of the uptrend from 150.96 until the multi-year high of 168.42, which failed to close north of the 166.07-168.55 resistance zone that extends back to February 2016....

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals