How to trade Forex profitably

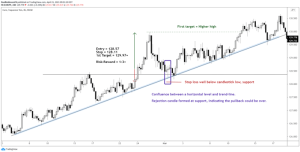

Using Candlestick Wicks to Identify Price Action Support and Resistance

Price Action Trends

Trend Trading

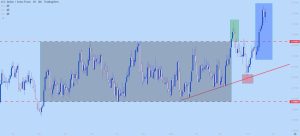

Range Trading

How to Trade Ranges

Breakout Ballistics in Trading and Analysis

Breakouts: Risks, Downsides and Pitfalls

Trading Rules and Wisdom

Trading Breakouts and Pullbacks

Building Confidence in Trading

How to Create a Trading Plan

Risk Management

What is a Drawdown in Trading and How to Handle It

Mistakes Traders Frequently Make & How to Fix Them

Trading Psychology: Managing Emotions

Economic Growth: What is GDP Growth?

What is Inflation. Its Global Impact. Explore

Quantitative Easing (QE) Explained: Central Bank Tool for Growth

NEW! S&P 500, Dow Jones: Stock Markets Predict Presidential Elections

How Societal and Economic Crises Impact US Presidential Elections

Gold Price Implications Around US Presidential Elections

How to Trade the Impact of Politics on Global Financial Markets

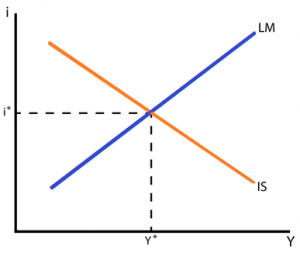

How Do Politics and Central Banks Impact FX Markets?

Central Banks Monetary Policy

The Nucleus of the Forex Market: Trade and Capital Flows

Employment: The Key Driver of Economic Growth and Prosperity

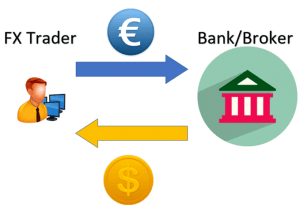

Forex Trading for beginners: What is Forex trading?

Trend Trading with Moving Averages

Death Cross: What is it and How to Identify it When Trading?

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals