‘Bond King’ Jeffrey Gundlach says the Fed shouldn’t raise interest rates this week

DoubleLine Capital founder and CEO Jeffrey Gundlach said Monday that the Federal Reserve should not hike rates at its December meeting later this week. “I think they shouldn’t raise them this week. The bond market is basically saying, ‘Fed you’ve...

Trump advisor Peter Navarro slams the Fed as the biggest risk to US economic growth

White House advisor Peter Navarro — just hours after President Donald Trump blasted the Federal Reserve — doubled down Monday, singling out the central bank as the biggest threat to U.S. economic growth. Appearing on CNBC’s “Squawk on the Street,”...

Trump’s Fed-bashing and interest-rate panic will cause a recession, not prevent one

President Donald Trump’s tweet on Monday morning admonishing the Federal Reserve for even thinking about raising interest rates amplified his recent criticism of Fed Chair Jerome Powell, and just a day before the Fed begins its two-day Federal Open Market...

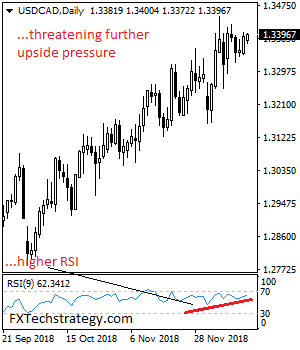

USD/CAD Looks To Extend Medium Term Upside Pressure

USDCAD looks to extend medium term upside pressure following its higher close the past week. Support comes in at the 1.3350 level where a break will aim at the 1.3300 level. Further down, support comes in at the 1.3250 level...

Americans are more worried about the economy — an ominous sign for Trump’s re-election

More Americans are predicting an economic downturn in the coming year, a shift that could affect President Donald Trump as he seeks re-election. Only 28 percent of Americans think the economy will get better in the next 12 months, according...

Stanley Druckenmiller says Fed must pause because the economy can ‘ill afford a major policy error’

The Federal Reserve should halt its interest rate increases as recent developments in the markets and economy signal caution, hedge fund manager Stanley Drunkenmiller said in a commentary for the the Wall Street Journal over the weekend. “The central bank...

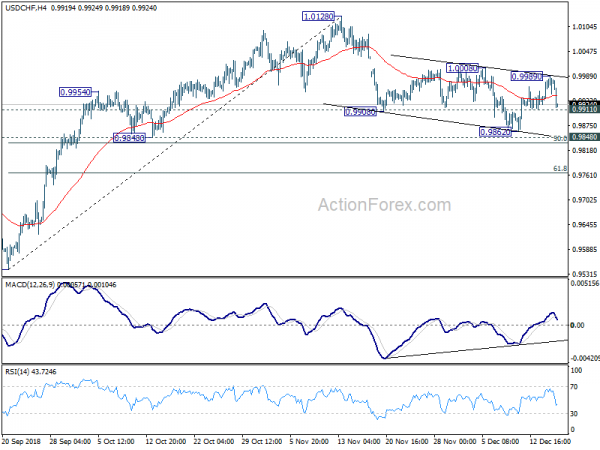

Swiss Franc Leads Europeans Higher, Dollar Softer after Poor Data

European majors are trading generally higher today, as led by Swiss Franc. Euro is also strong but to a lesser extend while Sterling just follows. On the other hand, Dollar is under some selling pressure, in particular after much weaker...

Explosive growth pushes CEE risk to new lows

Several countries in Central and Eastern Europe were among the star performers in Euromoney’s country risk survey in 2018, spurring the region’s unweighted average risk score to reach its highest since the turmoil in 2008-2010, caused by the collapse of...

EURUSD Remains Cautious

The major currency pair is rather unenthusiastic early in the week. The market managed to recover after the weak statistics published last week: investors’ interest in the USD as a “safe haven” asset went down, but they are still very...

Another Week in the Red for Canadian Dollar

USD/CAD is unchanged in the Monday session. Currently, USD/CAD is trading at 1.3384, down 0.01% on the day. On the release front, there are no major events on the schedule. Canadian Foreign Securities Purchases is expected to dip to C$6.20...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals