France, Germany risk spike shows core Europe wobbling

Although the risks facing the eurozone have improved during the past five years, almost every country remains worse off in Euromoney’s country risk survey since the global financial crisis struck in 2007-08. Plus, compared with last year – when concern...

China Weekly Letter: High-Level Trade Talks Resume, Enforcement the Key Hurdle

High-level trade talks resume, disagreement on enforcement the big hurdle. Metal markets still underpin a recovery, otherwise little macro news this week. Xi Jinping visits Europe amid concern over Italy signing memorandum on the Belt and Road Initiative. High-level trade...

The Weekly Bottom Line: When The Dots Are Down

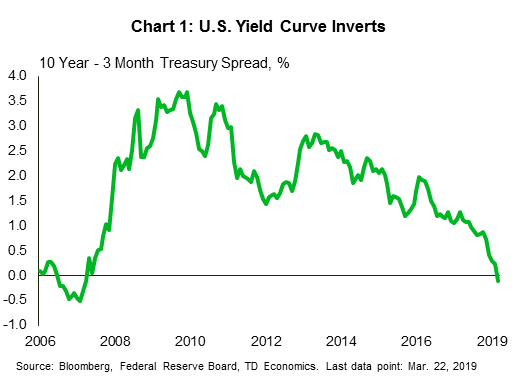

U.S. Highlights The Fed’s dots showed that it only expects to hike rates once more by the end of 2020, sending Treasury yields lower mid-week. On Friday, weakness in March manufacturing surveys in Europe, Japan, and the U.S. sent longer-term...

Dollar Recovers Fed Driven Losses on Safe-haven Flows

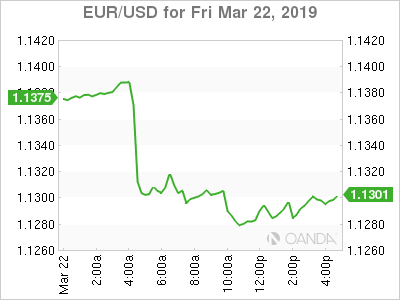

The US dollar had a wild week, finishing the week mixed against its major trading partners, as market participants reassess the effects of the Fed’s dovish commitment and how much weaker the German economy will become. Risk-aversion remains the key...

Apple is keeping partners in the dark about how it plans to package and price its video service

Apple is going to announce its new video streaming service plans at an event in Cupertino, Calif., on Monday, March 25. Over the past few months, CNBC has reported many details on Apple’s plans. But the big open question is...

Uzbekistan looks to boost local capital markets after eurobond success

The head of Uzbekistan’s new capital markets agency is hoping to build on the success of the country’s debut sovereign eurobond sale to attract foreign banks and investors to its domestic market. Atabek Nazirov,CMDA Atabek Nazirov, a former Goldman Sachs...

The Fed’s policy switch may be too late to save the economy from fading

The Federal Reserve’s policy pivot this week may be too late to save an economy that is suddenly struggling to avoid grinding to a halt. For the first time since before the financial crisis, short-term government bonds are yielding above...

Smaller prime brokers find new ways to gain foothold on slippery FX ladder

Offering FX and non-FX services via a shared platform is a key trend in the boutique prime brokerage market, particularly when servicing clients who need to be able to optimize their collateral by using a limited number of intermediaries. Larger...

Steady as She Goes – RBNZ OCR Preview

The RBNZ is likely to repeat the key messages from February, including “OCR on hold through 2019 and 2020” and “the next move could be up or down.” The details of the statement will also be similar to February, emphasising...

Weekly Economic and Financial Commentary: A Wait-and-See Approach

U.S. Review A Wait-and-See Approach The unanimous decision by the FOMC to keep rates unchanged this week was widely expected, but the committee’s increased caution regarding the outlook reaffirmed its wait-and-see approach to monetary policy. In other news, the Leading...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals