EBRD backs funding platform Funderbeam to plug SEE’s equity gap

Set up in Estonia in 2013, Funderbeam is the brainchild of former Nasdaq Tallinn Stock Exchange chief executive Kaidi Ruusalepp. The platform enables growth companies to raise equity, convertible and loan finance in either public or private funding rounds. A...

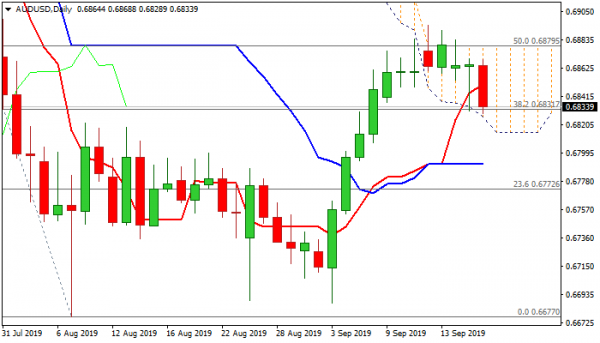

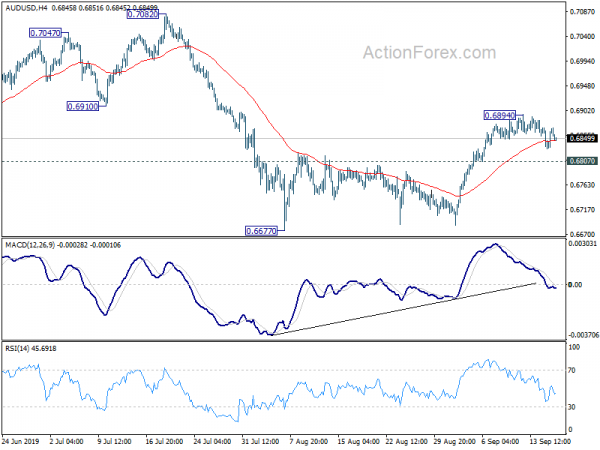

AUD/USD Outlook: Aussie Holds In Red And Attacks Again Pivotal Support Zone Ahead Of Fed

The Australian dollar holds in red on Wednesday and attacks again key supports at 0.6830 zone (daily cloud base / broken Fibo 38.2% of 0.7080/0.6677) which contained Tuesday’s spike to 0.6830. Fresh weakness signals again reversal after double Doji (Monday’s...

The NY Fed Smoothed Tensions Again By Announcing A Similar Operation For Today

Markets Tensions on US money markets, which started building from last Friday, escalated yesterday. US repo rates spike up to 10%, forcing the NY Fed to make up to $75bn available (eventually $53bn injected) through a repo auction in which...

Dollar Mildly Higher as Fed Cut Turned From Done Deal to Debatable

Dollar firms up mildly today as all eyes are on FOMC rate decision. A rate cut has turned from being a done to deal to debatable, based on market pricing. While a cut is still generally expected, the greenback could...

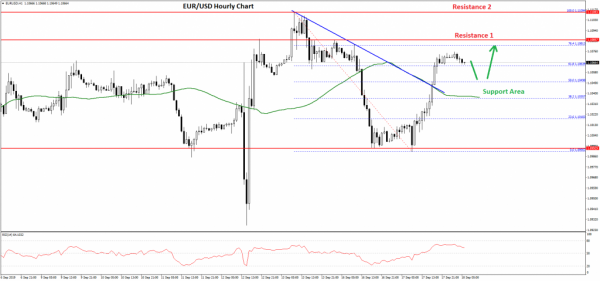

EUR/USD And USD/CHF Eeing Upside Break

EUR/USD recovered recently above the 1.1025 resistance level and it might continue to rise. USD/CHF is currently consolidating and it seems like it is sighting an upside break above 0.9940. Important Takeaways for EUR/USD and USD/CHF The Euro is showing...

Why Hong Kong’s bid for the LSE must struggle

Hong Kong Exchanges & Clearing’s (HKEX) $39 billion bid for London Stock Exchange (LSE) Group presents the London exchange with two alternative models of how an exchange should look in the modern world. HKEX’s bid is an argument for scale;...

Europe’s banks may be at risk of failing if negative rates continue: EIU

Large banking institutions face the risk of failure if interest rates in Europe continue to stay negative, an economist told CNBC after the European Central Bank cut rates last week. “I think there are big questions to banking sector profitability,”...

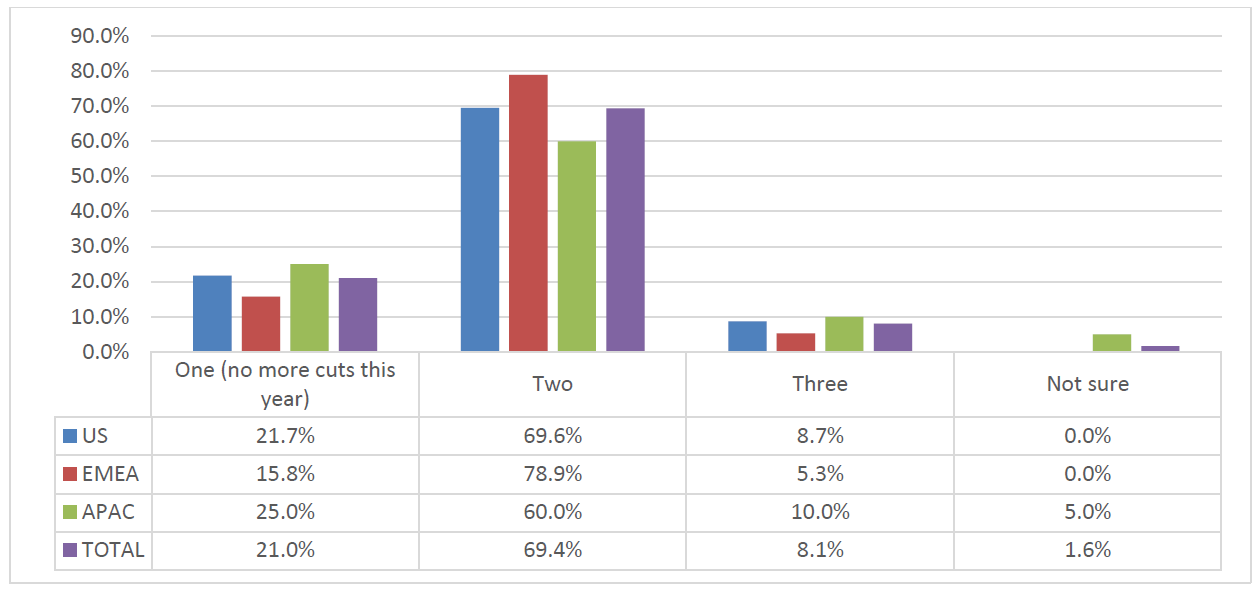

Fed expected to cut rates and Powell may have hard time appeasing critics inside and outside Fed

The Fed is expected to cut interest rates for the second time in a decade Wednesday, but Fed Chairman Jerome Powell is unlikely to deliver the message markets want to hear on plans for future rate cuts. “He’ll underwhelm everyone...

The new shines bright in Brazilian banking

Banco Pan is set to sell up to R$1.35 billion of shares this week – and it appears to have timed the transaction to perfection. The deal is technically a follow-on but, given the structural changes to the company and...

Fed rate cut is coming, but some market insiders doubt it’s really necessary

Federal Reserve Board Chairman Jerome Powell reacts after the two-day meeting of the Federal Open Market Committee on interest-rate policy on June 13, 2018, when it raised its benchmark rate to 1.75% to 2%. If the Fed cuts this week,...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals