Oil Bearish Continuation As Planned

My Oil trade has been more than 400-500 pips in profit as the move happened exactly as planned. I went against the big majority of long traders and it is paying off now. Historical selling has been aligned with the...

Yen Surges as Asia Opens on Risk Aversion

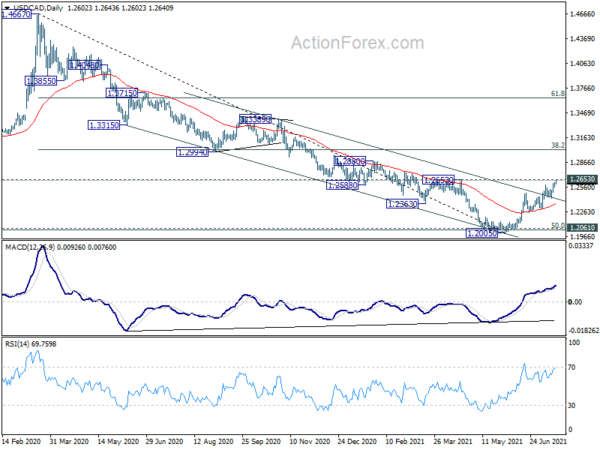

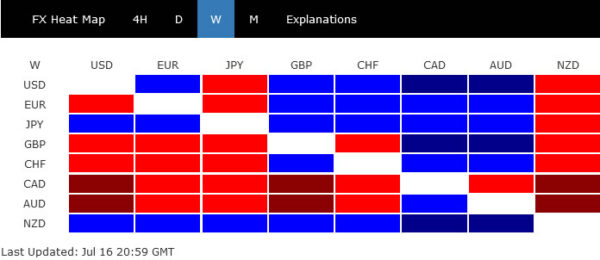

Yen rises broadly as the markets start the week with risk aversion in Asia. On the other hand, Canadian Dollar is trading as the weakest, leading other commodity currencies lower. European majors are mixed together with Dollar for the moment....

EUR/USD Could Nosedive Below 1.1780

Key Highlights EUR/USD is struggling to recover and it could decline further below 1.1780. A key bearish trend line is forming with resistance near 1.1820 on the 4-hours chart. GBP/USD failed to surpass 1.3900 and started a fresh decline. Crude...

Dow futures drop more than 100 points after major averages post first negative week in four

U.S. stock index futures were lower during overnight trading on Sunday, after the major averages posted their first negative week in four. Futures contracts tied to the Dow Jones Industrial Average slid 169 points. S&P 500 futures and Nasdaq 100...

Weekly Report: NZD Surged But Couldn’t Overcome Resilient Dollar and Yen

New Zealand Dollar ended as the strongest one last week, boosted by hawkish expectation on RBNZ. Though, the Kiwi’s strength didn’t provide much support to other commodity currencies, as Aussie and Loonie were indeed the worst performing ones. Yen and...

Weekly Economic & Financial Commentary: “Transitory” Feels Increasingly Long

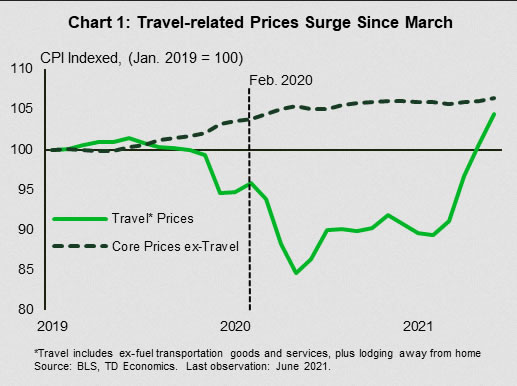

Summary United States: “Transitory” Feels Increasingly Long Chair Powell reiterated his view that current inflation pressures would prove temporary in testimony to Congress, but there were few signs of inflation cooling this week. Both consumer and producer price inflation came...

The Weekly Bottom Line: BoC Tapers QE, Upgrades Inflation Outlook

U.S. Highlights Fed Chair Powell was in the hot seat as members of Congress peppered him with questions about what the Fed is doing about hot inflation. Core CPI inflation neared a 30-year high in June. Travel-related inflation has surged...

Week Ahead: Earnings Season in Full Swing as the Delta Variant of the Coronavirus Wreaks Havoc

While last week was full of economic data and central bank meetings, this week will be lighter on both fronts. Major central bank meetings are limited to the ECB this week. Economic data will be light, highlighted by PMIs at...

AUD/JPY Testing Key Support ahead of AU Data, Tokyo Olympics

Most of Wall Street (and beyond) will be focused on Q2 earnings reports over the next couple of weeks, but traders shouldn’t forget about the key macroeconomic releases on the calendar. On that front, next week brings a highly-anticipated ECB...

Week Ahead – ECB on Deck as Stimulus Debate Heats Up

Financial markets want to know if the Fed is committed to a sustained inflation overshoot. The bond market flattener trade suggests many market participants think we have seen the peak in yields. Inflationary pressures are showing no signs of easing...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals