Euro Shrugs Strong Investor Confidence, Markets in Subdued Holiday Trading

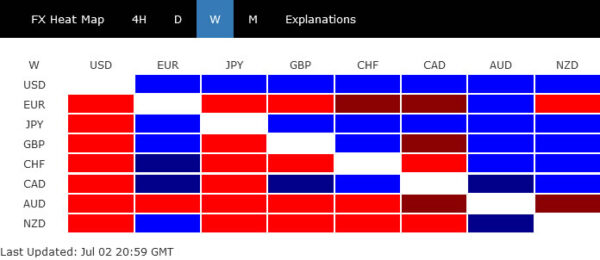

Overall, the forex markets are relatively mixed today and trading will probably continue to be subdued with US on holiday. Sterling is currently the stronger one, followed by Yen and Aussie. Canadian is the weakest, followed by Kiwi and then...

USD/JPY Technical Analysis: Retreats Below 50-MA, Upside Risks Under Strain

USDJPY has lost its recent footing off the 50-period simple moving average (SMA), as buyers’ latest efforts have become curbed by the mid-Bollinger band at 111.18. Nonetheless, the advancing SMAs are defending the near-term uptrend that evolved from the April...

AUDUSD In A Tight Range Ahead Of The RBA Rate Decision

Crude oil declined after the latest OPEC+ meeting ended without a deal. This happened after Saudi Arabia and Russia asked participating members to increase production in the next few months. The goal was to ease rising oil prices and extend...

RBA to Announce Adjustments in QE and YCC Programs

Important decisions will be made at this week’s RBA meeting. All monetary policy measures would remain unchanged. Yet, as indicated in June, policymakers would discuss on the format of QE purchases after completion of the current tranche in September, and...

EUR/USD Trend Overwhelmingly Negative Below 1.1950

Key Highlights EUR/USD extended its decline below the 1.1850 support zone. A key bearish trend line is forming with resistance near 1.1900 on the 4-hours chart. The US nonfarm payrolls increased 850K in June 2021, up from 583K. The Euro...

Markets Shrug Weak China Services Data, Euro Soft ahead of Investor Confidence

Dollar and Yen recover some ground in mixed Asian session today. Stocks in Japan and Hong Kong are slightly down by China and Singapore are steady. Much weaker than expected services data from China triggered little reactions. Swiss Franc is...

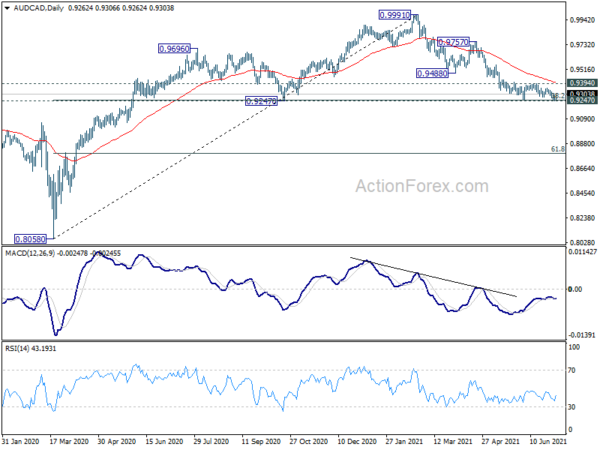

Focus Might Turns to Euro Selling While Dollar Rally Capped by Strong Risk Appetite

Dollar ended as the strongest one last week but Friday’s steel fall after solid non-farm payroll job reports suggests that it’s rally is already losing steam. It’s still a bit early to call a bearish reversal for the greenback. Yet,...

Weekly Economic & Financial Commentary: Supply-Side Challenges Continue to Bedevil the Recovery

Summary United States: Supply-Side Challenges Continue to Bedevil the Recovery After coming in below consensus for two months in a row, nonfarm employment surprised to the upside in June, with employers adding 850,000 jobs. The unemployment rate rose to 5.9%....

The Weekly Bottom Line: Pleasant GDP Surprise For Canada’s B-Day

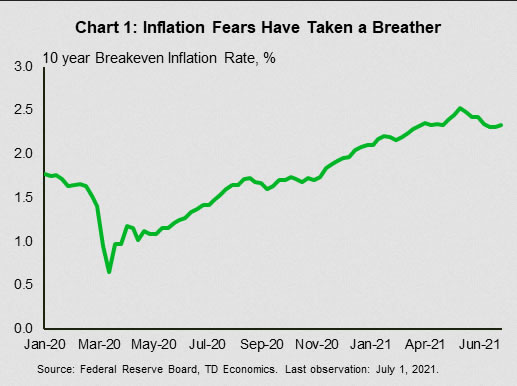

U.S. Highlights Inflation fears have taken a breather in recent weeks, but the jury is still out on how temporary price pressures are. Today’s jobs report showed further solid progress. While better employment and wage gains may reinvigorate inflation fears,...

Week Ahead: Eyes on RBA and Fed minutes before Q2 earnings kick off

It’s a fairly quiet week for economic data, albeit with a couple of highlights worth watching. Friday’s US NFP report was the highlight of the last week, but it certainly didn’t make anything clearer for traders…or policymakers. According to BLS...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals