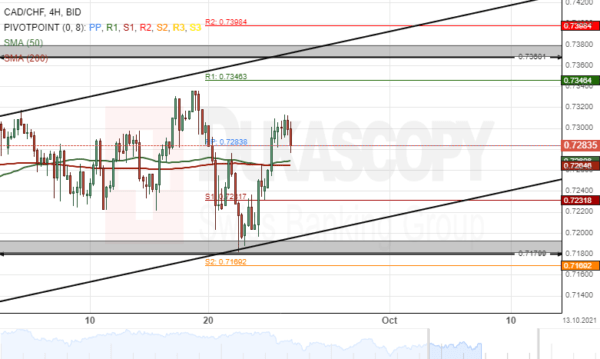

CAD/CHF Bulls Could Prevail

The Canadian Dollar has surged by 115 pips or 1.60% against the Swiss Franc since this week’s trading sessions. The currency pair breached the 50– and 200– period SMAs on September 23. Technical indicators suggest selling signals on the 4H...

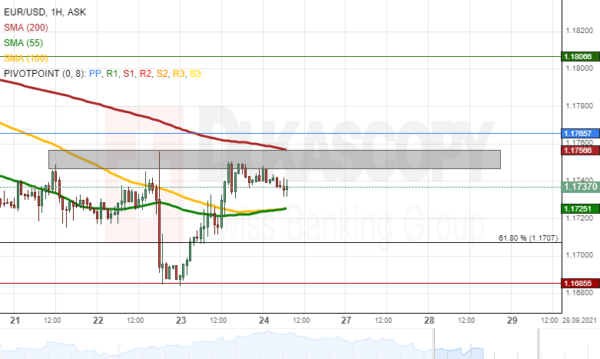

EUR/USD Analysis: Faces Resistance Zone

On Friday morning, the EUR/USD currency exchange declined, as it had bounced off the this week’s high zone that surrounds the 1.1750 level. In the case of the pair continuing to decline, it could find support in the 55 and...

GBP/USD Analysis: Is Pushed By 200-Hour SMA

On Friday, the GBP/USD currency exchange rate declined. The decline started on Thursday when the Bank of England caused surge ended at the 200-hour simple moving average at the 1.3750 level. If the rate continues to decline, it would most...

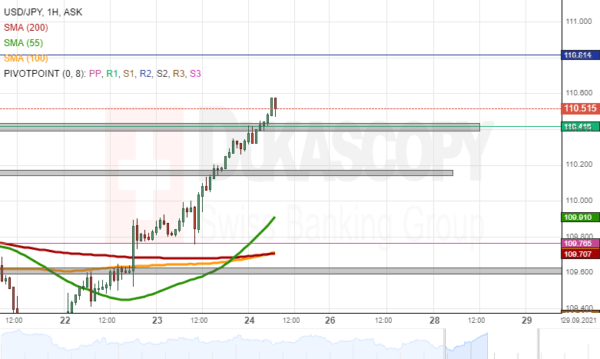

USD/JPY Analysis: Reaches Above 110.50

On Friday, the USD/JPY currency exchange rate passed the resistance of the 110.40 level, which was strengthened by the weekly R1 simple pivot point. Moreover, the rate reached above the 110.50 mark. In the near term future, the pair could...

Smart Money Performance Creates Doubts In The Stock Rally

US markets closed a second consecutive day with an impressive gain of more than 1%. The price of a barrel of Brent on Thursday returned to an area of yearly highs near $77. However, investors and traders should be aware...

Yen Dives as Market Sentiment Turned Bullish, USD/JPY Pressing 110.44 Resistance

Market sentiment took a big turn overnight with strong rally in US indexes. Nikkei follows in Asia and reclaimed 30k handle, but other Asian markets are soft. Yen dropped notably following return of risk appetite while Dollar also weakened. On...

New rules for investing in China: Lessons from Beijing’s education crackdown

Chinese ride-hailing company Didi offers cars for guests of the Annual Meeting of the New Champions 2017 (World Economic Forum’s Summer Davos session) on June 27, 2017, in Dalian, Liaoning Province of China. VCG | Visual China Group | Getty...

Federal Reserve holds interest rates steady, says tapering of bond buying coming ‘soon’

The Federal Reserve on Wednesday held benchmark interest rates near zero but indicated that rate hikes could be coming sooner than expected, and it significantly cut its economic outlook for this year. Along with those largely expected moves, officials on...

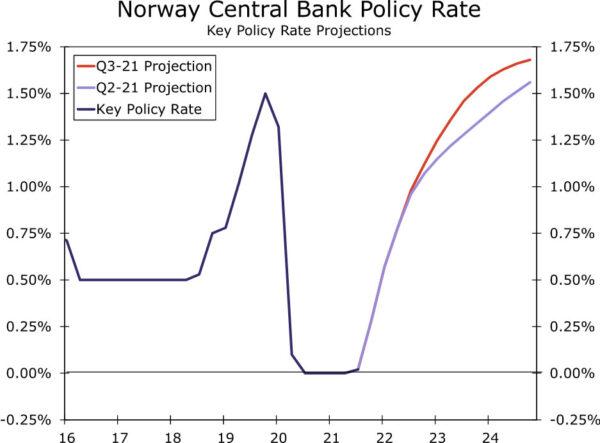

European Monetary Policy and FX Roundup

Summary It has been a particularly busy week across Europe, with several of the G10 central banks making monetary policy announcements and contributing to varying degrees of market excitement. In this report we briefly recap these announcements and assess their...

BOE Downgraded Short-Term Growth, but Turned Slightly More Hawkish about Tightening

The BOE voted 9-0 to leave the Bank rate at 0.1% at the September meeting. The members voted 7-2 to keep the QE program at 895B pound. Deputy governor Dave Ramsden and external member Michael Saunders favored lowering the amount...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals