GBPUSD Turns South after Reaching 200-Day SMA

GBPUSD is reversing following the advance to the 1.3745 level, which represents a nearly three-month high. Although the price declined following the touch of the 200-day simple moving average (SMA), it remains above the long-term declining channel. The MACD oscillator...

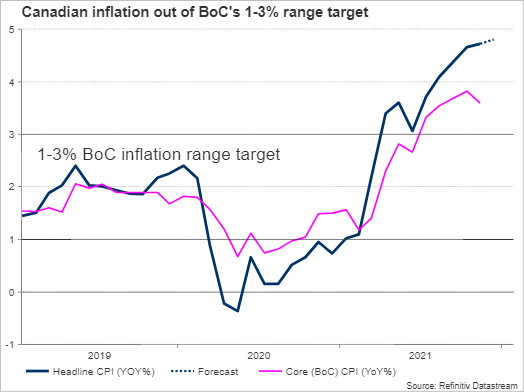

Could Canadian Inflation Power Loonie’s Rally?

The Canadian dollar could face fresh volatility when December’s CPI inflation data come out on Tuesday at 12:30 GMT. Forecasts point to another pickup and investors are highly confident that the central bank could raise interest rates as soon as...

AUDUSD’s Bearing in Question as Gradual Ascent Struggles

AUDUSD turns somewhat neutral as the pair’s improvements have failed to take flight for around one-and-a-half-months now. Currently, the simple moving averages (SMAs) are not implying a specific trend is in place, while the Ichimoku lines are also indicating weak...

Canada’s Manufacturing Sector Recovery Continued in November

Canada’s manufacturing sales increased 2.6% (month/month) in November, following a 4.6% increase in October. The outturn was still solid after accounting for price effects, with manufacturing shipment volumes up 1.9% on the month. The increase in nominal sales spanned 18...

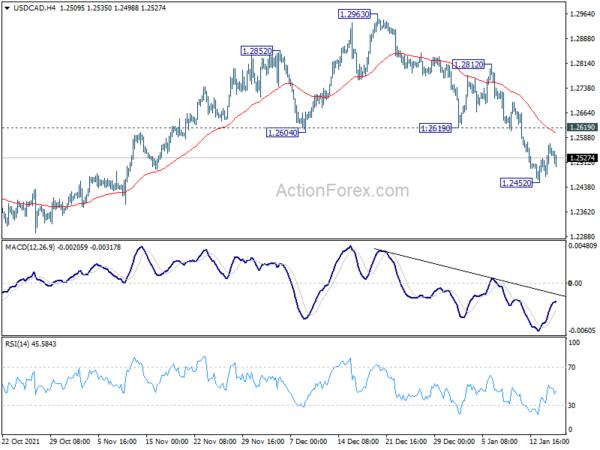

CAD Firm after Manufacturing Sales, Trading Generally Subdued

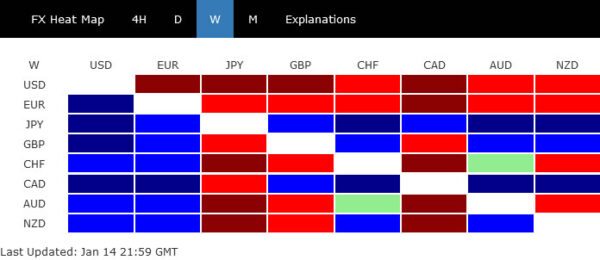

Canadian Dollar is trading as the strongest one for today, and remains firm after stronger than expected manufacturing sales data. Dollar is currently following, with help by rebound against Yen. Sterling is also slightly weaker, following Yen. Other currencies are...

Gold Price Moved into a Short-Term Negative Zone Below $1,820

Gold price failed to clear the $1,830 resistance and corrected lower against the US Dollar. The price broke the $1,820 support level to move into a short-term negative zone. Besides, there was a break below the $1,815 level and the...

Chinese GDP Growth Continued to Lose Steam

Markets US retail data on Friday printed softer than expected. Headline sales declined 1.9% M/M and control group sales (-3.1% M/M), a proxy for consumption in GDP, missed the consensus by quite a big margin. Omicron is affecting sales, at...

Dollar Ignores Hawkish Fed, Yen and Loonie Surged

Strong US inflation reading and hawkish comments from Fed officials were the main theme in the markets last week. While much volatility was seen in the stock markets, major indexes remained rather resilient. Dollar got practically no support from expectation...

Weekly Economic & Financial Commentary: U.S. Dollar Stumbles to Start the Year

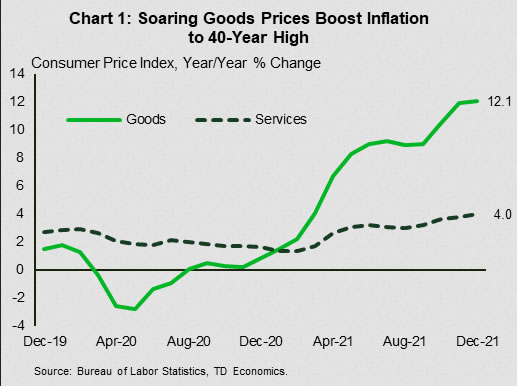

Summary United States: Not Through with 2021 Just Yet Inflation is intensifying and consumer activity is cooling, data covering the month of December reveal. The Consumer Price Index (CPI) rose 7.0% year-over-year, the fastest increase in nearly 40 years. Similarly,...

The Weekly Bottom Line: Eyeing Inflation Like a Hawk

U.S. Highlights Equity markets saw further losses this week, following more hawkish messaging from the Fed. Between Powell and Brainard’s confirmation hearings and other Fed speakers, the signals for a March rate hike are flashing loud and clear. December’s inflation...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals