Markets Tumble After US Sell-Off

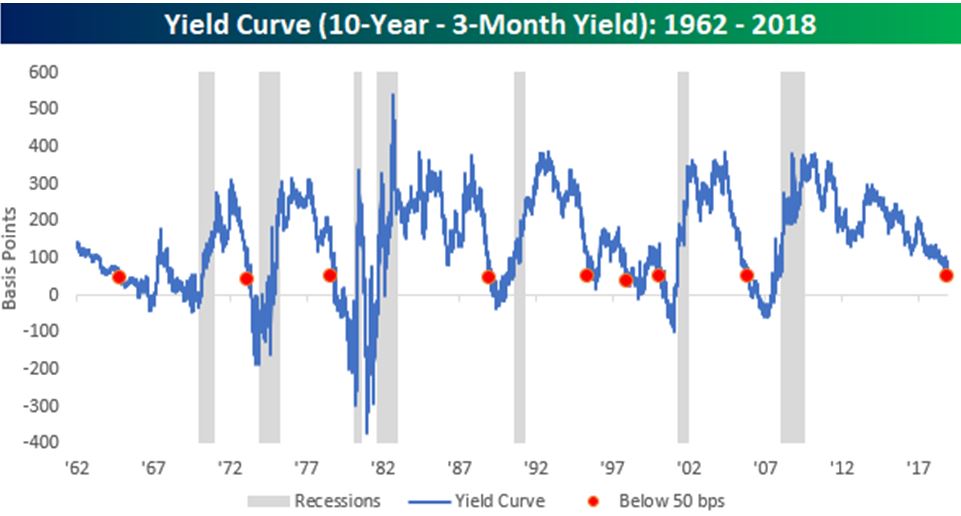

Traders fret about yield curve ahead of market closure Another major sell-off on Wall Street on Tuesday is dragging on markets across the globe on Wednesday, as traders continue to fret about the meaning behind the inverted US yield curve....

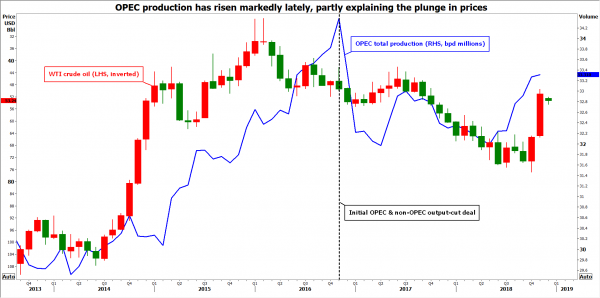

Oil Rebounds Ahead Of OPEC Meeting Amid Hopes For Production Cuts

The Organization of Petroleum Exporting Countries (OPEC) and its allies will meet in Vienna on Thursday, and expectations for a production cut to stabilize oil prices are riding high. With investors appearing confident such a reduction will indeed take place,...

ECB Preview – Focus on Reinvestment Plan, New Round of TLTRO

The market is closely watching ECB’s policy after QE. At the upcoming meeting next week, ECB would announce its plan to reinvest the maturing bonds. Meanwhile, market speculations are rising that the central bank would soon announce a new round...

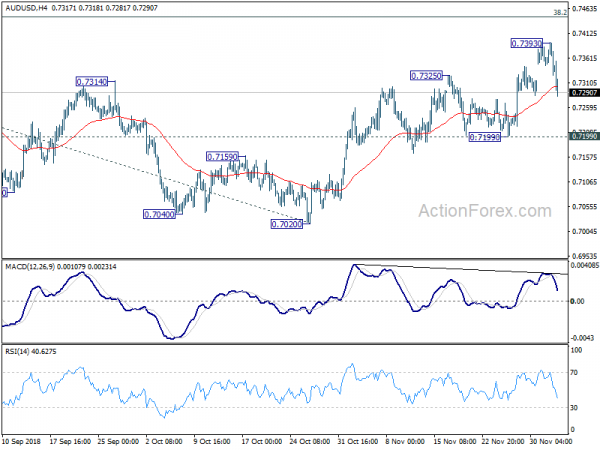

Dollar Regains Ground as Investors Rush from Stocks to Bonds, Aussie Additionally Pressured by GDP Miss

The US stock markets closed sharply lower overnight while treasury yields also dived. Such patterns continue in Asia, seeing major indices pressured while JGB year yields also drop. There are clear flows out of stocks into bonds. Fed has already...

Stocks plunge may have been a too fearful reaction to trade, economic worries

After sharp gains in the past week amid hopes for a trade deal, stocks fell back into correction mode Tuesday, plunging on worries the trade talks could fail and that global growth is slowing. But some strategists said the selling,...

Stocks making the biggest moves after hours: Hewlett Packard Enterprise, Marvell Technology and more

Check out the companies making headlines after the bell: Hewlett Packard Enterprise shares rose as much as 1 percent after its fourth-quarter earnings report beat analysts’ estimates. The company reported earnings of 45 cents a share on revenue of $7.95...

Treasury yield curve inversion is ‘noise’; veteran investor Jack Ablin suggests markets overreacting

Veteran investor Jack Ablin suggests Wall Street is overreacting to the first Treasury yield curve inversion in a decade. According to Ablin, the 5-year Treasury note yield falling below the 2- and 3-year yields should not raise a red flag....

Jamie Dimon doesn’t expect permanent China-US trade deal in just 90 days

J.P. Morgan Chase CEO Jamie Dimon said a permanent trade agreement between the U.S. and China will be tough to reach in just 90 days. “There’s no way you can see the complexity of these trade negotiations in 90 days,”...

London to lose $900 billion to Frankfurt due to Brexit, German finance group claims

London is predicted to lose up to 800 billion euros ($909 billion) of assets by March next year, as banks move their business operations to other hubs before Brexit takes place. Lobby group Frankfurt Main Finance (FMF) released the figure...

What to Expect From Central Bankers in 2019

Highlights 2019 is likely to represent the peak level of interest rates for the U.S. and Canada. The debate among market participants will continue to heat up on whether central banks will succeed in finding the sweet spot in the...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals