Crude Oil’s Triangle

Brent crude is back below $110/bbl, losing 2% since the start of the day on Monday. At the beginning of May, oil largely remained within the trends of previous months. There are still accumulating risks that oil will break down...

Risk Aversion Still Dominates But Dollar Lost Momentum, Euro Recovers

Risk aversion is the theme of the day, with major European indexes trading in red, while US futures are also diving. Australian Dollar is leading other commodity currencies lower. While Dollar is firm, it’s losing some momentum entering into US...

Technical Analysis and Review

DXY: On the H4, with price expected to reverse off the stochastics indicator, we have a bearish bias that price will drop from our 1st resistance in line with the swing high resistance to our 1st support where the 61.8%...

Traders Still Betting on 75bps Hike by Fed in June, Dollar Rally Capped

While RBA, Fed and BoE announced rate hikes last week, the impacts and reactions were rather delivered. RBA’s larger than expected hike was well received and helped Aussie secured the first place, even though it pared back much gains on...

Week Ahead: Volatile Follow Through after Central Bank Decisions

Last week was dominated by volatility as the RBA, Fed and the BOE all gave the markets something more to think about. The RBA hiked rates by more than expected, the Fed took the idea of a 75bps hike off...

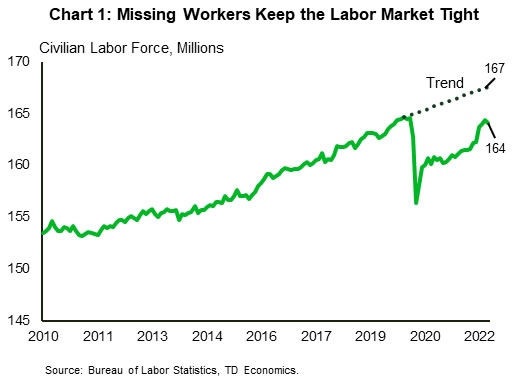

The Weekly Bottom Line: Tight Corners of the Economy

U.S. Highlights The Fed raised the monetary policy rate by 50 basis points for the first time since 2000 and signaled more hikes of the same magnitude are in the works. The economy added more jobs than expected in April,...

Weekly Economic & Financial Commentary: ‘Til the Medicine Takes

Summary United States: ‘Til the Medicine Takes The latest economic data suggest supply challenges worsened in April. Delivery times lengthened, and while employers continued to add jobs at a solid pace, the supply of labor weakened. Price pressure has remained...

NFP Headline Beats Expectations; Confirms Fed’s View that Labor Markets are Tight

US Non-Farm Payrolls showed that economy added 428,000 jobs in April, matching March’s revised print and beating average estimates of 391,000. In addition, the report showed that the Unemployment rate was unchanged at 3.6% vs expectations of a drop to...

GBPAUD’s Bounce Near 4¼-Year Low Level Struggles

GBPAUD’s recent bullish impetus from the early April 4¼-year low region has run out of steam just beneath the mid-Bollinger band at 1.7468. The longer-term 100- and 200-period simple moving averages (SMAs) are suggesting that the negative bearing has softened,...

Euro Talked Up By ECB Hawks, Dollar Shrugs NFP

Dollar turns slightly softer in early US session even though non-farm payroll report came in slightly better than expected. Yen is also weak on rising benchmark global yields. On the other hand, Euro jumps broadly as supported by hawkish comments...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals