Oil Price Moved into a Positive Zone Above $105

Crude oil price started a fresh increase after it formed a base above the $100 level against the US Dollar. The price broke the $105 resistance zone to move into a positive zone. The price gained pace for a move...

Dollar Back in Control ahead of NFP, Risk Aversion Back

Dollar is back in control as markets turned back into risk-off mode, just a day after the rallies triggered by Fed Chair Jerome Powell’s comments. Investors are apparently not too convinced by the ruling out of 75bps hike after a...

EURJPY Remains Above 20-Day SMA With Weak Momentum

EURJPY has gained little this week, and it managed to hold above the 20-day simple moving average (SMA) and re-enter the 137.00 area, with the RSI feeding some prospects for a possible positive short-term move, as it is holding above the 50 level. On...

GBPUSD Losing 2% after BoE with Next Big Stop as at Low as 1.2000

GBPUSD collapsed to 1.2380 by 2% or more than 230 pips from the start of the day on Thursday, with pressure intensifying after the Bank of England’s bank rate decision announcement. As analysts had expected, the Bank of England raised...

From Estee Lauder to Apple, big companies say China’s Covid restrictions are hitting business

Factories in China affected by Covid lockdowns can conditionally resume work, by housing workers on-site. Pictured here is an auto parts manufacturer in Suzhou that has had 478 employees on site since April 16. CFOTO | Future Publishing | Getty...

Gold’s Bearish Bias Calmed by Support Boundary

Gold is tiptoeing across the flattened red Tenkan-sen line at 1,864 after the more than two-week decline from the 2,000 price vicinity bounced off a support zone that stretches back to mid-February. The descending slopes of the simple moving averages...

USDJPY Indecisive ahead of FOMC Policy Decision

USDJPY has barely been moving so far this week ahead of the FOMC policy announcement, facing strong rejection around the 130.20 barrier. Although the pair remains close to its recent 20-year top of 131.24, the possibility for a downside correction...

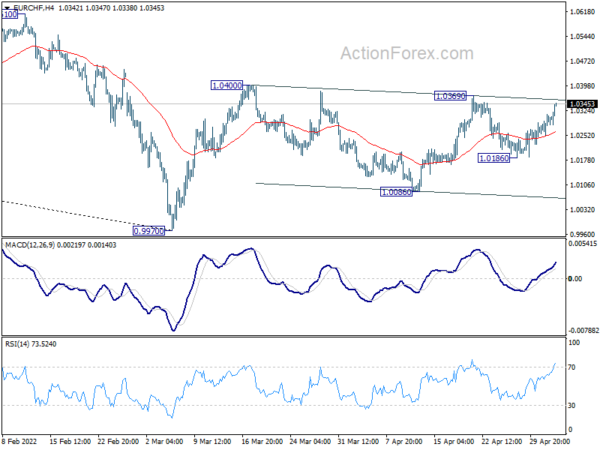

Swiss Franc Dips, Dollar Range Bound as Fed Hike Awaited

Major forex pairs are generally stuck inside yesterday’s range as markets await FOMC rate decision. Swiss Franc is the exception, though, as the selloff against Euro spreads to other Franc pairs. Dollar and Canadian are the next weaker ones. On...

Markets in Tight Range ahead of Fed Hike, Dollar Firm

Overall, the markets are pretty quiet as focuses turns to Fed’s rate hike and guidance today. Dollar is consolidating in tight range, preparing for the next move. For now, Aussie and Loonie are the stronger ones for the week, but...

AUD/NZD Technical Breakout on RBA Rate Hike

The RBA’s surprise hike caught AUD/NZD traders with their guard down. As a result, the pair traded to its highest level since August 2018. The Reserve Bank of Australia (RBA) surprised markets with its first interest rate of the new...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals