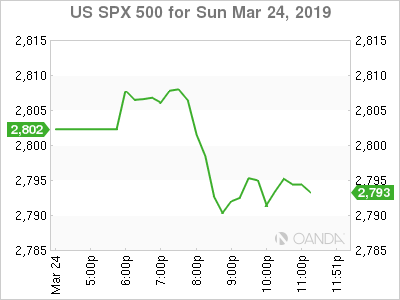

Investors Are Nervous About A Possible US Recession

Stock markets lost more than 2.5% during sell-off since the end of last week on fears that debt markets give a signal of an imminent U.S. recession. However, the global currency markets remained calm, and this, in our opinion, provides...

Gold Climbs to 4-Week High as Risk Apprehension Jumps

Gold has posted strong gains to kick off the week. In Monday’s North American session, the spot price for one ounce of gold is $1322.50, up 0.69% on the day. The metal is currently at its highest level since the...

British Pound Steady, But More Brexit Drama Looms

GBP/USD is almost unchanged in the Monday session. In North American trade, the pair is trading at 1.3228, up 0.14% on the day. It’s a quiet session for fundamentals, with no data events. In the U.S., the sole events are...

Canadian Dollar Unchanged on Light-Data Calendar

The Canadian dollar is unchanged on Monday, after USD/CAD rallied late last week. In the North American session, the pair is trading at 1.3430, unchanged on the day. There are no economic indicators on the schedule. In the U.S., we’ll...

European FX Handover

DISCLAIMER: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase of sale of any currency. All opinions and information contained in this...

Dollar Rebounds With Market Focused On Apple’s Event

The dollar is higher in the Asia session after US Attorney General said the Muller report did not find sufficient evidence against President Donald Trump. Safe havens retreated slightly but will be on hand as another week filled with risk...

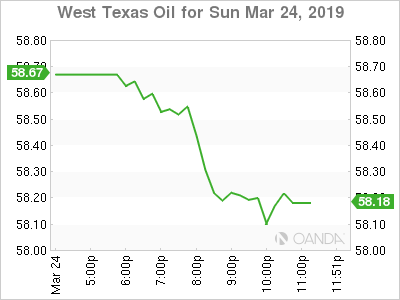

Oil Lower On Dollar Rebound

Energy prices are lower on Monday as the US dollar rebounds after the comments from the US Attorney General removed some uncertainty surrounding the White House. Oil rose after a surprise 9.6 million drawdown and the efforts of the OPEC+...

European Recession Revisited

Fears of a Eurozone recession are back in the headlines today after a series of disappointing PMI figures from the currency bloc. The March manufacturing PMI declined more than expected to 47.6, the lowest level since 2013 (Figure 1). Some...

China Weekly Letter: High-Level Trade Talks Resume, Enforcement the Key Hurdle

High-level trade talks resume, disagreement on enforcement the big hurdle. Metal markets still underpin a recovery, otherwise little macro news this week. Xi Jinping visits Europe amid concern over Italy signing memorandum on the Belt and Road Initiative. High-level trade...

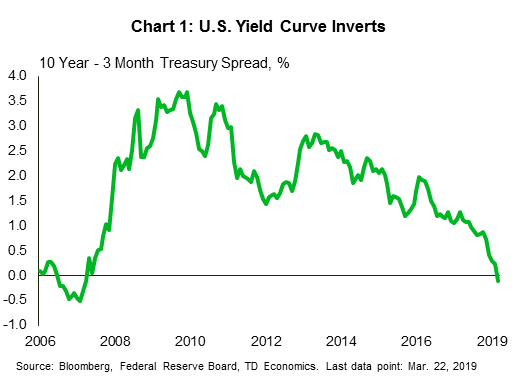

The Weekly Bottom Line: When The Dots Are Down

U.S. Highlights The Fed’s dots showed that it only expects to hike rates once more by the end of 2020, sending Treasury yields lower mid-week. On Friday, weakness in March manufacturing surveys in Europe, Japan, and the U.S. sent longer-term...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals