Bulls Are Back Amid Thinning Volumes And Fragile Appetite

The European and the US markets rebounded yesterday, as investors shrugged off the worries of omicron, while of course, the news flow is far from ideal. New restriction measures are announced every other day and the impact on the economic...

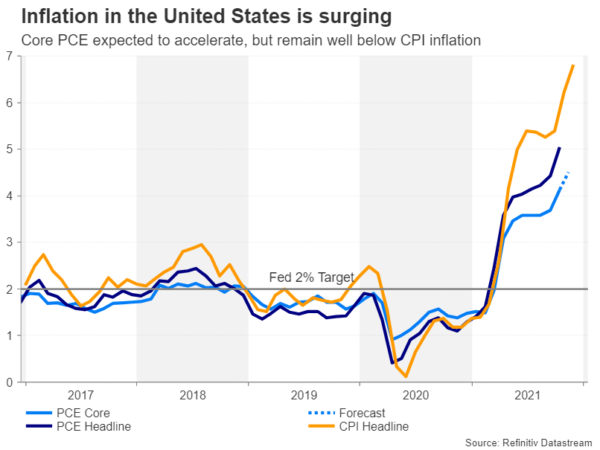

US PCE Inflation Expected to Jump; Fed’s Hawkish Turn Relieves Markets

The US dollar has been roaring lately, capitalizing on the risk-off sentiment in the markets caused by the Omicron variant. This week, dollar bulls will be closely eyeing the barrage of the last major US data releases of the year....

Risk Sentiment Recovers

ActionForex.com was set up back in 2004 with the aim to provide insightful analysis to forex traders, serving the trading community for over a decade. Empowering the individual traders was, is, and will always be our motto going forward. Contact...

Canadian Dollar Keeps Falling

The US dollar is flexing some muscle as USD/CAD has started the week with considerable gains and is trading around 1.2950. The Canadian dollar had a rough week, losing 1.29%. USD/CAD is closing in on the symbolic 1.30 line, which...

NZD Falls as Consumer Confidence Slows

The New Zealand dollar continues to lose ground. In the European session, NZD/USD is trading at 0.6715, down 0.39% on the day. The currency ended last week on a sour note, falling 0.89%. New Zealand consumers pessimistic There is a...

Weekly Economic & Financial Commentary: Hawkish Fed Steals the Show

Summary United States: Hawkish Fed Steals the Show, but Supply Issues Persist Behind the Scenes The more hawkish tone coming out of the Fed’s latest policy meeting was the main event grasping markets’ attention this week. But in other news,...

Week Ahead: Omicron in Focus as Holidays Begin

The last two weeks of the year are typically reserved for holidays and slow markets as much of the world is away from their desks after wrapping up the year. Indeed, many market participants finished trading a bit early this...

Week Ahead – The Festive Season is Upon Us

Will markets coast into the new year? Last week was action-packed, dominated by major central bank announcements that in many cases represented a change of direction as we head into 2022. From supporting the economy through the pandemic to reining...

The Weekly Bottom Line: Slaying the Inflation Dragon

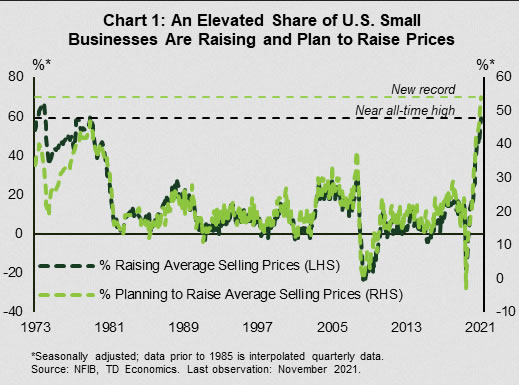

U.S. Highlights Evidence of accelerating price pressures continued to trickle in this week. Producer prices accelerated to 9.6% year-on-year in November. This was accompanied by an elevated share of small businesses raising prices (+6 points to 59%). After a strong...

Weekly Focus – Central Banks Choose the Hawkish Path

Central banks were in the spotlight this week, and the general outcome was on the hawkish side. The Federal Reserve brought its forward guidance more in line with what markets and analysts had already been expecting, signalling an end to...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals