Week Ahead: Earnings Season Begins, China Escalations Continue, and the Jobs Report Has Past

Earnings season is always a big deal for the markets; however, this earnings season will be particularly noteworthy. As many analysts and economists feel that growth may have peaked over the summer, Q3 earnings will be closely watched for earnings...

Week Ahead – Fed Minutes and Inflation in Focus

A busy week in store Another fascinating week in the markets and there’s little reason to think there isn’t plenty more to come in the final months of the year. Russian President Vladimir Putin calmed investor nerves this week, reassuring...

Stagflation: 1970s Deja Vu?

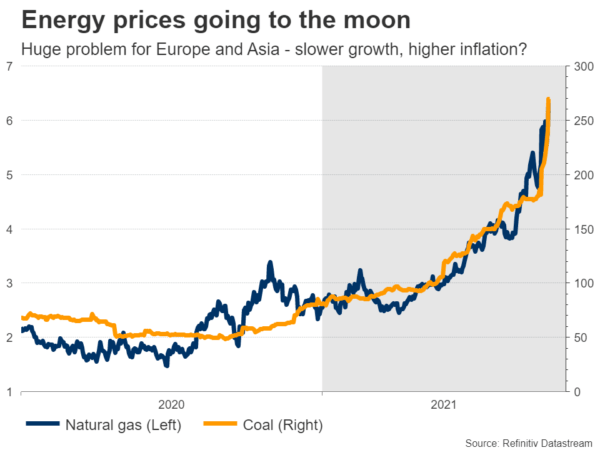

Summary The term “stagflation”, which was widely used in the 1970s and the early 1980s, essentially disappeared from the lexicon over the subsequent few decades. However, it has become in vogue again recently with the marked rise in inflation that...

AUD Moves Higher, NFP Next

The Australian dollar has found its legs on Thursday, in what has been an uneventful week. Currently, AUD/USD is trading at 0.7308, up 0.50% on the day. The Australian dollar has had a mostly quiet week, and even an RBA...

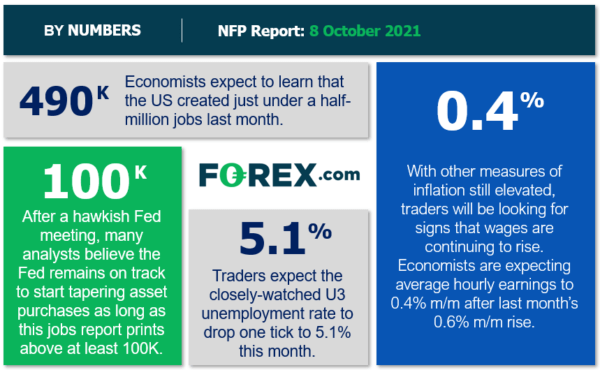

NFP Preview: Fed Locked in to Tapering Starting Next Month Unless NFP Bombs?

Any time we discuss the monthly US non-farm payrolls (NFP) report, we always emphasize that it’s significant primarily because of the impact it has on Federal Reserve policy. Following last month’s FOMC meeting though, Fed Chairman Jerome Powell made it...

Natural Gas’s Boom And Bust

The energy market may have passed an inflexion point yesterday. The more than 20% jump in prices in Europe on Tuesday to $1,500 per 1,000 cubic meters triggered an avalanche of margin calls during the trading on Wednesday. At one...

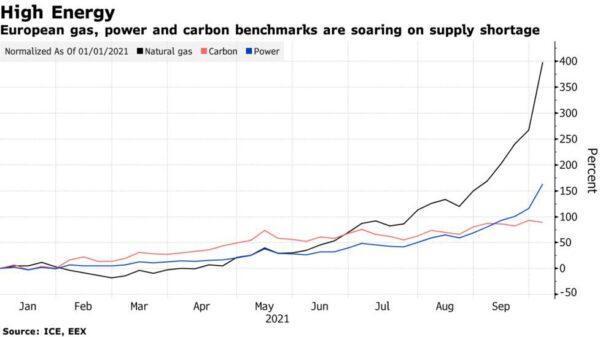

Natural Gas Goes Nuclear, Russia Rides to the Rescue…But is it Enough?

Today brought a modicum of good news for energy-strapped European nations: Russia has offered to increase natural gas exports to the continent, potentially to record highs… For those across Europe (and much of the world), the economic and market story...

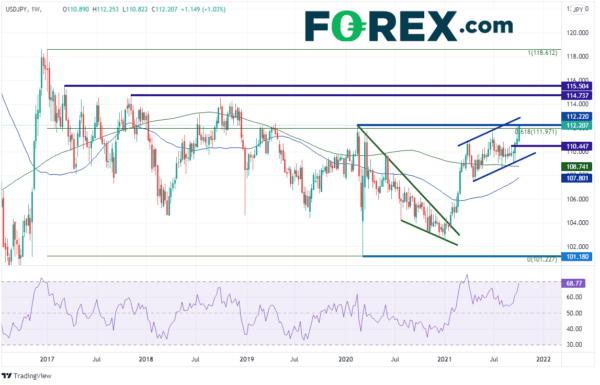

Roaring Dollar Turns To Nonfarm Payrolls

The US employment report for September will hit the markets at 12:30 GMT Friday. It will single-handedly decide whether the Fed pushes the taper button next month. As for the dollar, it has sliced through its rivals lately as investors...

U.S. Service Sector Remains Strong

The ISM services index surprised with an increase to 61.9 in September from 61.7 in August. This was higher than market expectations for a decline to 60. Combined with the manufacturing reading, the ISM Composite reading moved to 61.8 from...

NZ Dollar on Hold ahead of RBNZ

The New Zealand dollar is calm in the Tuesday session, ahead of the RBNZ policy decision. NZD/USD is currently trading at 0.6963, down 0.10% on the day. The currency has been on an impressive upturn, rising two full cents since...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals