Risk Aversion Still Dominates But Dollar Lost Momentum, Euro Recovers

Risk aversion is the theme of the day, with major European indexes trading in red, while US futures are also diving. Australian Dollar is leading other commodity currencies lower. While Dollar is firm, it’s losing some momentum entering into US...

Traders Still Betting on 75bps Hike by Fed in June, Dollar Rally Capped

While RBA, Fed and BoE announced rate hikes last week, the impacts and reactions were rather delivered. RBA’s larger than expected hike was well received and helped Aussie secured the first place, even though it pared back much gains on...

Euro Talked Up By ECB Hawks, Dollar Shrugs NFP

Dollar turns slightly softer in early US session even though non-farm payroll report came in slightly better than expected. Yen is also weak on rising benchmark global yields. On the other hand, Euro jumps broadly as supported by hawkish comments...

Dollar Back in Control ahead of NFP, Risk Aversion Back

Dollar is back in control as markets turned back into risk-off mode, just a day after the rallies triggered by Fed Chair Jerome Powell’s comments. Investors are apparently not too convinced by the ruling out of 75bps hike after a...

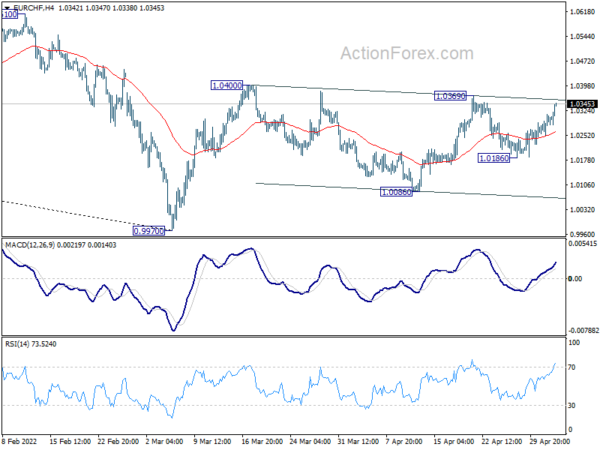

Swiss Franc Dips, Dollar Range Bound as Fed Hike Awaited

Major forex pairs are generally stuck inside yesterday’s range as markets await FOMC rate decision. Swiss Franc is the exception, though, as the selloff against Euro spreads to other Franc pairs. Dollar and Canadian are the next weaker ones. On...

Markets in Tight Range ahead of Fed Hike, Dollar Firm

Overall, the markets are pretty quiet as focuses turns to Fed’s rate hike and guidance today. Dollar is consolidating in tight range, preparing for the next move. For now, Aussie and Loonie are the stronger ones for the week, but...

Dollar Softer Slightly, European Majors Trying a Rebound

Dollar is turning softer entering into US session, as traders might start to lighten up position ahead tomorrow’s FOMC rate decision. Commodity currencies are also soft, except Aussie which is supported by RBA’s hawkish rate hike. Yet, there is no...

Dollar Staying Firm in Quiet Markets, Canadian Dollar Lower With Oil Price

Dollar remains the firmer one today, in quiet markets, as traders are awaiting Fed’s rate hike, and forward guidance later in the week. Yen’s trading tone is so far positive, as risk markets lack buyers. Commodity currencies are weak together...

Dollar Index Hit Two-Decade High as Focus Turns to Fed Hike

Dollar ended up as the strongest one last week, having the best week since 2015 and with Dollar index hitting a two-decade high. Though, the rally somewhat slowed towards the end of the week. It could be a result of...

Dollar Consolidates Gain after Strong PCE Inflation Data

Lots of important economic data are released today but they’re largely ignored. Inflation data from the US and Eurozone are strong. Canada’s monthly GDP growth was well above expectation while Eurozone GDP growth turned weaker in Q1. But reactions to...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals