Fed Might Cut Just Once More in Mid-Cycle Adjustment as Sentiments Improved

Threat of US-China trade war escalation receded last week after both sides offered some concessions. Further than that, there is increasing hope of de-escalation of some form as the idea of an “interim” trade deal floated around. Both sides seemed...

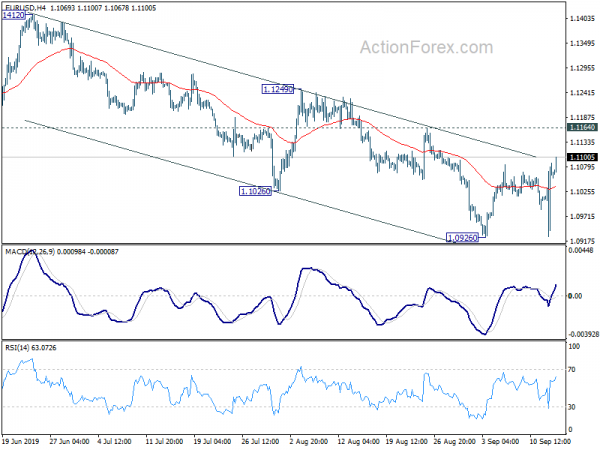

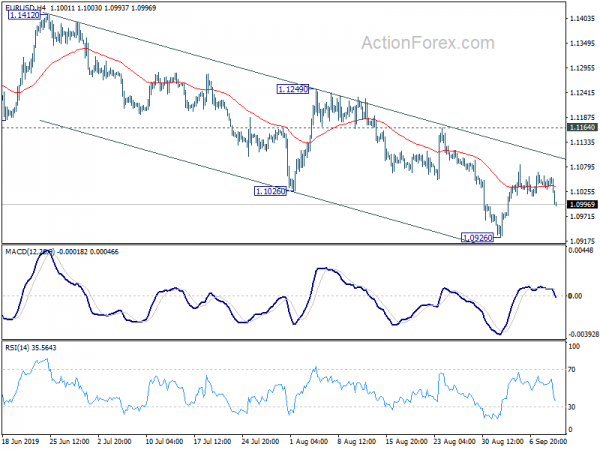

Euro to End Firm as ECB Seen Done with Easing

European majors remain generally firm today. In particular, Euro is supported by the view that ECB has done with policy easing after yesterday’s stimulus package. Such view is supported by rare open criticism on the measures by ECB officials. Commodity...

European Majors Strong after Euro Survived ECB Stimulus

European majors are generally stronger today, after Euro survived yesterday’s ECB monetary easing. Meanwhile, Canadian Dollar is broadly pressured following decline in oil prices. New Zealand Dollar is also weak after poor manufacturing data. Dollar is soft despite more positive...

Euro Sold Off on ECB Easing With QE and Deposit Rate Cut

Euro drops broadly after ECB finally delivers and announced a package of stimulus. The cut in deposit rate and size of QE are somewhat smaller than expected. But the new economic projections remain decidedly dovish despite the easing package. At...

Sentiments Lifted by US-China Goodwill Gestures, ECB Stimulus Awaited

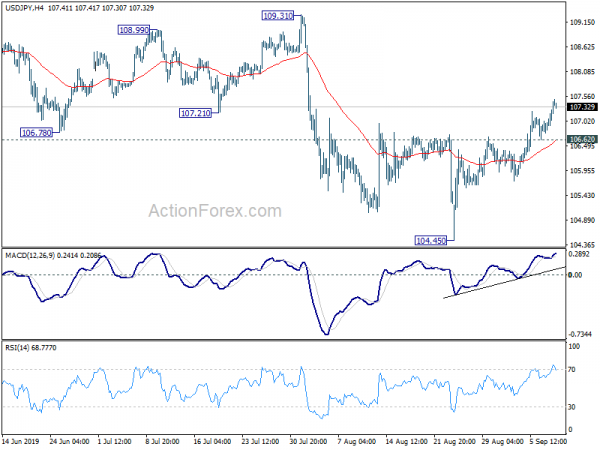

Market sentiments were given another strong lift after both US and China offered gestures of good will ahead of next month’s trade meeting. Yen extended this week’s pullback and remains generally soft in Asian session today. Swiss Franc follows as...

Euro Lower as Traders Prepare for ECB, Dollar Shrugs Trump’s Tweets

Euro weakens broadly today, in relatively quiet markets, as traders are probably adjusting their positions ahead of tomorrow’s ECB rate decision. A new package of stimulus is widely expected. Yet, opinions on the exact composition of the package is divided....

Sentiments Lifted as China Exempt Some Tariffs on US, Removes QFII Quota

Market sentiments are generally lifted in Asia, by China’s announcement to exempt some US imports from tariffs, ahead of next month’s meeting. Also, while symbolic, investors also cheer China’s move to remove quota for foreign institutional investors on the capital...

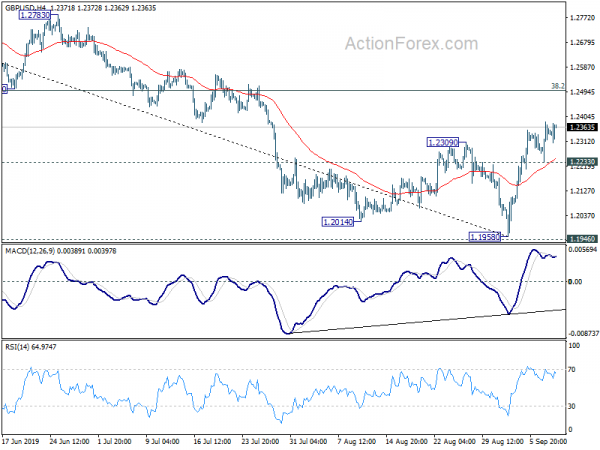

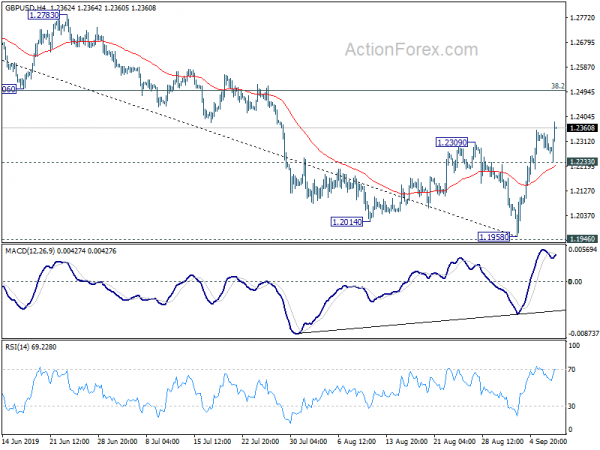

Sterling Lifted Mildly by Job Data, Markets Steady Overall

The financial markets are generally steady today, with stock and bond markets bounded in tight range. Most major currency pairs and crosses are also staying inside yesterday’s range. Swiss Franc is currently the firmer one, followed by Sterling is mildly...

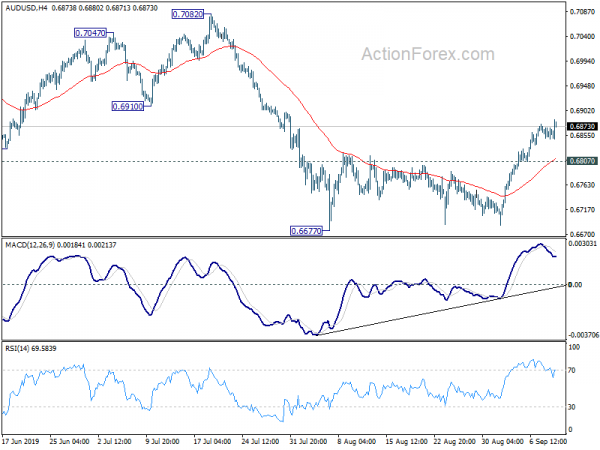

Yen Lower as Yields Recover, Aussie Falls on Business Confidence

Yen weakens broadly today following recovery in major treasury yields, as a sign of stabilization in sentiments. Most notably, German 10-year yield closed above -0.6% at -0.585, while US 10-year yield closed above 1.6% at 1.622. Australian Dollar is currently...

Sterling Extends Rally as GDP Data Suggests Receding Recession Risks

Sterling rises broadly today as recession risk recede after better than expected GDP data. While it’s unsure whether growth could sustain, the Pound cheers the improved outlook anyway. At this point, Australian Dollar is second strongest, followed by New Zealand...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals