Risk Appetite Unmoved by ECB Accounts, US CPI, Brexit White Paper, Nor NATO Showdown

Return of risk appetite is probably the main theme in the markets without a main theme today. There are quite a number of “high-level” events today, ECB meeting accounts, US CPI release, UK’s Brexit white paper, and the NATO showdown....

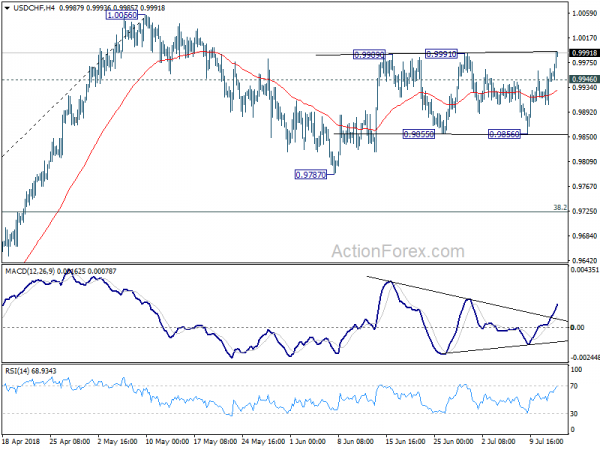

Dollar Strong as Markets Look into US CPI

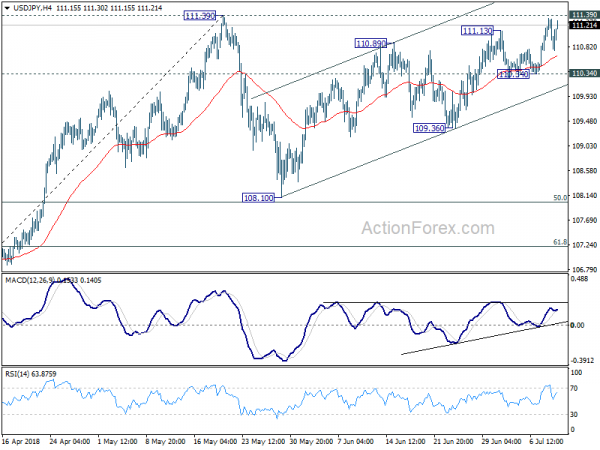

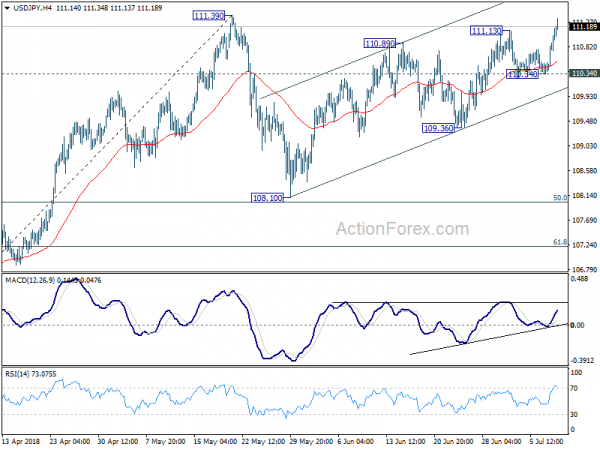

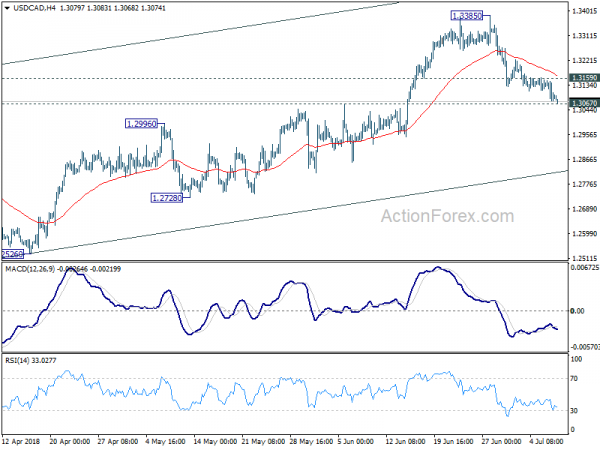

Yen was sold off sharply overnight after stronger than expected US producer price inflation data. Selling continues in Asian session as risk aversion receded. The impact of US-China trade war escalation on the markets was brief and limited. Most importantly,...

Dollar Marches On With NATO Showdown and US-China Trade War

Global stocks tumble as US escalated the trade war with China again today, moving on to the process to impose tariffs on additional USD 200B of Chinese goods. On the other hand, Trump is fighting allies of the US in...

Yen and Dollar Surge as US Moves on with Tariffs on $200B in Chinese Imports

Yen and Dollar are both strong as the US announced to move on with 10% tariffs on another USD 200B in Chinese imports. That could come into effect as soon as in September. Asian Markets are broadly in red. At...

Dollar Rallies as Euro Pressured by German ZEW Miss, Yen Lower on Risk Appetite

Dollar strengthens broadly today, partly with help from Euro’s post data weakness. Much weaker than expected German ZEW economic sentiment is giving some pressure to the common currency. On the other hand, USD/JPY surges through 111.13 temporary top and is...

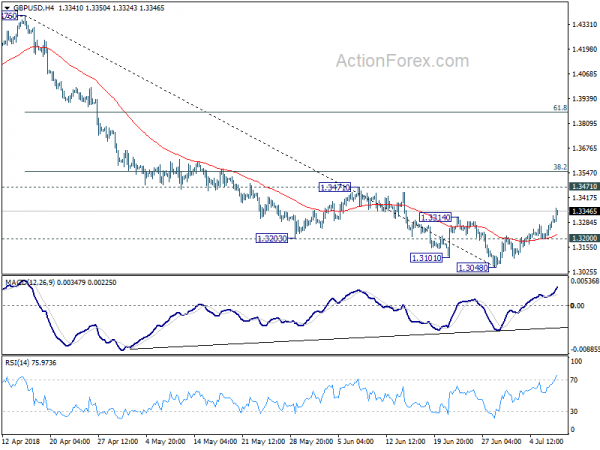

Sterling Stabilized after Wild Ride, Strong Risk Appetite Continues to Pressure Yen

Strong risk appetite is keeping the Japanese Yen broadly weak this week. DOW jumped as impressive 302.11 pts or 1.31% to close at 24776.59, turned positive for 2018. S&P 500 followed by rising 24.35 pts or 0.88% to 2784.17. NASDAQ...

Sterling’s Fortune Reversed after Boris Johnson Resignation

While the reaction to former Brexit Minister David Davis was largely muted, the situation seemed to change drastically after adding former Foreign Minister Boris Johnson. Prime Minister Theresa May wanted to provide certainty to UK businesses with her locked up...

Sterling Strengthens Broadly as Davis Resignation is Seen as Good For Soft Brexit

Quick update: Sterling drops notably after Foreign Minister Boris Johnson finally resigns. judging from the current price action, Boris’s resignation seems to be taken more seriously by the markets than Davis’s. The global stock markets are in positive mood today....

Sterling Volatile on Brexit Jitters, Yen Lower as Chinese Stocks Lead Asian Rebound

Yen trades broadly lower today, followed by Dollar, as Asian markets recovered broadly. China’s Shanghai SSE composite leads the way by gaining 1.9% and breaches 2800 handle. It looks like some solid support was obtained between 2016 low at 2638...

US, European and Asian Markets Reacted Differently to Start of US-China Trade War

The global markets reacted rather differently as the US-China trade war formally started while there were only signs of further escalations. Over the week, NASDAQ was a star performer and rose 2.37% to 7510.30. S&P 500 rose in tandem by...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals