Gorman can’t wait to have less capital

Morgan Stanley CEO James Gorman kicked off his third quarter earnings call on Thursday after hold music that had veered wildly from funk to orchestral, and he sounded upbeat after what he described as strong results. The firm’s wealth management...

High cost of European exchange data sparks investor revolt

In December, the Plato Partnership – a not-for-profit-organization whose members include large asset managers such as Axa Investment Managers, Blackrock, DWS, Fidelity, Norges Bank, Union Investment and many others, as well as leading investment banks – announced a new venture with...

Awards for Excellence 2019: Rise of the regionals

It was quickly obvious that, after the financial crisis, the number of truly global banks would decline. It has. You can now count them on the fingers of one hand. That trend has had a notable impact in developing markets,...

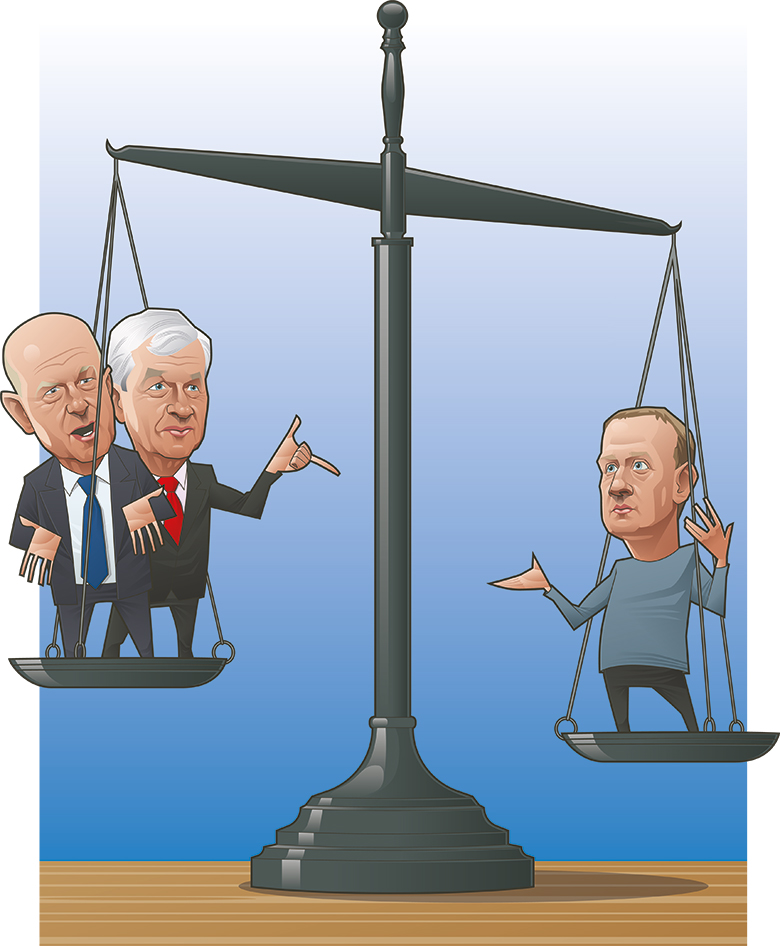

Macaskill on markets: The coming proxy war with Facebook

US president Ronald Reagan joked that the nine most terrifying words in the English language are: “I’m from the government and I’m here to help.” Bankers often complain about the burdens of regulation, but they will rely heavily on support...

Sideways: Spencer for governor of the Bank of England!

Michael Spencer, founder of brokerage firm Icap First, the growing likelihood that Boris Johnson will be the next UK prime minister led to speculation that his former adviser, Gerard Lyons, could be in the frame for the top slot at...

Environmental finance: From Dong to Ørsted – a story worth repeating

Environmental and political writer George Monbiot recently made the salient point that while Shell launched a $300 million fund in April to invest in natural ecosystems, it also invested $25 billion into oil and gas in 2018, including exploration for...

Latin America banking: HSBC fights back in Brazil

Brazil’s growth might be continuing to disappoint but HSBC is pressing ahead with ambitious plans for its comeback in the country. HSBC sold its corporate and wholesale banking operations as part the sale of its full Brazil business to Bradesco...

Trump’s idea to ban Chinese listings won’t upset Asian exchanges

Reports emerged last week that Donald Trump was considering a ban on Chinese companies listing on US exchanges, as the next escalation of the US-China trade war. We doubt it will happen. Nasdaq, for one, has been quick to pour...

WeWork’s failed IPO shows the danger of allocating to private equity

At the end of September, Schroders released the findings of its third annual survey exploring the key concerns, return expectations and thoughts on allocation of 650 of the world’s largest end investors – including pension funds, insurance companies, endowments and...

ECM vs equities: Has Deutsche Bank got it right?

Deutsche Bank has taken the radical step of getting rid of its equities business, but thinks it can still offer ECM. Can it? Signal2forex reviews

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals